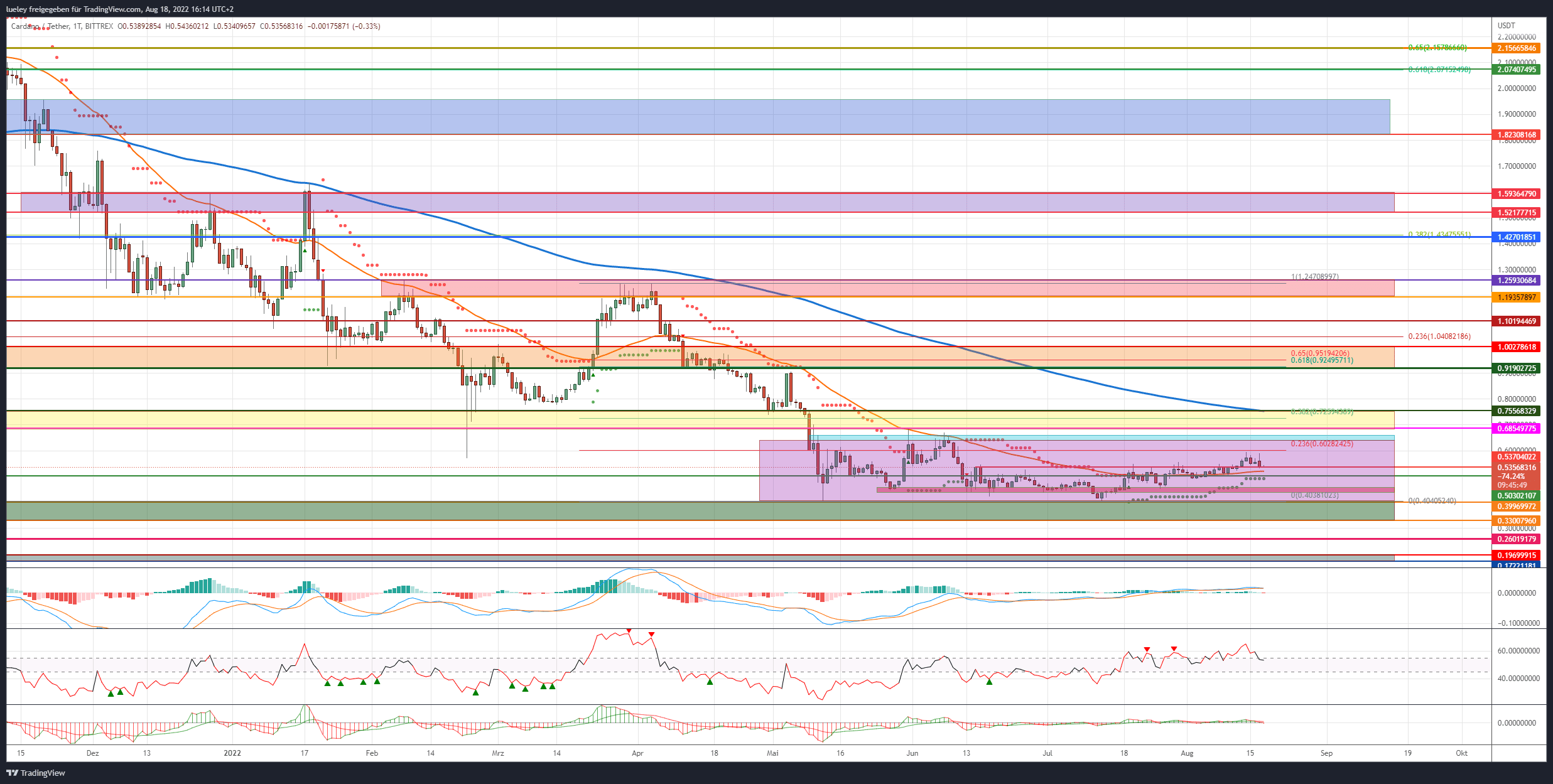

- Course (ADA): 0.53 USD (Previous week: 0.52 USD)

- Resistances/Goals: $0.60, $0.64/$0.68, $0.75, $0.92/$0.95, $1.00, $1.04, $1.10, $1.19, $1.25, $1.43, $1.59, $1.82, $1.96, $2.07

- Support: $0.53, $0.50, $0.45, $0.39, $0.33, $0.26, $0.19

Price analysis based on the ADA/USD value pair on Bittrex

Cardano Recap:

- Although the news about the Cardano update Vasil, which has been postponed again, only had a short-term negative effect on the price development of the altcoin, the ADA price has not yet managed to rise back to its highs at $ 0.68.

