The long-awaited Ethereum merge caused a bullish momentum in the ETH price and on the crypto market last week. However, the merger could lead to some negative regulations for the crypto space and affect the prices of numerous cryptocurrencies.

In September 2022, the so-called Ethereum Merge is expected to take place. The consensus mechanism of the blockchain will be switched from proof-of-work to proof-of-stake. The associated innovations can certainly be considered bullish: the energy consumption of the blockchain will decrease by 99% after the upgrade and ETH will become a deflationary asset.

However, it could be that financial regulators decide to classify Ethereum as a “security” (security) after the merge. This, in turn, could have a negative impact not only on ETH, but also on the entire crypto market. Regulators, as with XRP, could put pressure on cryptocurrencies and gain more control over the crypto space.

On July 24, 2022, Adam Levitin, a professor of law at Georgetown University Law Center in Washington, D.C., published a tweet about possible new classification of ETH. He wrote:

“Something that no one is talking about: after the merge, there will be strong arguments that ether will be considered a security. The token of each proof-of-stake system will then probably be a security.”

Something no one is talking about: after the Merge, there’s going to be a strong case that Ether will be a security. The token in any proof of stake system is likely to be a security.

– Adam Levitin (@AdamLevitin) July 23, 2022

Is Ethereum an investment contract?

Gary Gensler, the head of the Securities and Exchange Commission (SEC), is still striving for the US authority to gain control over the crypto market. In June 2022, Gensler told CNBC that Bitcoin is the only crypto assetthat he does not consider as a security. If the SEC really evaluates Ethereum as security, then the authority could treat cryptocurrencies in the same way as stocks.

As Levitin explained, any token of a proof-of-stake network could be classified as security. The evaluation uses the Howey test, which was introduced by a US court in 1946. It is crucial whether the asset is a so-called “Investment Contract” investors can expect a profit.

During the test, it is checked whether there is a “Investment in a joint venture with the reasonable expectation of profits derived from the efforts of others”, out there.

This could be the case with Ethereum. After all, investors who stake ETH expect an annual profit (currently of around 4.2%). In addition, they are investing in a kind of ”joint enterprise”. However, the requirement that investors make the profits “exclusively from the efforts of a third party” is a grey area. After all, stakers are also network participants and therefore “work” for the validation of the ETH blocks.

Levitin argued that the contribution of most ETH stakers is relatively small compared to the total amount of staked ETH. Therefore, he assumes that the SEC could come to the conclusion that the income “solely from the efforts of a third party” come. However, how exactly the SEC will justify this decision is questionable. Levitin explained that:

“However, all this does not answer the more difficult question (IMHO), who is the ”issuer” when dealing with a decentralized system.”

ETH Course Update

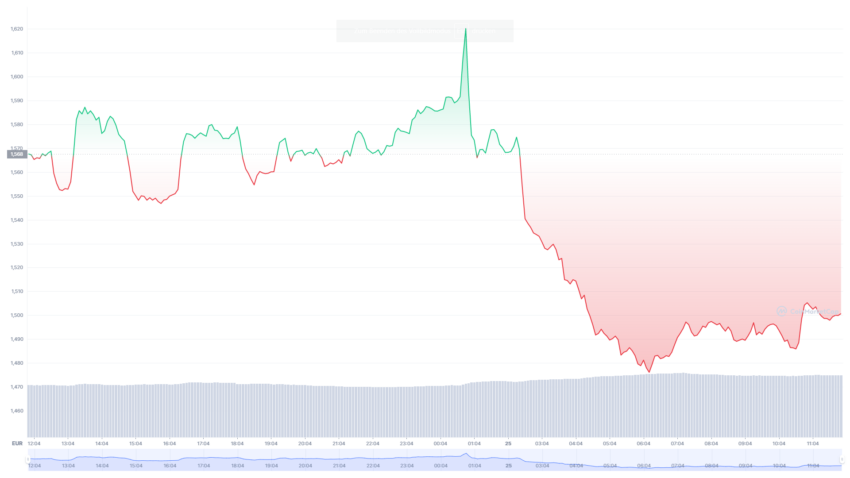

After a 30% rally in the last two weeks, the price was rejected at a crucial resistance level last weekend. The price decline continued this Monday morning.

At the time of publication of this article, the ETH price is $1,500, according to Coinmarketcap. Currently, the ETH price is still around 69% away from the last all-time high.

Ethereum Price in Euro Chart Source: Coinmarketcap

Ethereum Price in Euro Chart Source: Coinmarketcap

Negative news about the US macroeconomic data and inflation could lead to further turmoil in the stock markets this week. Therefore, there could be greater volatility in the Ethereum price and in the crypto market.