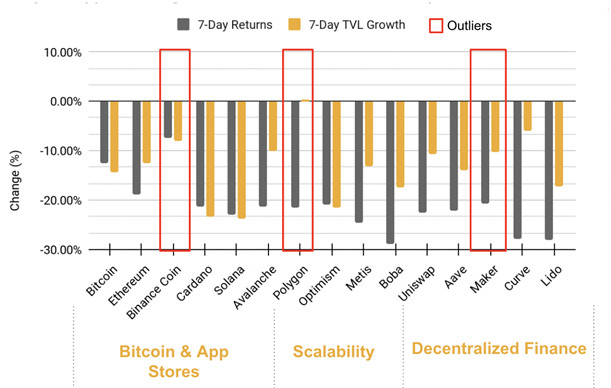

Over the past week, prices and, as a result, the assets invested in them fell according to total value Locked (TVL) of the most important crypto assets: Bitcoin and Ethereum fell by 12.6 and 18.9 percent, respectively. The best performance was observed in the assets Binance Coin, Polygon and Maker, which lost 7.4 percent, 21.5 percent and 20.8 percent in value. Polygon was the only asset to increase by 0.24 percent in TVL. In this blog post, we want to get to the bottom of this development with a special focus on the market for future positions and the ban on the Tornado Cash crypto mixer.

Figure 1: Development of Prices and Total Value Locked in Key Crypto Sectors

Figure 1: Development of Prices and Total Value Locked in Key Crypto Sectors

Series of sales of long positions

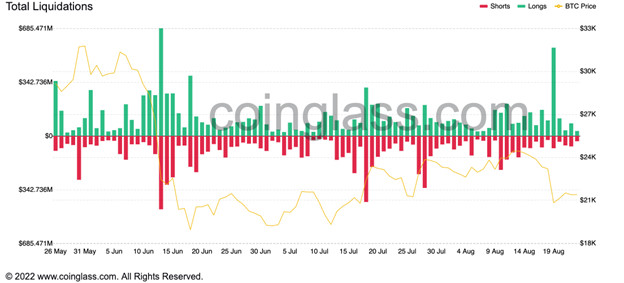

Figure 2: Sales of long and short positions

Figure 2: Sales of long and short positions

It was a series of sell-offs that took place on Friday in the market for future positions and are likely to have contributed to the development of the crypto markets. According to data from Coinglass, positions of 157,000 traders were liquidated on Friday alone at a total value of over $ 600 million – $ 239 million was lost in connection with Bitcoin trades and $ 224 million in connection with Ethereum trades In a short time, $ 562 million was lost in long positions and $ 79 million in short positions – it is the largest liquidation of long positions on futures since June 13, shortly before the Bitcoin price had fallen to $ 20,000.

On-chain indicators

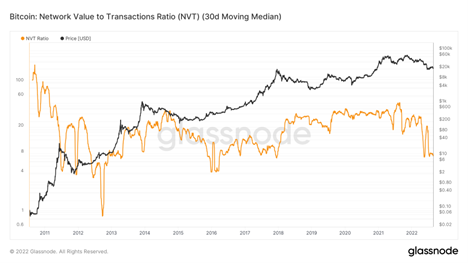

Figure 3: NVT Ratio of Bitcoin (2011-2022)

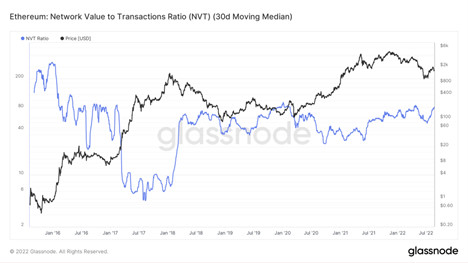

Since traders cannot meet the margin requirements, the enormous liquidations were the result. Regardless of this, however, the Net Value to Transactions Ratio (NVT) – analogous to the price-earnings ratio for shares – provides an estimate of the actual valuation level of an asset. As shown in Figure 3, an NVT ratio of 100 indicates that the Bitcoin price is overvalued, while downtrends such as the one on July 24th indicate that investors are buying Bitcoin at a discount. In December 2018, when the Bitcoin price fell to $ 3,000, the NVT ratio fluctuated between 13 and 33. Compared to the current NVT ratio, which stood at 45 on Monday, Bitcoin seems to be undervalued. When the price of Ethereum fell to $ 85 on December 16, 2018, the NVT ratio was 58.57. Compared to the current NVT ratio, which stood at 102.76 on Monday, Ethereum seems to be overvalued compared to historical values.

