The leading crypto currency Bitcoin (BTC) slipped to a new annual low of $ 17,567 last Saturday, June 18, before the buyer’s side managed to catapult the BTC price back above the psychologically important $ 20,000 mark. The second largest cryptocurrency Ethereum (ETH) also came under more pressure and in the meantime slipped below the important price level at $ 1,000. The Ether price subsequently fell back to the 881 USD. Only here the bulls came back into the market and lifted Ethereum to currently 1,179 USD. In addition to the interest rate hike by the US Federal Reserve, the trigger for the massive price reductions was also the increasing default risks of several lending platforms such as Celsius.

Is the hoped-for recovery in the overall market now following?

Since Bitcoin as well as Ethereum have processed important price targets on the downside over the weekend, courageous investors took advantage of the significant price declines in some cryptocurrencies and boldly attacked. In the short term, the lows of the weekend should have marked a historical low. The broad-based price recovery of the US stock indices in the first hours of trading on Tuesday afternoon is also currently supporting this. The entire crypto market is benefiting from a significant recovery movement among US technology companies.

Price developments of the top-10 altcoins:

- The list is headed this week by Solana (SOL): after a sell-off to the central support zone in the area of $ 27.00 in a week-on-week comparison, the cryptocurrency was able to recover by 36 percent. This puts new bullish price targets at USD 44.37 and USD 58.49 in the short term in the focus of investors. A current course analysis with further target brands can be found here.

- The memecoins Dogecoin (DOGE) can also recover significantly with a 27 percent price increase, as well as Shiba Inu (SHIB) with a price jump of 34 percentage points. The DOGE course once again benefits from supportive statements by Tesla founder Elon Musk, who once again signaled his support for Dogecoin. Shiba Inu, on the other hand, is trying to get rid of his memecoin status by launching the Layer2 solution Shibarium, apparently with the first success.

Reversal formations take shape

- Soil formation also seems to be evident in Polkadot (DOT). With a weekly increase of 16 percentage points, Polkadot can noticeably move from its current low of USD 6.40 north to currently USD 8.18. A first important price target for Polkadot is in the range of 12.50 USD.

- Cardano (ADA) and Ripple (XRP) also broke away from their annual lows in the last few trading days and each rose by around 9 percentage points in value.

- Only the two top dogs Bitcoin and Ethereum show a price discount of 4 percent (Bitcoin) and 2 percentage points (Ethereum) in a 7-day comparison. Investors seem to consider the strong price discounts on altcoins from the second and third series as more worthwhile at the moment.

Stability of the top-10

- Bitcoin’s price stabilization above the psychologically important $20,000 mark has generated strong buying interest in the entire crypto market over the past 48 trading hours.

- The vast majority of the top-10 altcoins benefited from this counter-movement.

- All top-10 altcoins bounced from relevant support levels to the north and are likely to further expand this recovery movement, at least in the short term.

- After 10 trading weeks with some harsh price corrections, the crypto market seems ripe for a recovery movement.

Many altcoins have corrected 95 percentage points

- The fact that the altcoins of the leading crypto currency Bitcoin have recently been able to chase significant market shares again indicates an increasing demand for oversold cryptocurrencies. The majority of the top 10 altcoins corrected from their all-time highs by 85 to 95 percentage points. A technical countermovement therefore seems more than overdue.

- With a view to the ranking of the top 10 altcoins, there is a change of place to report. Shiba Inu jumps two places to the north and pushes past Tron (TRX) and Avalanche (AVAX) to ninth place. Avalanche is slipping back to 11th place among the 10 largest cryptocurrencies after months.

