Palantir has signed a three-year contract with Management on sanitary inspection behind quality of foodstuff and medicines USA (FDA) for the provision of its software to integrate and analyze data when testing drugs.

Shares Palantir Technologies (PLTR), increased more than 200% since the release on the NYSE on September 30, increased by 21.34% on Monday on news of a new major government contracts.

Company Palantir, founded in 2003 by Peter Thiel (cofounder of PayPal) and Joe Lonsdale, provides software to collect and Annalisa large amounts of data, which allows to detect important patterns and to make informed decisions.

Half of the clients Palantir is a state structure, the company has received dozens of major contracts, gaining credibility. According to media reports, the latest win Palantir’s three-year contract with the Center for evaluation and research of drugs by the FDA and the Oncology center of excellence in the amount of $44.4 million

Software Palantir will be used in the approval process of drugs, possibly including the treatment of coronavirus.

In October Palantir stated that its software will help the Federal government to create a system that will track the production, distribution and use of vaccines against Covid-19 among 300 million Americans as part of operation Warp Speed.

Government contracts amounts to more than half of the Palantir, and last quarter brought in $163 million In November, the company Palantir stated that its recent contracts were: deal with the US army, the contract with the National institutes of health and the prolongation of the contract on $300 million with a customer from the aerospace industry.

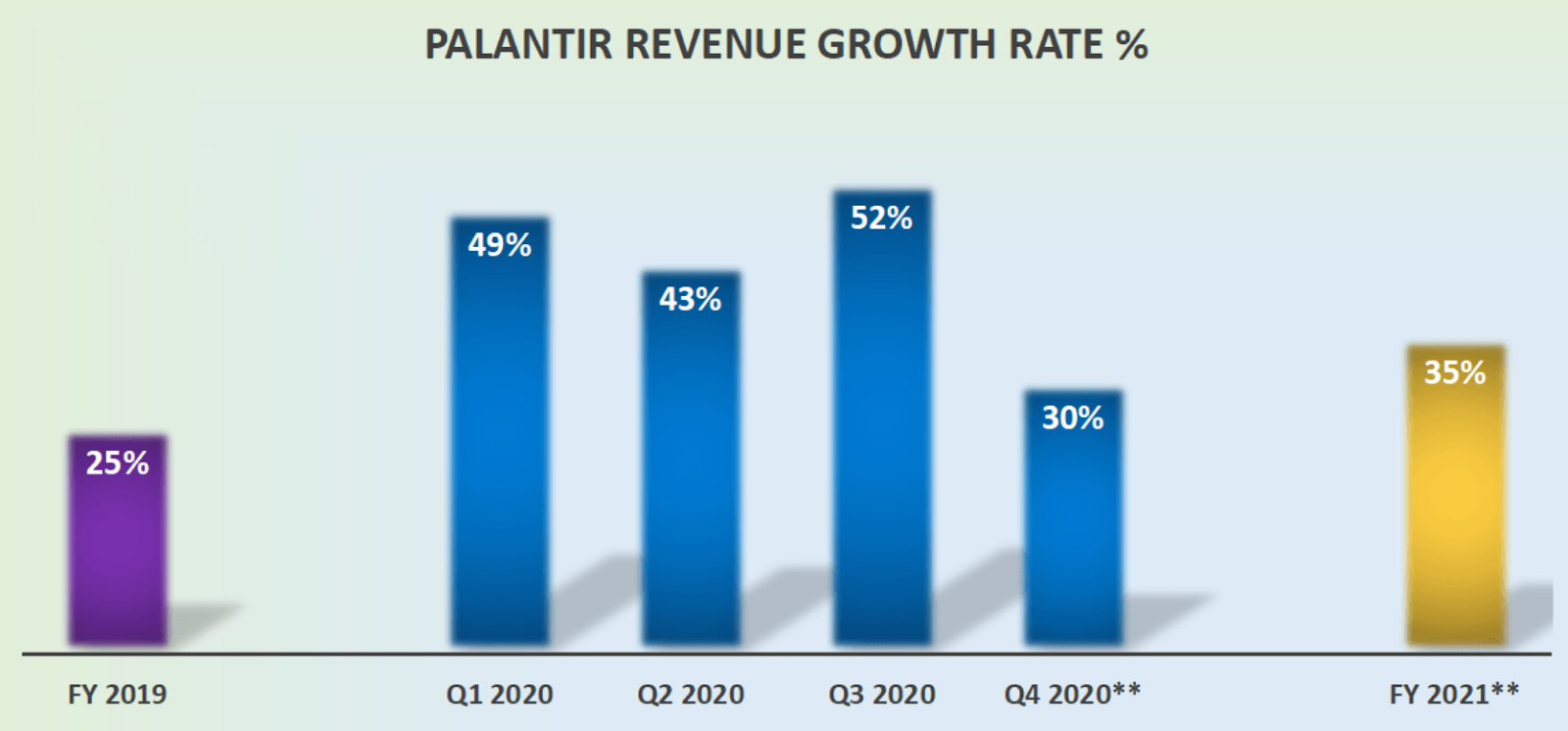

Despite the fact that the company reported a widening loss for the quarter ended in September, it raised its forecast of revenue growth for the entire 2020 to 43.5% to $1.07 billion Palantir also increased its operating profit forecast for the year 2020 from $130 million to $136 million

The following is a schedule of changes in the growth rate of income Palantir, including the whole of 2019, quarterly data 2020 and the forecast for the fourth quarter and full 2021 fin. year.

Analyst Michael Wiggins De Oliveira notes that the company Palantir is predictable permanent income as the average duration of its contracts was 3.5 years.

In addition, Palantir minimum requirement of capital cost in just 1% of revenues. This gives the company a good basis for a permanent increase profits with a steady growth of income.

Source:

Bloomberg