Traditional hedge funds are gradually welcoming investments in cryptocurrencies, but only to a limited extent, according to a new study by PricewaterhouseCoopers (PwC).

In its fourth annual report on crypto hedge funds worldwide in 2022 (4th Annual Global Crypto Hedge Fund Report 2022), PwC says that about a third of the traditional hedge funds surveyed had already invested in digital assets such as Bitcoin (BTC). So-called “multi-strategy” hedge funds are the most likely to have invested, followed by macro or equity strategy companies.

Of the hedge funds currently investing in the crypto space, 57 percent have used less than 1 percent of their total assets under management. Two thirds of the companies that have invested currently plan to make further investments by the end of 2022.

Respondents cited “regulatory and tax uncertainty” as the biggest obstacle to investment. Hedge funds are particularly concerned about the fragmented regulatory environment around the world.

The survey was conducted in the first quarter of 2022 and a total of 89 hedge funds participated.

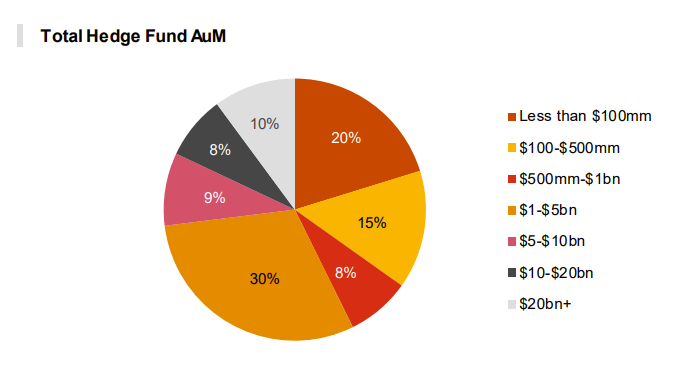

The majority of the hedge funds surveyed manage assets in excess of $ 1 billion. Source: PwC

The majority of the hedge funds surveyed manage assets in excess of $ 1 billion. Source: PwC

Hedge funds and other traditional asset managers have been monitoring developments in the crypto sector for some time to assess whether they should invest in this area. Several hedge funds have set up crypto departments and invested in this area. However, the majority of companies are still waiting. A survey of 100 global hedge funds in 2021 showed that asset managers plan to invest an average of 10.6 percent in crypto within five years.

In this context: Institutions are investing in crypto: but why? BlockFi Sales Manager David Olsson clarifies

Although there has been a crypto bear market since 2022, institutional investors continue to buy despite the recent decline. Inflows into Bitcoin investment products, such as exchange-traded funds and Grayscale’s GBTC, have increased by $126 million in the past week, according to CoinShares. Bitcoin mutual funds have seen over $500 million in net inflows this year.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.