Chip machine from ASML: The Dutch want to expand production more than previously planned.

Munich orders without end: The Dutch chip supplier ASML can no longer cope with the flood of orders. Therefore, the machine manufacturer plans to expand its production even more than previously announced. However, this will not be a self-starter, warned Chief Financial Officer Roger Dassen on Wednesday. The question is: “Can we do that?” Because the suppliers also have to expand strongly, the manager stressed.

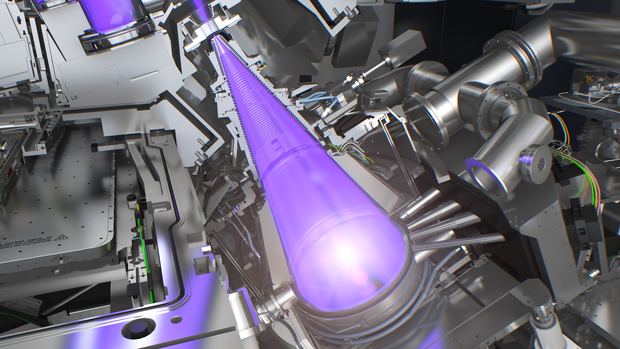

In 2025, ASML wants to produce 90 so-called EUV systems, a good quarter more than previously planned, Dassen explained. The machines, each costing more than 100 million euros, are the backbone of global semiconductor manufacturing. Worldwide, only ASML has mastered EUV lithography, the most advanced production process in the chip industry. EUV stands for extreme ultraviolet light, with which the semiconductors are exposed. Only this technology makes it possible to produce chips of the most modern generation with structure sizes of less than seven nanometers.

ASML benefits from high semiconductor demand

The most important suppliers of ASML include two Swabian corporations: Zeiss and Trumpf. They supply core components for the sophisticated systems: Zeiss produces mirrors, Trumpf the lasers.

Like no other European group, ASML is benefiting from the huge boom in the semiconductor industry. The Dutch have orders for 29 billion euros on the books. In the first quarter, new orders in excess of seven billion euros were added. “The demand is very, very strong,” emphasized CFO Dassen. However, the good business is slowed down by the scarce production capacities.

In the first three months of the year, sales fell by around a fifth year-on-year to EUR 3.5 billion. However, this is purely for accounting reasons: in order to deliver the machines faster, the final tests and acceptance are now carried out at the customer’s site. As a result, sales that would normally have been recorded in the first quarter are now coming later. At the end of the year, sales will also shift to 2023.

ASML aims to increase sales by a fifth

The profit more than halved to 695 million euros, but was higher than analysts expected. ASML is struggling with rising wages, higher component prices and rising freight rates, Dassen explained.

ASML confirmed its forecast for the entire year: sales are expected to increase by around a fifth. Last year, revenues were even up by a third. ASML’s most important customers include chip manufacturers Samsung and Intel as well as TSMC, the world’s leading contract manufacturer.

Only the investors, who have not really believed in the growth story lately. Since autumn, the shares have lost almost a quarter of their value. Compared to the spring of 2020, however, the price has almost doubled. In early trading in Amsterdam on Wednesday, the securities gained more than four percent to almost 590 euros.

With a market capitalization of around 237 billion euros, ASML is the most valuable tech group in Europe. For comparison: the software manufacturer SAP comes to around 115 billion euros. The stock market value of the largest German chip group, Infineon, is less than a fifth of ASML.