The level of arrears mortgage loans in the United States greatly increased because of these effects of the pandemic COVID-19 as a jump in unemployment and decline in income. At the same time, alarming figures refer only to the early stages of arrears, the proportion of penalties for delay remains low.

Analytical data of the consulting company CoreLogic, as of the end of April 2020 suggests that 3.4 percent of all mortgages in the United States were in some stage of delinquency (overdue 30 or more days).

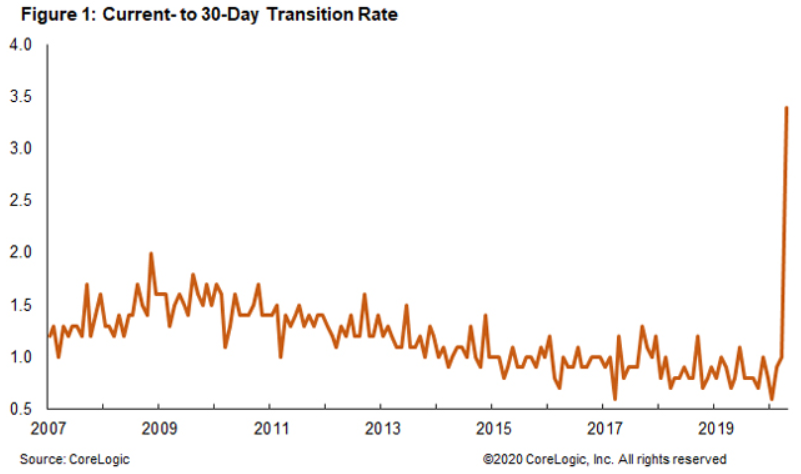

The share of 3.4% is substantially above a peak of 2.0% in 2008, which suggests that the economic damage caused by pandemic COVID-19, has affected more Americans than the last biggest financial crisis.

April was the month with the highest jump in the overall level of arrears by 2.5 percentage points compared to the previous month, which was the completion of the 27-month series of consecutive annual reduction in the overall level of delinquency.

In April of 6.1% of mortgages were in some stage of delay, with the greatest increase occurred in new York, new Jersey, Florida and Nevada.

Of these 6.1% share 4.2% were overdue for 30-59 days compared to 1.7% in April 2019.

However, not all bad and not all of the indicators of overdue mortgages hit record decades. The level of serious delinquencies, defined as mortgage payment is overdue by 90 days or more in April was 1.2%, lower than last year, equal to 1.3%.

“April was the fifth consecutive month with a level of serious delinquency at the lowest level since June 2000”, – stated in the Core Logic.

Such a figure as a foreclosure in April was the lowest for at least 21 years old.

Thus, despite the fact that the Americans began to delay payments on mortgage loans, it is not leading to registration serious penalties.

At the same time, the growth of overdue mortgage payments, it seems, does not weaken the housing sector. Due to record low interest rates on mortgage loans, which, in the opinion of the analysts of the market are likely to continue to decline, demand for home purchase and refinancing increased.