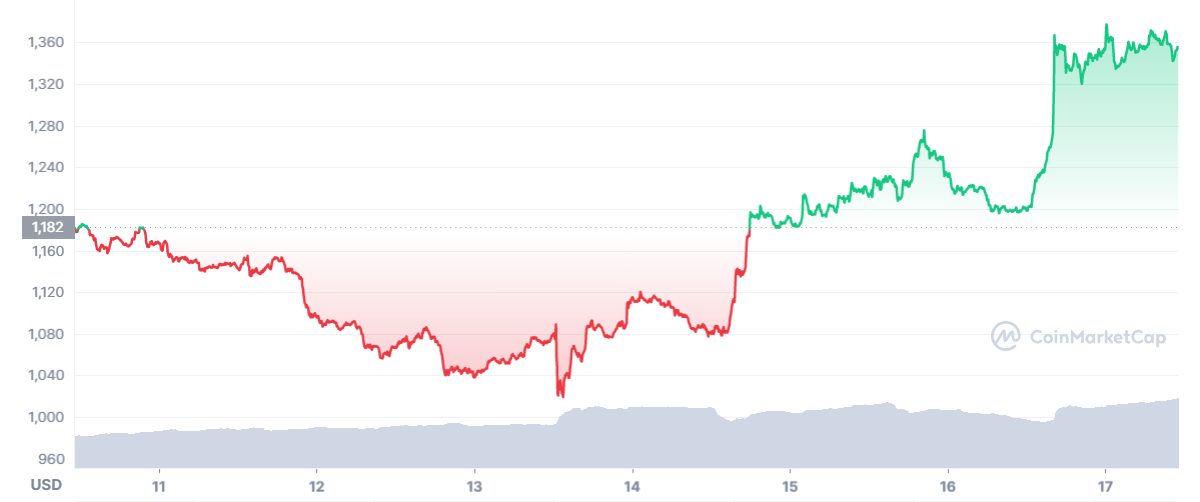

Yesterday, Saturday, 16.07.22, the Ethereum price was able to break through an important resistance.

For the first time since mid-June, Ethereum (ETH) is currently trading above the 1250 US Dollar Mark. We look at whether ETH is already in the process of bottoming out and take a detailed look at the chart in our Ethereum Coin price analysis.

Price development of the cryptocurrency Ethereum (ETH) within the last 7 days

Price development of the cryptocurrency Ethereum (ETH) within the last 7 days

Reasons for the Ethereum price increase

A few days ago we reported on the announcement of the Ethereum developers on the date of the ETH proof-of-stake conversion.

Ethereum Merge: ETH Proof-of-Stake Conversion Dated

Developers of the cryptocurrency Ethereum (ETH) announce the date for the conversion of the blockchain from proof-of-work to proof-of-stake: the merge is getting closer and closer.

The details of the Ethereum Merge can be found here

The details of the Ethereum Merge can be found here

The mechanism of switching to proof-of-stake, which has been anticipated for almost two years now, can be noted as the central reason for the current Ethereum (ETH) price momentum.

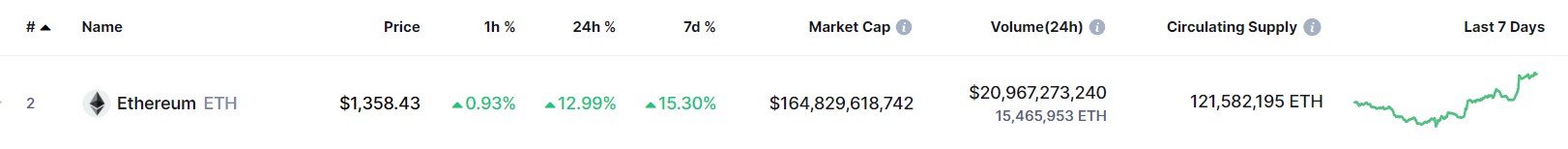

Within the last 24 hours, the price of the DeFi cryptocurrency Ethereum has been able to Gain 13 percent.

Current information about the cryptocurrency Ethereum (ETH)

Current information about the cryptocurrency Ethereum (ETH)

Current chart analysis and forecast for the price of the cryptocurrency Ethereum (ETH)

In the chart itself, we can see a clean break from the previously established structure. Previously, the ETH rate was rejected twice at the 1250 US dollar mark.

