As if after the clock, the ongoing crash of the crypto market has once again brought the well-known prophecies of doom in the style of “Bitcoin is dead” onto the scene.

If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it can just as easily fall another 70% down to $6,000. Given the excessive leverage in #crypto, imagine the forced sales that would take place during a sell-off of this magnitude. $3,000 is a more likely price target.

– Peter Schiff (@PeterSchiff) June 14, 2022

This time, this black painting is perhaps as justified as it is rare, because the past weeks have been quite painful for crypto investors, the sad peak or low point has now been reached in the form of an intermediate low of only a paltry 17,600 US dollars. Nevertheless, the “condolences” for the supposed death of Bitcoin (BTC) could be as inaccurate as the other 452 times before (see below).

Counter for “Bitcoin obituaries”. Source: 99Bitcoins

Counter for “Bitcoin obituaries”. Source: 99Bitcoins

Experienced crypto investors now have nerves like tightropes, which, however, are also urgently needed in order not to panic and be able to make objective decisions. It’s worth taking a sober look at the on-chain data to find out whether it’s time to buy or sell. What do some of the most important metrics for Bitcoin say? Is the party over yet?

Does the 200-MA keep what it promises?

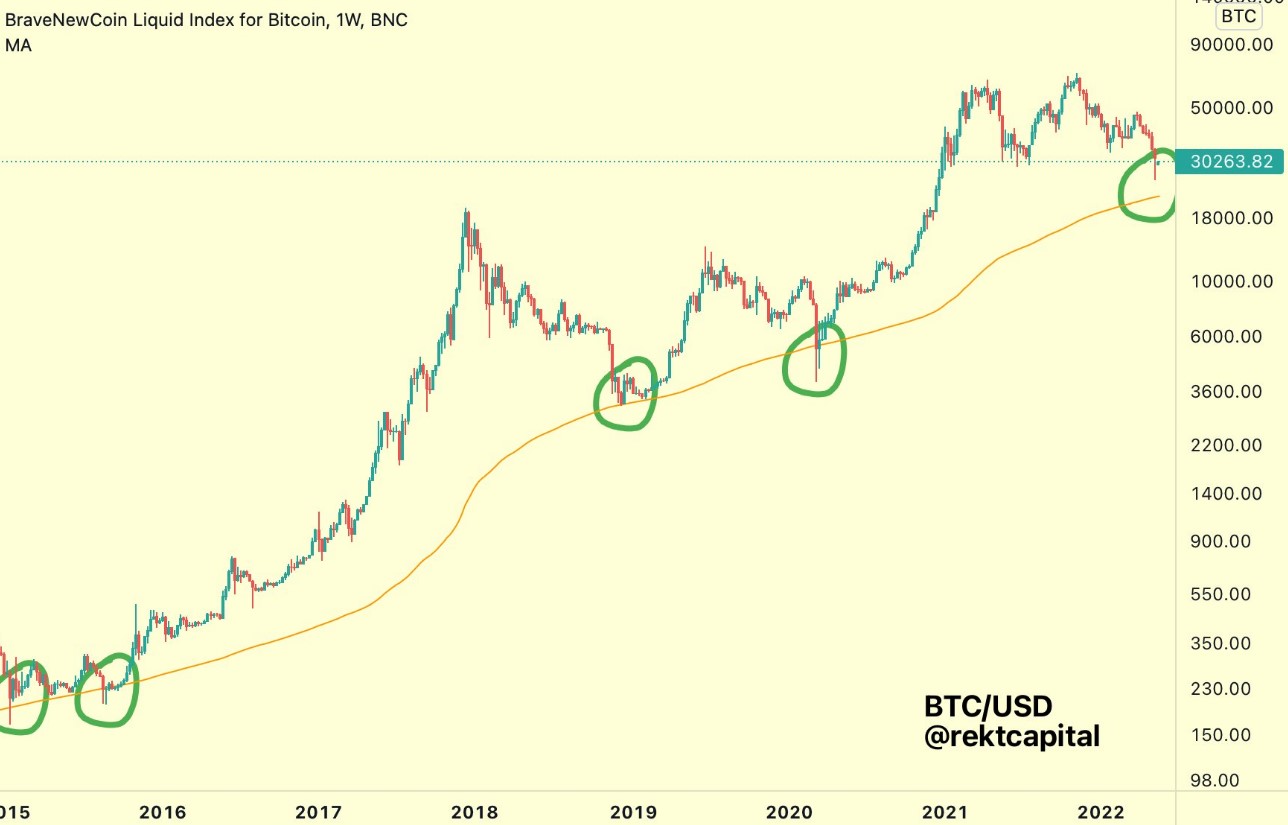

First of all, there is the 200-Week Moving Average (200-MA): The moving average of the last 200 weeks has always proven to be a solid lower limit in the history of Bitcoin, which has at most temporarily fallen below.

Bitcoin course and 200-Week MA. Source: Twitter

Bitcoin course and 200-Week MA. Source: Twitter

As can be seen in the above price chart on the green markings, the local lows were in the immediate vicinity of the 200-MA, which could prevent further downturns each time.

After the declines to this “lower limit of the lower limits”, it went back up significantly and back into a new uptrend.

Also currently, the Bitcoin price is again in the immediate vicinity of the 200-week MA, whereby the mark on June 14 has already been undercut in the meantime. Although further losses cannot be completely ruled out, the history so far gives hope that the dwell time under the important moving average is usually only short.

Are the established supports slowing down the free fall?

