Stuttgart/Munich The Stuttgart-based plant manufacturer Exyte is preparing for a long-lasting boom. “There will be ten billion euros in sales in 2027,” CEO Wolfgang Büchele told Handelsblatt. “That would be a doubling to 2021.”

Exyte benefits from the fact that chip companies are spending billions on new plants worldwide in the face of dramatic supply bottlenecks. Büchele explained that 2022 had got off to an excellent start: “In the first two months of the year, order intake was well above our expectations.“

The Swabians see themselves as a leading provider for the planning, development and construction of high-tech plants, in particular of chip plants. According to Exyte’s own data, last year it booked orders of a good eight billion euros, more than twice as much as in 2020. The company generates more than 80 percent of its revenue from the semiconductor industry. The rest is earned by the Group with data centers and the pharmaceutical industry.

The prospects for its main customers, that is, chip manufacturers, are bright. The sales of the chip industry will increase by up to eight percent every year until 2030, the consulting firm McKinsey estimates. As a result, global revenues would climb from a good $ 600 billion to more than a trillion dollars.

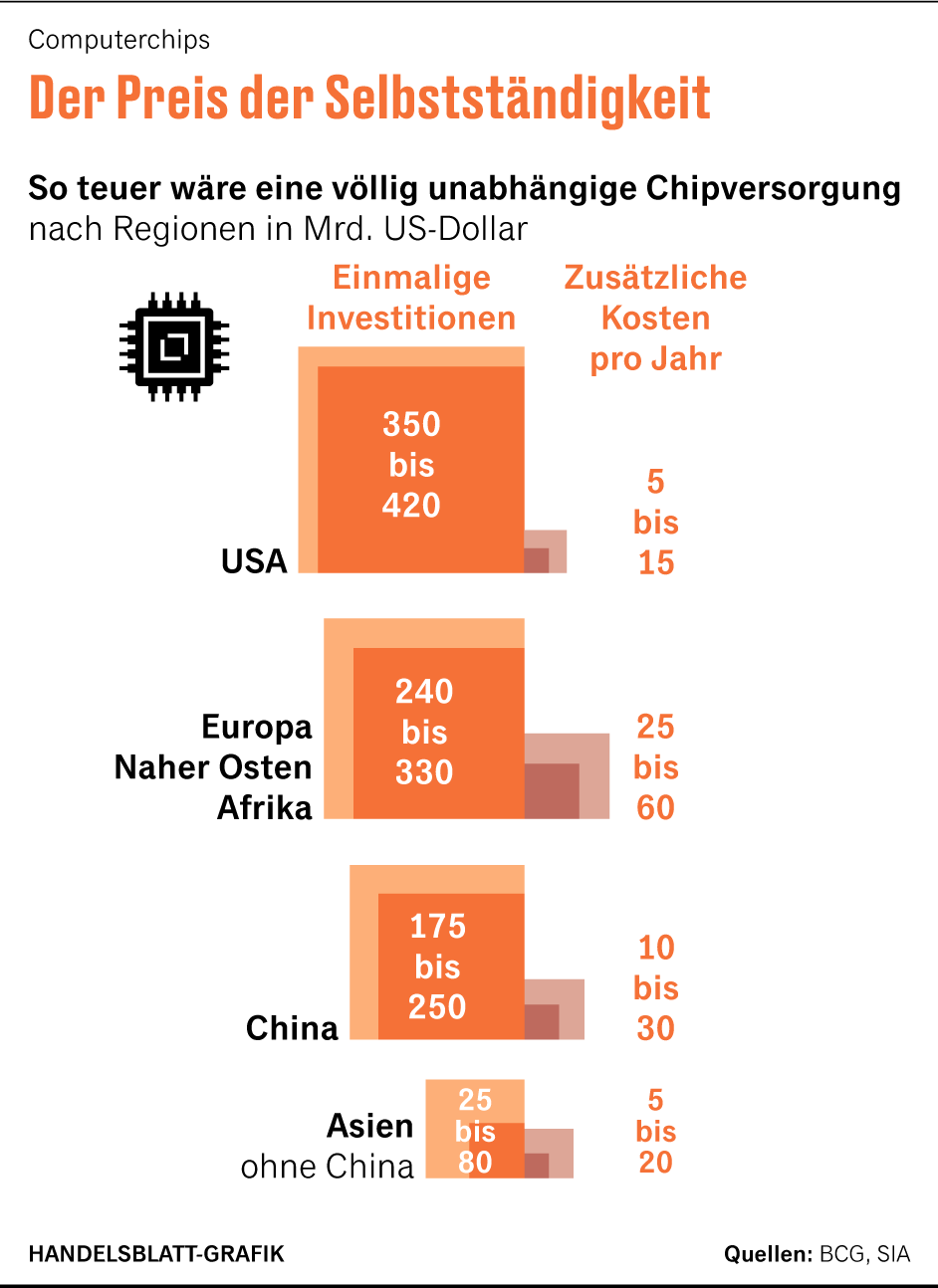

To meet this demand, dozens of new works are needed. In Europe alone, production capacity must quadruple if the EU wants to achieve its self-set goal: Commission President Ursula von der Leyen wants to increase Europe’s share of global production from ten to 20 percent.

Exyte has already achieved sales targets for 2025

“Megatrends such as working from home, the growth of artificial intelligence and the increasing demand for electric cars mean that the demand for semiconductors will also increase sharply,” says Ondrej Burkacky, chip expert at McKinsey.