With a strong volume candle on a 4-hour basis, Ethereum was able to break through this resistance level and henceforth as Course Support win.

Ethereum Course ” Live ETH price in EUR, USD and CHF

Current live data on the Ethereum (ETH) exchange rate in Euro (DOT/EUR), US dollar (DOT/USD) and Swiss franc (CHF) as well as forecasts and analyses.

Within technical analysis, it can be assumed that price resistances (price supports) are converted into price supports (price resistances) by breaking through them.

At the moment, the cryptocurrency Ethereum is listed at 1360 US Dollars.

Since the temporary low on June 20, the price of the ETH coin has been able to more than Gain 50 percent.

Price of the cryptocurrency Ethereum (ETH) on the 4-hour chart, Tradingview

Price of the cryptocurrency Ethereum (ETH) on the 4-hour chart, Tradingview

Short-term momentum and relief rallies of the kind we have seen with Ethereum quickly cause a positive stir and in some cases to anticipate further price gains and thus greed.

After Ethereum, like all cryptocurrencies, had to endure strong sell-offs over the ETH exchange rate, it is perfectly normal that counter-movements to the current trend occur.

Chart analysis: basics, key figures and tips (2022)

Chart analyses are considered the basis of the classical valuation methods. Bitcoin2Go shows the basics and 5 most important key figures for the analysis method.

Such counter-movements can be found in all financial markets, there is no pure “up-only” or “down-only”.

Meanwhile, the renowned crypto-chart analyst Rekt Capital shares with his Twitter community his opinion on the current breakout of the price of ETH:

ETH has broken out.

However, most likely, this movement is most likely a relief rally in a still macroeconomic downtrend.

$ETH has broken out

Probabilistically however, this move is most likely a relief rally in what is still a macro downtrend#ETH #Crypto #Ethereum

– Rekt Capital (@rektcapital) July 16, 2022

A relief rally or bear market rally is a short-term strong positive price impulse, which causes a positive stir.

Due to the overlying macroeconomic circumstances if the price increase is short-lived in most cases, an even stronger sell-off often follows.

In order to be able to establish a sustainable trend change, the Volume over weeks constantly increasing and the individual resistance levels are surpassed one after the other.

Beginning of soil formation – positive long-term development

In technical analysis, the viewing period of the time period of the chart is of central importance.

Depending on the setting, it is thus possible to switch between short- medium and long-term perspectives.

📈

If we now look at the long-term 7-day chart of the price of the cryptocurrency ETH, we can see that Potential for the formation of a potential course floor at the present time is quite present.

First of all, we can state that the basic condition for a trend change is present: Increase in trading volume.

Of the last 4 weeks, the ETH price has been able to record three out of four candles at a positive price level. The volume itself has been increasing since the first week of July.

Furthermore, the Relative Strength Index (RSI) the presence of a large amount of potential purchasing power.

Ethereum (ETH) price from a long-term perspective on the 7-day chart

Ethereum (ETH) price from a long-term perspective on the 7-day chart

With a value of current 34 the RSI is listed just above the “oversold” status.

Such a low value was most recently in December 2018 recorded, at that time Ethereum was trading at $ 100.

Accordingly, it can be stated that from a purely chart-technical perspective, without considering macroeconomic influences, a Bottoming can get closer and closer.

Short-term momentum – However, ETH trading volume is already declining

It is clear that Ethereum was able to gain short-term momentum for the ETH Coin price due to the current price momentum.

Depending on whether Ethereum is able to Maintain support levels, further price increases could take place in the future.

📉

On the other hand, it must be noted that the trading volume for ETH has already declined again in the short term and a further sell-off is quite possible if the now established price support breaks.

Through a so-called “Short Squeeze” in the entire crypto market, those traders who bet against the market, i.e. against price increases, were also liquidated.

Thus, prices increased more, which, however, was not caused by fundamental data, but by the market participants or traders themselves.

Textbook short squeeze $BTC

Open interest rising with increasingly negative funding rates as price grinds up. (Shorts)

Meanwhile, CVD rising indicating spot bidding. pic.twitter.com/ARI27bvpCU

– Will Clemente (@WClementeIII) July 16, 2022

In this context, the macroeconomic development play a decisive role for the further momentum of Ethereum and for the entire crypto market.

You can find more detailed information summarized in our new YouTube video

Our Bitcoin savings plan calculator shows you that regular investing is worthwhile. Try it out!