The Ethereum price has been falling for seven days. But today the Ethereum price is rising very strongly and if ETH breaks this resistance, the correction is over.

If the Ethereum price breaks this resistance, $1,912 is in prospect

Ethereum Price Chart by Tradingview

Ethereum Price Chart by Tradingview

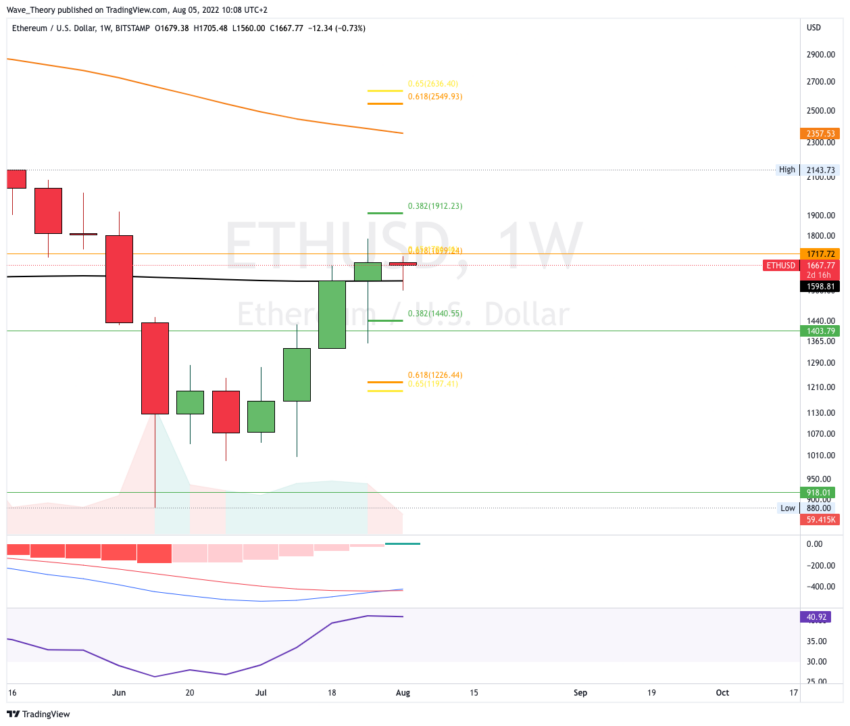

The Ethereum price shows bullish momentum today, because yesterday ETH formed a higher low point, after which the price already shot up about 5%. In addition, the MACD is also clearly bullish in the 4H chart, because the MACD lines crossed bullish while the histogram ticks bullish higher. The RSI is neutral.

Ethereum now takes place at around $1,700 significant fibonacci Resistance. If this resistance is broken, the correction may have ended and Ethereum could reach its last high point at around $1,785 rise. If ETH also breaks this resistance, wait at around $1,912 significant Fibonacci Resistance.

If the Ethereum price breaks the trend line, 1,440 – 1,512 USD are in prospect

Ethereum Price Chart by Tradingview

Ethereum Price Chart by Tradingview

If, on the other hand, Ethereum is rejected bearishly at the Golden Ratio resistance at around USD 1,700 and then does not maintain the series at higher lows, Ethereum may return to the correction target between USD 1,440 – 1,512. There, Ethereum encounters 0.382 Fib support and the 50-day EMA.

In addition, the MACD is clearly bearish in the daily chart, because the histogram ticks bearishly lower and the MACD lines are crossed bearishly. Moreover, not only would one Rejection at $1,700 bearish, but also a Daily closing price below $1,646. Because this would not even break the 0.382 Fib resistance, which would make the trend short-term bearish would be confirmed.

Then Ethereum could return to support between $1,440 – $1,512 this weekend.

Ethereum Price Could Close Above 200-week EMA

Ethereum Price Chart by Tradingview

Ethereum Price Chart by Tradingview

In the weekly chart, the MACD continues to be clearly bullish, because the histogram ticks bullish higher and the MACD lines are crossed bullish. Should ETH close above around $1,600 this week, it would indicate a continuation of the upward movement.

Then ETH could target the 0.382 Fib resistance at around $1,912 the following week. If this is broken bullish, Ethereum will find the next significant Fibonacci resistance at around $ 2,600, with the 50-week EMA already acting as an important resistance at around $2,360.

Monthly chart does not yet give any indication of a bullish trend reversal

Ethereum Price Chart by Tradingview

Ethereum Price Chart by Tradingview

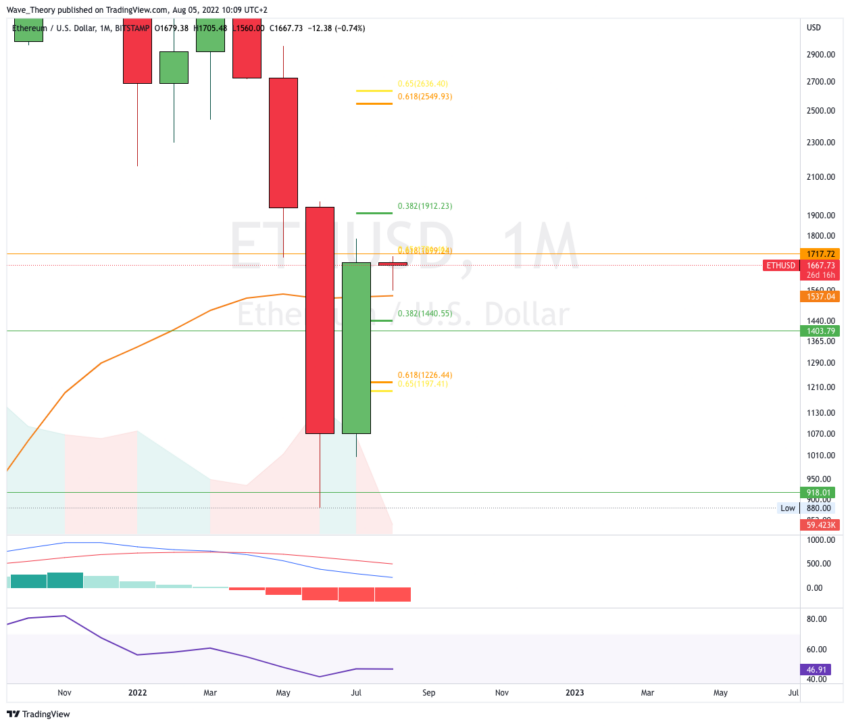

The month has only just begun, and so far August does not give any signs of a bullish trend reversal. Thus, the histogram of the MACD also ticks bearishly lower and the MACD lines remain bearishly crossed. Meanwhile, the RSI is neutral.

Against BTC, the ETH price is at the Golden Ratio resistance

Ethereum Price Chart by Tradingview

Ethereum Price Chart by Tradingview

Against BTC, the ETH price is at the Golden Ratio resistance at around 0.074 BTC. In the event of a bearish rejection, the price target is around 0.0644 – 0.0655 BTC. If ETH, on the other hand, breaks the golden Ratio bullish, the price target is around 0.083 BTC.

In addition, the MACD is clearly bullish on the weekly chart, because the histogram ticks bullish higher and the MACD lines are crossed bullish.

So it still looks bullish in the medium term, but rather bearish in the short term.

Here you can find the latest Ethereum price forecast.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.