Haven’t heard of Celsius in a while? This is probably due to the fact that the network, battered by liquidity problems, has not been communicating with its customers for a month. Now an analysis company is making serious allegations.

The crypto network Celsius is probably not in too much of a hurry when it comes to keeping its customers up to date. The last real update was on June 13, since then the blog entries have not been published more than is already known: withdrawals, barter transactions and transfers are not possible.

But how did the tragedy actually come about?

It has not been known since last week when Celsius was able to repay parts of the loan amount at Aave, MakerDAO and Compound. MakerDAO is said to be over 200 million US dollars, which pushed the liquidation price of Bitcoin to a vanishingly small amount.

An analysis company wants to show the course of the tragedy:

Coverage of the Celsius crisis has thus far been superficial and anecdotal.

Using on-chain and off-chain data and analytics, Arkham has revealed a more comprehensive picture of Celsius’ activity. 1/14

– Arkham (@ArkhamIntel) July 8, 2022

The company Arkham published a report in which they show the exact process. According to the Post, they use off-chain and on-chain data to provide an overview of all actions. She makes serious allegations – also against CEO Alex Mashinsky.

Step 1 – Have money managed by someone else

The Celsius management allegedly made the first wrong decisions back in 2020 when the pseudonymous asset manager 0xB1 was hired. He had previously built a name for himself in the crypto community – at one time he was the third largest DeFi user, after Justin Sun and Alameda Research.

Gradually, Celsius 0xB1 also became familiar with trades, from August 2020 to April 2021, it is said to have involved transactions in the millions. Already in December 2020, 0xB1 managed around 365 million US dollars from Celsius. Arkham used the trader’s wallet evaluations and an external balance check at Celsius to come to the conclusion.

From this point on, the problems began: the assets with which the user had traded were partially liquidated by Aave and Compound, the return was very bad. Finally, 0xB1 was able to transfer back the sum of 1.13 billion with a deposit of 534 million US dollars. Sounds like a win?

This may seem at first, but: at the same time, the value of the cryptocurrencies Bitcoin, Ethereum, etc. handed over to him increased by several hundred percent. At the end of the day, a loss of around 350 million US dollars was recorded under comparison of the cryptocurrencies handed over to him.

I’m limited in what I can say with litigation pending, but 0xb1 was not the only address KeyFi managed for Celsius – follow the litigation and more details will emerge that show the full picture.

– 0xb1 (@0x_b1) July 8, 2022

According to Arkham, the user is Keyfi CEO Jason Stone. In the meantime, the latter has filed a lawsuit against Celsius because he accuses the company of market manipulation. According to his own statements (Twitter), 0xb1 was not the only address that KeyFi managed for Celsius.

Celsius – It lags at all corners and ends

The network is said to hold over 1 billion US dollars in DeFi protocols – some under the observation of the broad masses. First of all, Arkham leads the leveraged positions of the lending giant.

Due to the poor market situation, Celsius had been forced to deposit over 750 million US dollars in additional collateral – at the expense of consumers. Because the money is currently not available for withdrawals.

There will be a lot more colorful: Not only $750 million is said to be inaccessible, but also $100 million has been lost in DeFi hacks. According to the analysis company, these are the BadgerDAO and Stakehound protocols.

Buy your own tokens? No one would ever do that, would they?

Some users may think so. In the case of Celsius, however, this was not the case. Arkham makes serious accusations and claims that Celsius bought back about $ 350 million of its own tokens, and this despite the fact that the company had already stored billions of US dollars in tokens.

A picture of arkhamintelligence.com/reports

A picture of arkhamintelligence.com/reports

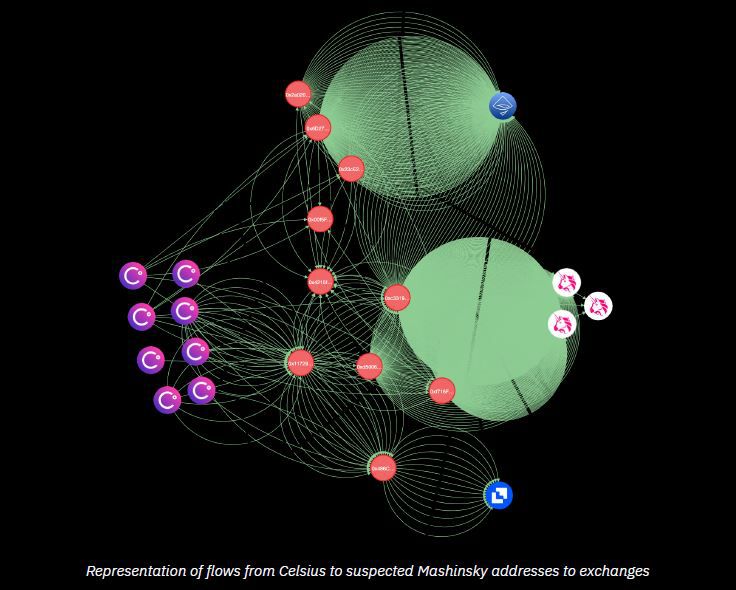

However, the analysis company goes much further: CEO Alex Mashinsky allegedly sold $ 45 million of CEL tokens himself – while the company was buying on the market. Arkham proves this in several analyzes by using special analysis tools.

The extent to which the allegations are true will probably also be part of the court process around the allegations of market manipulation.