Figure 4: NVT Ratio of Ethereum (2011-2022)

Figure 4: NVT Ratio of Ethereum (2011-2022)

The BendDAO case: Democratically decided measures after the insolvency crisis

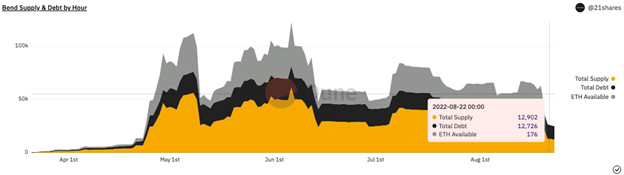

Benddao, a peer-to-peer lending protocol for NFTs, is the next crypto project hit by an insolvency crisis. The project allows users to deposit their NFTs and in return to borrow ether (ETH) in the amount of up to 40 percent of the NFT equivalent. The foreign exchange reserves of benddao, which is technically built on the Ethereum blockchain, reportedly fell to below 1 ETH on Monday.

Figure 5: Benddao Inventories and debts

Figure 5: Benddao Inventories and debts

Source: 21Shares, Dune Analytics

According to BendDAO’s homepage, the project currently offers an annual percentage rate of 87.06 percent on ETH deposits – 81.82 percent is paid out in ETH and 5.24 percent in the in–house BEND token. The yield is generated by NFT holders paying interest on ETH they borrowed against their NFTs; the interest rate on these ETH loans was 93.96 percent on Monday. At the current time, however, this interest rate has fallen to -101.44 percent. Borrowers were prevented from repaying their loans, which led to bad debts and, as a result, a liquidity crisis. The co-founder of the protocol warned the benddao community on Discord to calm down, on Monday the team of BendDAO proposed some short-term solutions:

- an adjustment of the liquidation threshold to 70%.

- an adjustment of the auction duration to 4 hours.

- a lifting of the first bid limit of 95% of the floor price

- an adjustment of the base rate to 20%

- and a preparation of an emergency plan to deal with bad debts.

Among the long-term, proposed improvements are the support of offers for collateral in BendDAO, contacting exchanges to list collateral, as well as support for down payments for auctions. 97 Percent of the Benddao community approved the proposal in a vote. The underlying technology that makes NFTs so unique and non-fungible creates numerous possibilities and use cases – but it is questionable whether NFTs are currently suitable as a financial instrument for borrowing due to the nature of this asset class.

Tornado Cash ban as a factor in share price declines?

Crypto exchanges: The reverberation of the ban on the Tornado Cash crypto mixer imposed by the US Treasury is unprecedented – it could even be a factor in the recent declines in the crypto market. Brian Armstrong, the CEO of Coinbase, announced in a tweet that his company would rather shut down its staking service for ETH than censor transactions at the protocol level to comply with a hypothetical censorship order from regulators on the Ethereum blockchain. According to data, Conbase is even the third largest actor for the validation of Ethereum transactions – as soon as the “merge” has taken place. It thus becomes clear which income losses could arise as a result of regulatory measures in the crypto world. The lending service Gemini also wants to offer staking services for MATIC, the cryptocurrency of the Polygon network – and later for ETH, SOL and DOT. It is further evidence of the bullish sentiment still prevailing around the staking services industry.

Mining Pools: Ethermine, the largest ETH mining pool, announced that it will discontinue support for planned POW forks. The service provider instructed its users to join other POW-based networks such as Raven and Ethereum Classic instead if they want to continue in the mining business. Since this announcement, ETC’s hash rate has increased to ATH over the weekend. Bittrue will also join the bevy of other exchanges supporting speculative activity on potential forks, as they are expected to release an ETHPOW token before the merge.

The $ETHS + $ETHW swap is now live!

Swap your $ETH for these two IOU tokens now ahead of the #Merge upgrade. Don’t miss out on this opportunity to claim the potential PoW ETH token for free, and look forward to trading these tokens in ~4 hours!

Swap now: https://t.co/DXTRduWs0P pic.twitter.com/KdPQIsGBFk

– Bitrue (@BitrueOfficial) August 19, 2022