In addition to the “fixed” support from the 200-Week MA, there are also a number of significant supports that have repeatedly provided reliable support for Bitcoin in the past.

Bitcoin course and established supports. Source: TradingView

Bitcoin course and established supports. Source: TradingView

The last time BTC slipped below $24,000 was in December 2020. At that time, the $ 21,900 mark stood out as a decisive support, from which the market-leading cryptocurrency was able to catapult itself up to $ 41,000.

If the psychologically important 20,000 US dollar mark is now finally undershot, there are other important supports at 19,900 US dollars and 16,500 US dollars, which should initially slow down another slump (see above).

Is Bitcoin selling below value?

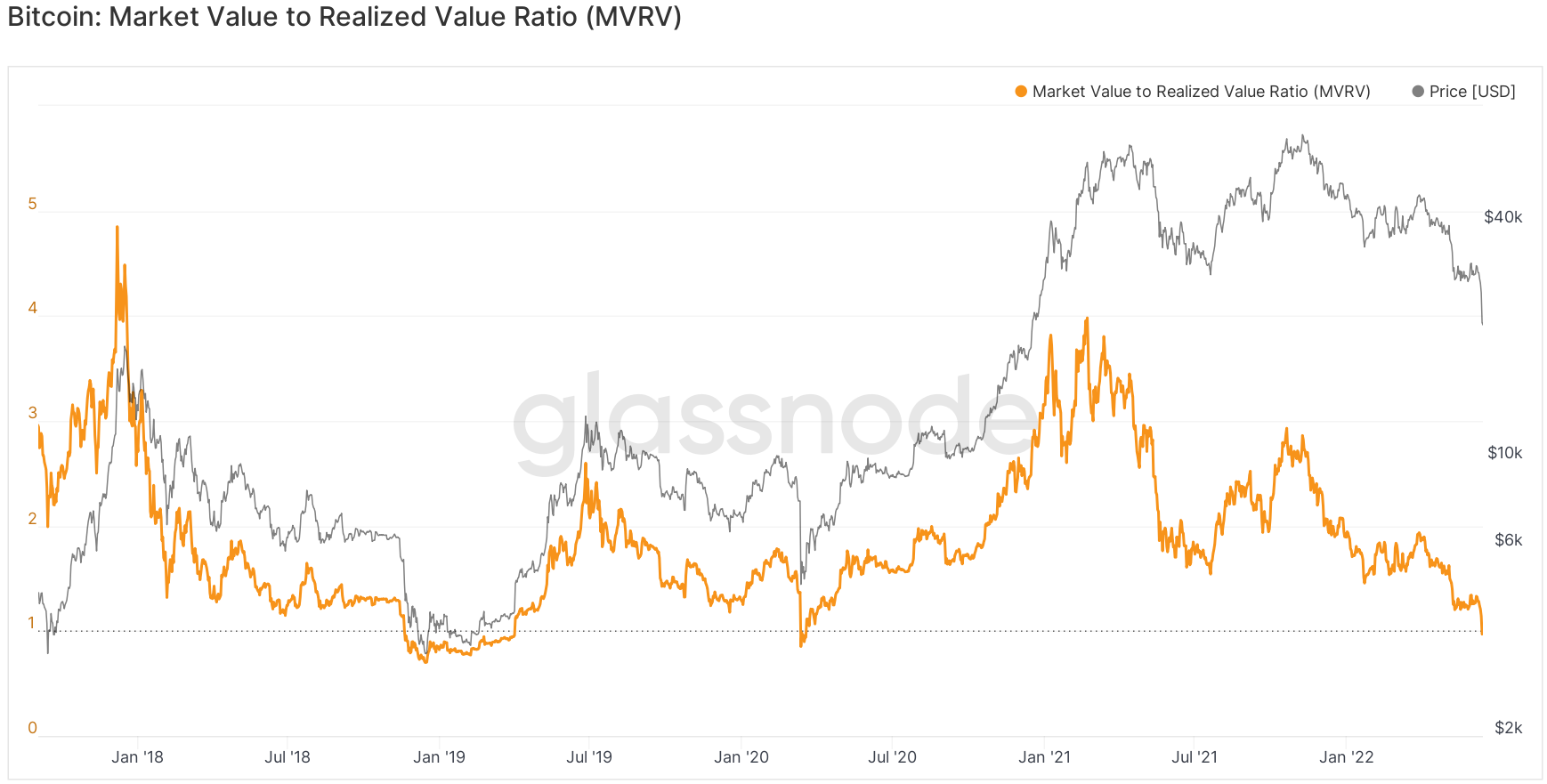

The last important indicator that gives hope and could indicate that Bitcoin is possibly in a favorable buying opportunity is the so-called Market value-to-Realized-Value ratio (MVRV), which currently has a value of 0.969 points.

Bitcoin MVRV (orange) and Bitcoin price (black) in comparison. Source: Glassnode

Bitcoin MVRV (orange) and Bitcoin price (black) in comparison. Source: Glassnode

As can be seen from the diagram above, the MVRV – which puts the actual Bitcoin price in relation to the calculated market value – has been mostly above 1 point (dashed line) over the past four years. Only during two major downtrends was this mark briefly undercut.

On the one hand, the MVRV slipped to a low of 0.85 points in the corona crash of March 2020, where the key figure then lingered for seven days, and on the other hand, the indicator was below 1 for a whopping 133 days during the bear market from 2018 to 2019.

Although it is not possible to say unequivocally here that the Bitcoin price will not continue to lose, one can at least guess that the worst may have already passed and that the market-leading cryptocurrency will not remain permanently in these lowlands.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.