The Bitcoin price stopped the free fall, bounced off the all-time high of the last cycle and rose above $ 22,000 on June 16, 2022. Have we finally reached the bottom?

The Bitcoin price fell by 26% over the course of this week and reached a new 18-month low on June 15, 2022 at 20,193 US. Since then, however, the BTC price has recovered somewhat. However, at the time of writing, the Bitcoin price is still 67% away from the last all-time high at $22,344.

Jurrien Timmer, director of global macro at investment giant Fidelity, examined the price-earnings ratio (P/E) for Bitcoin. Since Bitcoin is a cryptocurrency, and not a company, Trimmer used a price / network ratio.

According to the chart that Jurrien Timmer shared on Twitter, the ratio is at the same level as in 2013 and 2017, when the BTC price reached the highs of the cycles of that time. The Bitcoin price, on the other hand, is at the same level as at the end of 2020. Timmer pointed out that “the valuation is often more important than the price”.

Is BTC cheaper than it looks? If we consider a simple “P/E” metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. The price is more important than the price. /THREAD pic.twitter.com/6XMPrtRUzF

– Jurrien Timmer (@TimmerFidelity) June 15, 2022

Bitcoin: where is the bottom?

The price-earnings ratio (also P/E ratio) is used in the classic financial markets to estimate the value of a company. In the classic P/E ratio, the current share price is weighted with the earnings per share. This does not work with cryptocurrencies, which is why the price is correlated with network activity. Alternatively, the “Network Value to Transaction Ratio (NVT)” can also be considered, as analyst Willy Woo has already done.

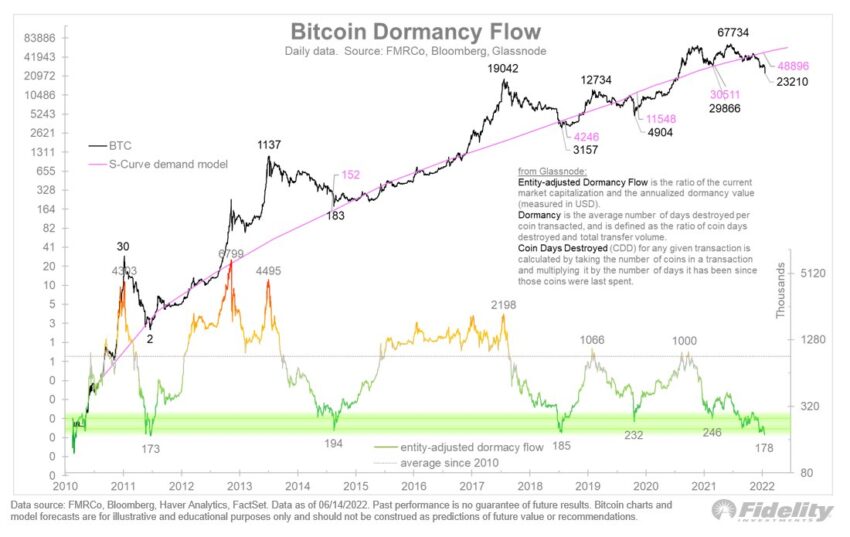

Timmer, on the other hand, compared the number of non-empty Bitcoin addresses with the BTC rate. ”The price is currently below this network curve,” Timmer wrote. He then used Glassnode’s Bitcoin Dormancy Flow Model to show how oversold the asset is currently. According to the model, Bitcoin is as oversold as in the market capitulations of 2011, 2014 and 2018.

Chart – Glassnode/Fidelity

Chart – Glassnode/Fidelity

This could be an indication that we are near the bottom of this market cycle and the sell-off this week may have been the last sell-off wave.

Miners sell large amounts of BTC

However, there is another factor that could lead to a final price decline, similar to the market crash of 2018: the Bitcoin miners.

Bitcoin miners moved large amounts of BTC to the crypto exchanges this week. CoinMetrics reports that on June 15, 2022, the value of BTC (88,000!), which the miners sent on crypto exchanges, reached a new all-time high (calculated in USD) at 1.94 billion US dollars.

The partner of Castle Island Ventures, Nic Carter, explained the background in a recent tweet.

The miners have to sell their assets to cover the rising energy costs and to be prepared for a crypto winter. The sale of the miners could lead to another strong sell-off. In recent cycles, the BTC price has fallen by over 80% after reaching the corresponding peaks. So history could repeat itself.

If that happens, then the Bitcoin price could fall pretty quickly to around 12,000 US dollars (about -82% from the last all-time high), as the expert Peter Brandt explained.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.