“The chip volume is crucial for us,” says CEO Büchele. “This has grown continuously over the past 30 years. Now it is increasing exponentially. Until 2030, I’m not worried and actually not beyond that.“

For example, Exyte’s revenue has almost doubled since he took office five years ago. Originally, he had targeted five billion sales for 2025, according to Büchele. The company almost reached this goal by 2021. The fact that Exyte was slightly left out was due to delays on the construction sites due to the corona pandemic. “This year we will substantially surpass this mark,” says Büchele.

To cope with the flood of orders, the 62-year-old now has to recruit new people en masse. “We have a substantial need for personnel and want to hire between 1,500 and 2,000 additional employees this year,” says Büchele. Exyte currently has 7,500 employees.

For months, the chip industry has not been able to keep up with the orders – and is therefore planning new factories around the globe. In February, Intel announced that it would invest 17 billion euros in two plants in Magdeburg. In addition, 4.5 billion will be invested in a site for the further processing of the components in Italy.

The Americans are a regular customer of Exyte, even if the Stuttgart-based company does not comment on the cooperation with the second largest chip manufacturer in the world. Currently, Exyte is engaged in the expansion of Intel factories in Ireland. There are more orders on the island: Intel CEO Pat Gelsinger wants to spend an additional twelve billion euros at the location in Leixlip over the next few years. Intel is also investing in the US state of Ohio and Malaysia.

And that’s not all: Germany’s leading chip manufacturer, Infineon, has decided to build a new factory in Malaysia for two billion euros. For the Munich-based company, Exyte recently pulled up a plant in Villach, Austria – and completed it three months earlier than planned last summer.