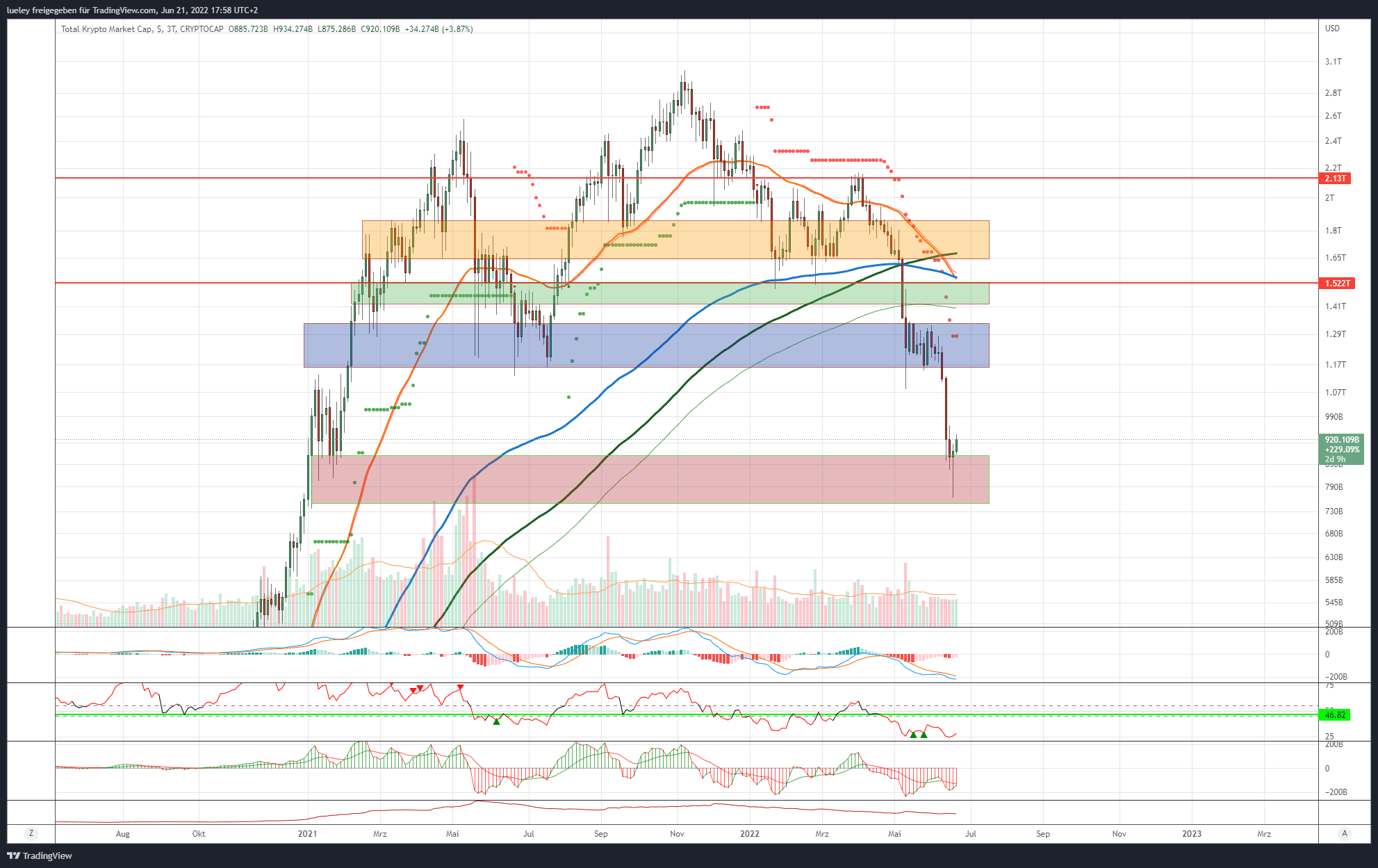

Total market capitalization based on values presented by Cryptocap

Winners and losers of the week

- The entire crypto market can recover significantly from its sell-off last weekend. In the meantime, the total market capitalization fell to a new annual low of USD 762 billion. On Tuesday afternoon, however, at USD 920 billion, it is trading a good 20 percentage points above its lowest level.

- Accordingly, the vast majority of the top 100 altcoins are seeing a price increase in a week-on-week comparison.

- More than half of the 100 largest cryptocurrencies have a double-digit price increase on a weekly basis.

Winners and losers among the top 100 altcoins

- The long list of weekly winners is led by Celsius (CEL), which increased in value by more than 100 percent due to the support of the CEL community on Tuesday and is even 316 percent higher in the 7-day comparison.

- Other cryptocurrencies from the field of decentralized finance (DeFi) are also increasing significantly in value. TitanSwap (TITANIUM) with an 80 percent price increase, followed by Synthetix Network (SNX) with a 63 percent increase in value, stand out positively here.

- The list of underperformers is clearly led by Chain (XCN), which has a price slump of 36 percent, followed by DeFiChain (DFI) with 23 percent price correction. The in-house token of the crypto exchange KuCoin (KCS) also loses slightly in value with a 6 percent price discount.

- If the crypto reserve currency Bitcoin (BTC) stabilizes further in the coming trading days, the overall market is also likely to recover further from its lows.

Disclaimer: The price estimates presented on this page do not constitute buy or sell recommendations. They are just an analyst’s assessment.

The chart images were created using TradingView.

USD/EUR rate at the time of writing: 0.94 Euro.