Munich Small company, big attention: TSMC is rolling out the red carpet for Europe’s most valuable chip start-up. Graphcore is the first customer of a new, groundbreaking production process of the world’s largest contract manufacturer in the semiconductor industry. The up-and-coming British chip designer hopes this will give him a significant advantage in attacking the industry giant Nvidia.

“It’s quite remarkable that we can work so closely with TSMC as a young company,” Simon Knowles, co-founder and chief technology officer of Graphcore, told Handelsblatt.

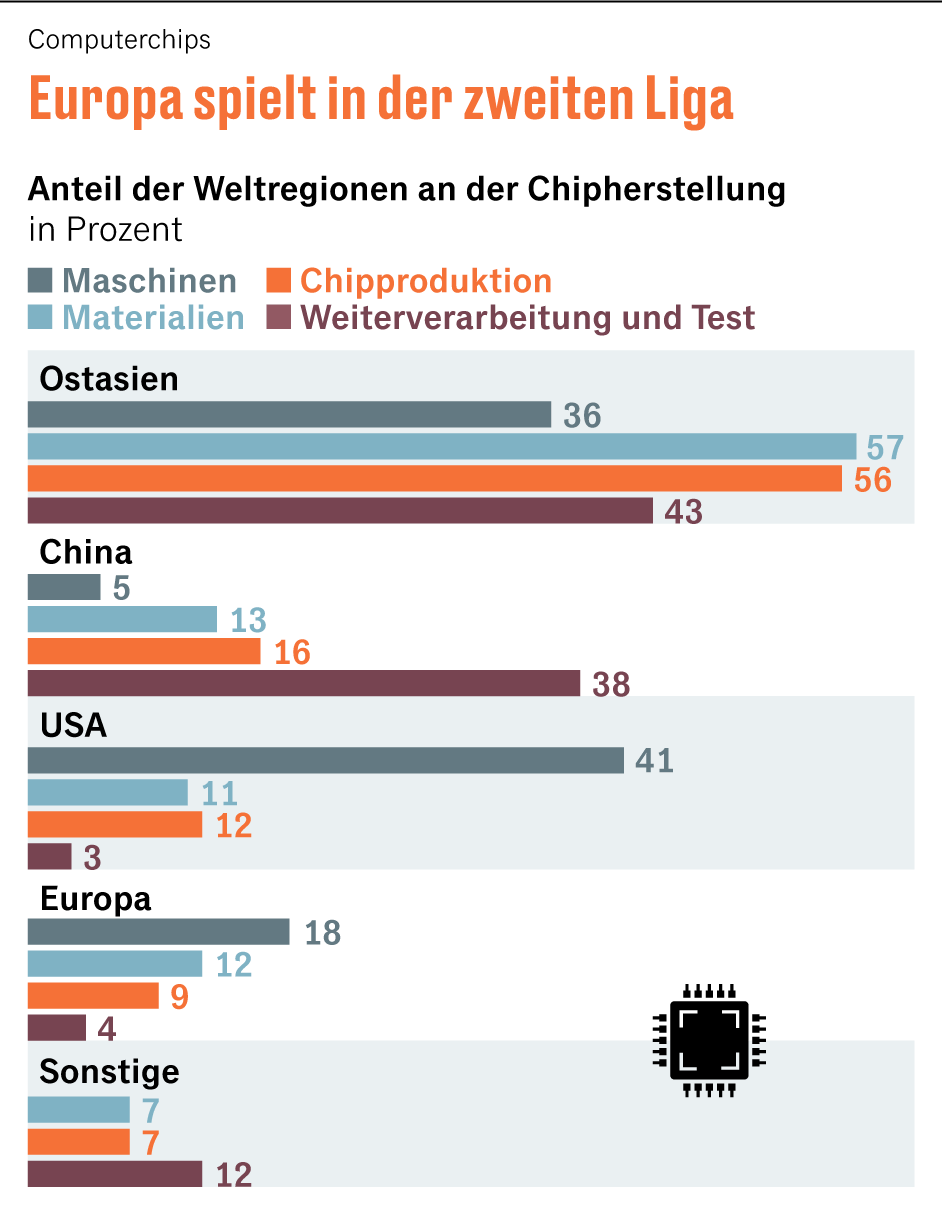

Graphcore is one of the biggest hopes of the chip industry in Europe. Because Knowles and his co-founder and CEO Nigel Toon are pushing into the top class of the industry: the processors. They are the brain of every computer. It is a field that Europe has so far largely left to the Americans.

