Munich The start has been a success: Jochen Hanebeck is leading Infineon with good numbers. Sales in the past quarter increased by 22 percent to around 3.3 billion euros, the Dax Group announced this Monday. The bottom line was a profit of 469 million euros, more than twice as much as in the same period last year. The operating margin was 23 percent. This means that Germany’s largest chip manufacturer has exceeded its own forecast and also the expectations of analysts.

“Our business continues to perform well in an increasingly challenging environment,” said Hanebeck. The previous Chief Production Officer took over the chief position from the long-standing Chairman of the Board of Management, Reinhard Ploss, on April 1. At the same time, the manager warns: “Global uncertainties are weighing on supply chains, especially the war in Ukraine and the further course of the coronavirus pandemic.“

The chip shortage is not over

As has been the case for more than a year, Infineon has not been able to deliver as much as customers order for a long time. “We live from hand to mouth,” explained Sales Board Member Helmut Gassel. Especially the contract manufacturers in the Far East are not lagging behind with the production. Nothing will change so quickly, on the contrary. It could get even worse in the coming months.

Infineon now has orders in excess of 37 billion euros on its books. This is six billion more than at the end of the fourth quarter of 2021 and corresponds to almost three times the revenue planned for the current financial year.

Top Jobs of the day

Find the best jobs now and

be notified by e-mail.

Nevertheless, Hanebeck is reluctant. “We are monitoring the short- and medium-term market and delivery conditions very closely in order to be able to react if necessary,” the manager added.

Specifically, Hanebeck is concerned about possible restrictions on energy supply in connection with the Ukrainian war. In Europe, Infineon operates large plants in Dresden and Villach. High energy costs would burden Infineon, and the prices for materials have also risen sharply, said CFO Sven Schneider. The lockdown in Shanghai, China, would also make logistics more expensive.

Not only Infineon is growing strongly, the entire chip industry has been booming for almost two years now. The digitalization of daily life and electric mobility are generating record sales for the companies. At the same time, the semiconductor industry is struggling with massive supply bottlenecks because production capacities are not sufficient.

However, Infineon’s competitors have recently been less skeptical than the Munich-based ones. “Overall, demand continues to exceed the increased supply, and inventories in all end markets remain very thin,” said NXP CEO Kurt Sievers.

Infineon expects half a billion more sales

“Demand exceeds capacity by 30 to 40 percent,” said Jean-Marc Chery, Chief Executive Officer of STMicroelectronics. The orders were already sufficient today to fill the plants of the Franco-Italian company for almost the entire next year. The order intake is strong and the sales increase of up to 20 percent predicted at the beginning of the year for 2022 is realistic.

Despite all the uncertainties, Hanebeck raised the forecast on Monday. Sales are now expected to rise to 13.5 billion euros in the current financial year, which ends on September 30. Previously, Infineon had expected 13 billion euros. The operating margin should now be above the 22 percent that the Group had previously targeted.

Jochen Hanebeck

The new Infineon CEO presented the figures for the first time.

(Photo: dpa)

This is the second time in the current financial year that the company has increased its forecast. Compared to the original outlook from autumn, there is an increase in sales of 800 million euros. One reason for the improved outlook: Infineon was able to increase prices in view of the global supply bottlenecks. In addition, the quantities are increasing. And that’s not all: the strong dollar is helping the Bavarians. In the second half of the financial year, this will result in 150 million euros more in sales, according to Chief Financial Officer Schneider.

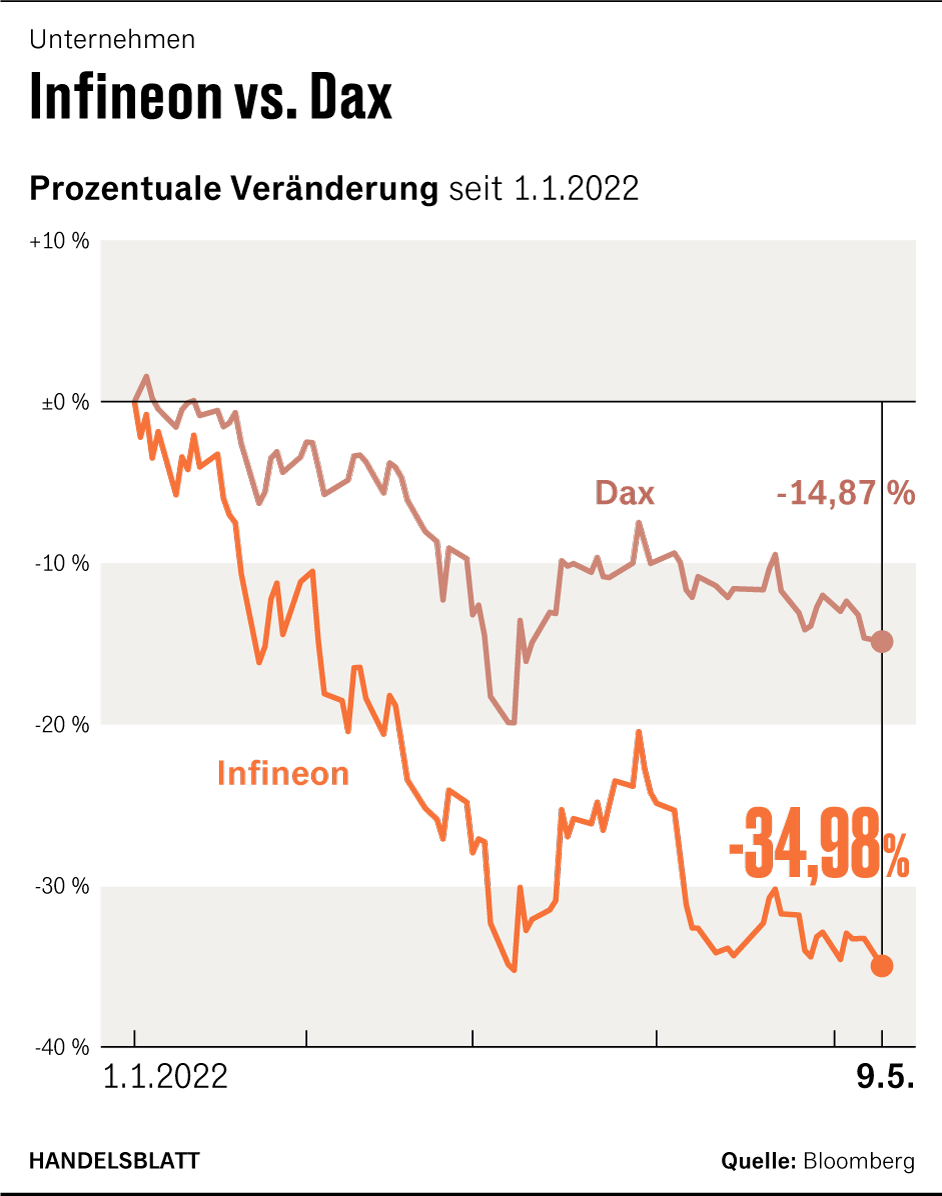

Investors, however, fear a quick end to the chip boom. The share prices of almost all chip manufacturers have fallen sharply in recent months despite good figures. Infineon’s shares have lost more than a third of their value since the beginning of the year. On Monday, things went downhill again, the securities fell more than three percent in a weak environment and traded at around 26.30 euros. Infineon was one of the biggest losers in the Dax.

More: The chip Paradox: Why business is booming and stock prices are suffering.