Bitcoin (BTC) was able to improve slightly again on today, June 14, after the opening of trading on Wall Street, which is why analysts are slowly confident again that a long-term support can now be established.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

What is the Central Bank doing?

As the data from Cointelegraph Markets Pro and TradingView show, BTC/USD can last hold above $ 22,500 today, after reaching an interim daily high of $ 23,300.

The Bitcoin price was able to make a strong upswing at only $ 20,800, probably partly due to the fact that the American stock market is also slowly recovering after the new inflation fears.

Accordingly, the crypto analysts of Material Indicators point out that the market-leading cryptocurrency was able to recapture the 200-day Simple Moving Average (200 SMA). An important milestone, because in bear markets, this brand usually acts as a critical support.

Nevertheless, it is still “much too early” to be able to reliably say whether the area around the 200 SMA could actually be established as a strong support. Especially with a view to tomorrow, June 15, because the US Central bank is expected to decide on another key interest rate cut on Wednesday.

#BTC just reclaimed the 200 Week MA. Some decent bid liquidity seen on #FireCharts, but too early to tell if it will hold. Expect all eyes to be on the #FOMC conference Wednesday. pic.twitter.com/OEV18iTSrD

– Material Indicators (@MI_Algos) June 14, 2022

The fear of the “Fed” is already making itself felt in the crypto community, because more and more voices assume that there will be an even bigger key rate cut by 75 basis points, instead of 50 basis points as before.

Tomorrow’s FOMC expectations are heavily weighted towards extreme 150-175 bps rate hikes pic.twitter.com/l5EW64mnvP

– CRYPTO EXCHANGE IRB (@crypto_birb) June 14, 2022

“Currently, the market expects a 96% probability that the Central Bank will decide on a key rate cut of 75 basis points on Wednesday. So far, the market had only priced in a 50 basis point cut, but sentiment has changed following this week’s new inflation figures. (A week ago, the probability of a reduction of 75 basis points was still 4%)“, as the analyst Tedtalksmacro, in turn, notes.

He added that a reduction of 50 basis points would have been very beneficial for both stocks and cryptocurrencies.

“Maybe that would have caused a little recovery,” as crypto expert Filbfilb agrees.

.

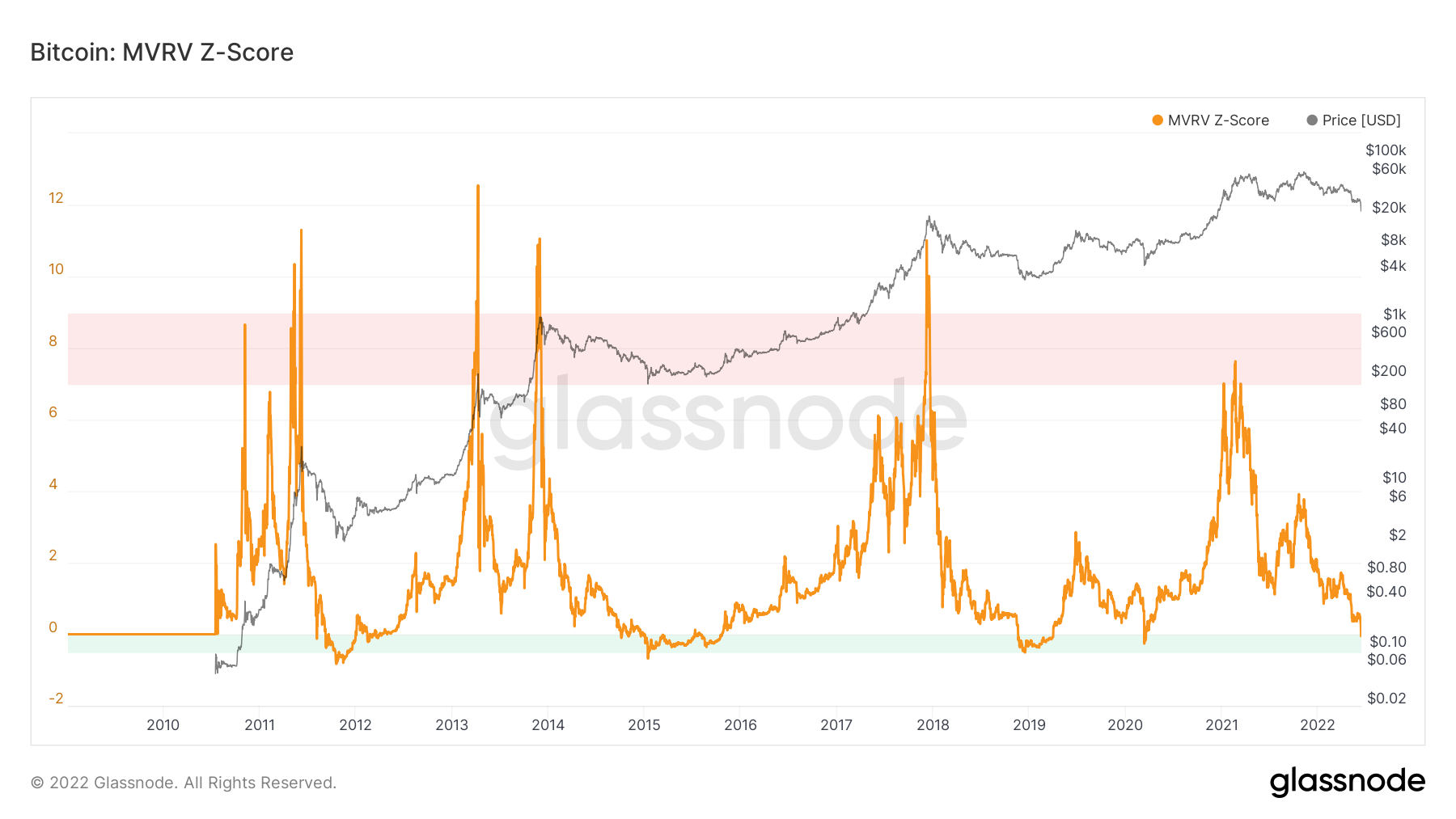

Bitcoin MVRV-Z Score. Source: Glassnode

Bitcoin MVRV-Z Score. Source: Glassnode

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.