The chips specifically for artificial intelligence (AI) are not only faster than those of the market leader Nvidia, claims CEO Toon. Over the entire service life, they are also ten times cheaper. He calls them Intelligent Processing Units, IPUs for short.

A full-bodied, but apparently credible promise. Because TSMC is not just anyone. The contract manufacturer has the most advanced production processes in the world. From Apple to Qualcomm, all major chip companies have their products manufactured by the Taiwanese.

TSMC praises groundbreaking designs

The designs of Graphcore are “groundbreaking”, says Paul de Bot, European head of TSMC. “Graphcore has taken full advantage of the opportunity to connect the power supply directly via our wafer-on-wafer technology to achieve a major performance increase.“ Instead of further shrinking the structures on the chips with enormous effort, two components are superimposed and connected to each other in the process. This is already common with memory chips, but not with processors, says Knowles.

So far, the roles in the processor market have been clearly distributed: for decades, the US company Intel has dominated the business with processors for PCs and servers, the so-called central processing units, or CPUs for short. Nvidia supplies so-called graphics processors, the GPUs. They were initially intended as a supplement for CPUs, but have now become established as a separate category.

Originally developed for video games, GPUs are now also found in many network computers, the servers. Nvidia CEO Jensen Huang also believes in a great future of GPUs in artificial intelligence. Nvidia has a market capitalization of around $ 330 billion, making it the most valuable semiconductor manufacturer on Earth.

Toon and Knowles, however, see their chips as a superior solution. Because the components, they argue, are specially designed for AI applications such as machine learning. They want to establish the IPUs on the market as a new, separate processor category alongside CPUs and GPUs.

Review

2,8

Billions of dollars

Graphcore is currently the most expensive chip start-up in Europe.

The financiers believe in a great future of Graphcore. In the most recent financing round at the end of 2020, they valued the six-year-old company at just under $ 2.8 billion. This makes Graphcore the most expensive chip start-up in Europe. The company has raised $700 million so far.

“We continue to see excellent development opportunities at Graphcore,” says Ingo Ramesohl, CEO of RBVC, Bosch’s venture capital subsidiary. The world’s largest automotive supplier was one of the company’s first financiers from Bristol in 2016. The latest industry comparison for machine learning, the so-called MLPerf, has once again proven Graphcore’s competitiveness, says Ramesohl. The investors also include BMW, Dell, Microsoft and Samsung. The most famous financial investor is Sequoia.

Competitors richly endowed with capital

However, the competition is fierce – and the competition is also richly endowed with capital. For example, the start-up Sambanova raised 676 million dollars in the spring of last year and can thus fall back on a total of more than a billion dollars. Investors value the Silicon Valley company at over five billion dollars.

California-based competitor Groq raised $300 million in mid-April last year. The company is valued at about a billion dollars. Intel acquired Israeli AI chip start-up Habana for two billion dollars three years ago.

The young companies are pushing into a fast-growing market. In 2021, sales of AI chips increased by more than half to almost $ 36 billion. According to Gartner expert Alan Priestley, around 80 start-ups around the world are hoping for a breakthrough.

Graphcore sees itself ahead of its competitors: “We are the ones who are most likely to make life difficult for Nvidia,” Toon asserts. “Because our systems are more powerful.“ However, the size difference is glaring: Nvidia has around 22,000 employees, Graphcore a good 500.

The start-up, however, seems quite successful, but does not publish financial data. According to their own statements, the British have two important customer groups in particular: the operators of data centers as well as research institutions such as the Karlsruhe Institute of Technology (KIT) or the University of Oxford.

IPO as an option – but not now

Toon and Knowles have talked about an IPO more often in the past. In view of the stock market lull, this does not seem realistic at the moment. First of all, the company does not need fresh money. Graphcore has more than $200 million in the account, Toon claims.

However, a competitor may also be involved. Toon is familiar with this: eleven years ago, he sold his former company Icera for $ 435 million to Nvidia of all companies.

TSMC, meanwhile, is pleased with the cooperation with Graphcore. “We are looking forward to working with you on further developments of this technology,” says Head of Europe de Bot.