Singapore plays a special role for Exyte

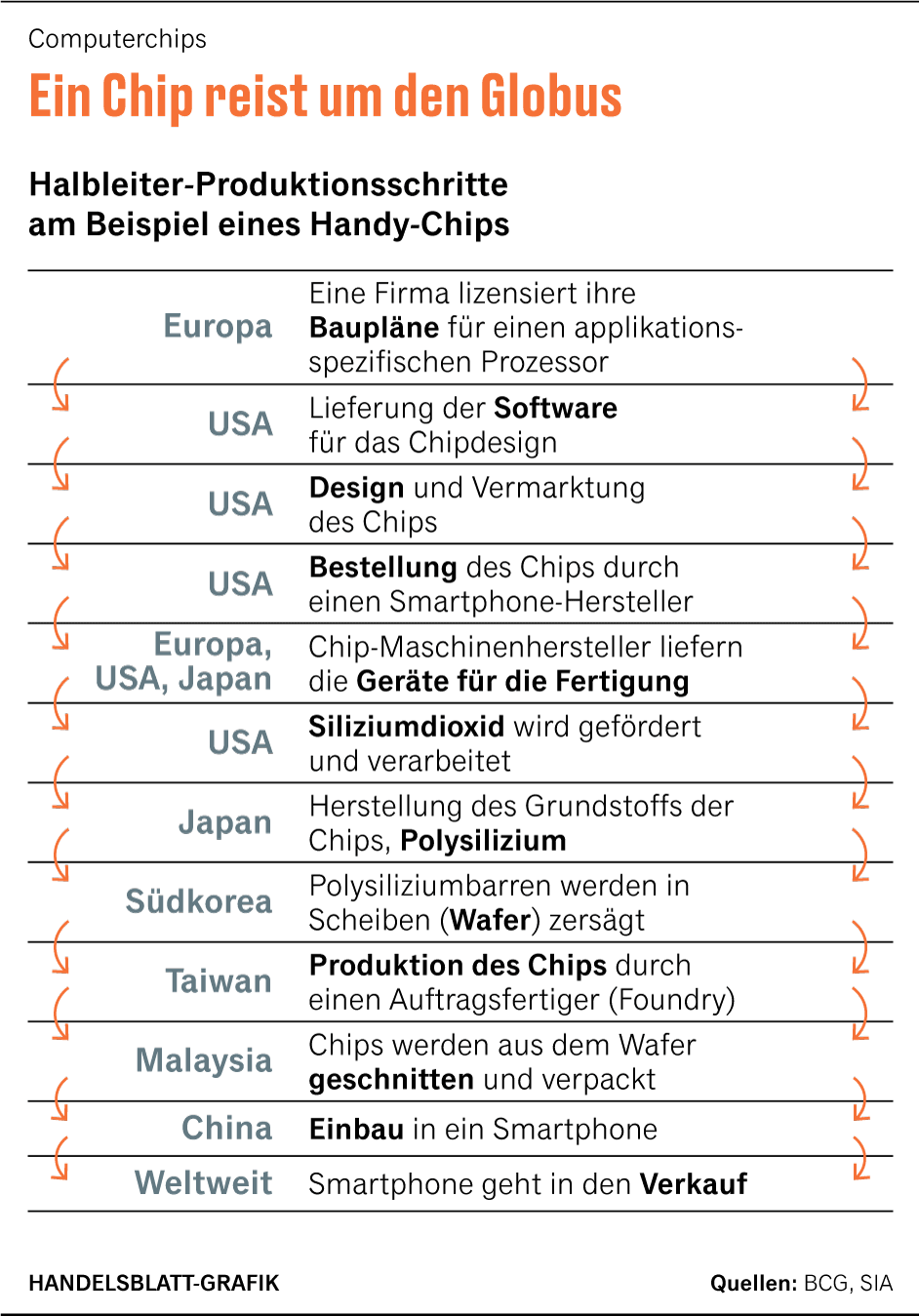

Currently, Exyte is particularly active in Singapore: in the city-state, the Group is building a factory for the Munich-based wafer manufacturer Siltronic, among other things. Wafers are slices of silicon, from which chips are formed. In addition, Exyte is active in Singapore for the memory chip manufacturer Micron and the contract manufacturer Globalfoundries.

The best-known project in Germany is a battery factory of the Chinese manufacturer CATL in Thuringia. In China, Exyte also employs 700 people who build plants for local customers. As a rule, Exyte accounts for between 20 and 25 percent of the total investment amount for itself.

The name is hardly known to the public yet, but Exyte has a great tradition: the company founded in 1912 by Karl Meissner and Paul Wurst is one of the pioneers of cleanroom technology. Over the past 30 years, however, the owners have changed frequently, even more often the CEOs. Since 2009, the company has been owned by the Austrian Georg Stumpf.

Büchele, who holds a doctorate in chemistry, became head of the M+W Group in March 2017, which was renamed Exyte a little later. in 2018, owner Stumpf wanted to put the company on the stock exchange, but the growth story did not catch on with the investors, and so the issue failed.

Exyte has long since left Russia

Stumpf has not made a new attempt on the floor since then. Due to the Ukrainian war, the chances for a successful IPO are probably not very good at the moment. Büchele: “If the markets are right, this will become an issue again. But at the moment, of course, the time is not ideal.“

However, the war in Ukraine has so far not burdened Exyte beyond that, and the sanctions against Russia also play no role for the company. In view of the country’s economic decline, Büchele has long since closed the office in Moscow with 60 employees: “We already said goodbye to Russia last autumn. We had to act because we preferred to use the capacities in other countries for profitable business.“