- Thus, the 23 Fibonacci retracement at $ 0.60 remains unchanged as a strong resistance mark for the time being.

- According to Cardano founder Charles Hoskinson, the Hard Fork is in the final phase of development, but there is no new date for the conversion yet.

- The recent implementation of the stablecoin DJED on the decentralized Cardano Exchange WingRiders has also not caused a festive mood among investors so far.

What does the chart say?

- The ADA price is currently trading listlessly within its trading range of the last three months. On a positive note, however, Cardano has been able to stabilize above the EMA50 (orange) for a week now.

- The first relevant resistance area on the upside is unchanged between $ 0.64 and $ 0.68. A breakout above this zone activates the make-or-break level at $0.75 as the first target mark. In addition to the 38 Fibonacci retracement of the current price movement, the EMA200 (blue) can also be found here in the daily chart.

- On the downside, the ADA rate initially finds good support around $ 0.50. Among other things, the supertrend in the daily chart runs in this area.

- The indicators also do not show a clear trend. The RSI as well as the MACD indicator both have a slight buy signal, but could quickly turn into a sell signal if the price weakens again.

Bullish scenario (Cardano):

- The ADA price again failed to break the range by $ 0.60. Again and again, the bulls’ attempts to rise are countered by the seller’s side. The low trading volume further complicates a breakout back above the $ 0.60 in the direction of the turquoise zone.

- Only when Cardano can establish itself above the 0.60 USD, the intermediate highs from June 2022 between 0.64 USD and 0.68 USD will come back into view.

- If the bulls manage to stabilize Cardano above this zone at the close of the day, an attack on the make-or-break area at $ 0.75 is to be planned.

- In the short term, a directional decision is to be expected for the coming weeks.

- Should the buyer succeed in lifting the ADA price back over the cross resistance of EMA200 and the old break-off edge, the chart picture will continue to brighten.

The first price target is $ 1.00

- Then Cardano is likely to rise quickly towards $ 0.92 and target the golden pocket of the current trend movement.

- Already in this area it is necessary to plan with increased resistance of the bear camp.

- Only when the $ 0.95 is dynamically broken through, the price recovery expands to the psychological $ 1.00. Just above this at $ 1.04, the 23 Fibonacci retracement of the complete downward movement is taking place. From a chart technical point of view, this represents the minimum goal of a recovery movement.

- If Cardano can subsequently bite above the 1.00 USD, the price mark of 1.10 USD will be targeted by investors in the future.

- If there is no significant price correction here either and Cardano continues to strive north, the medium-term target range between USD 1.19 and USD 1.25 will activate. Cardano failed here several times in 2022. For the time being, this zone is therefore to be regarded as the maximum increase target for the coming trading weeks.

- New bullish impulses of the leading crypto currency Bitcoin (BTC) will be required to break the ADA price above this strong resistance area.

More upside potential possible

- If the bulls manage to stabilize the ADA price above the red resistance area in the coming months, the resistance mark at $ 1.43 will become the focus of investors in the future. In addition to a strong horizontal resistance, the superior 38 Fibonacci retracement also runs in this area.

- If the ADA price also breaks through this resistance mark, the next relevant target range is waiting between $ 1.52 and $ 1.59. This is also where the previous year’s high is going. Investors may want to take chips off the table again.

- If the buyer side manages to leave this area behind sustainably despite taking profits, a march into the blue resistance zone between 1.82 USD and 1.96 USD is conceivable.

- Thus, the maximum derivable price target in the form of the parent golden Pocket between 2.07 USD and 2.15 USD would also be within reach.

Bearish Scenario (Cardano):

- The bears defended the resistance around $ 0.60 very bravely last time. Any attempt to break out on the part of the cops were negated.

- As long as the ADA price remains capped below the $ 0.68, a new sell-off towards the annual low is conceivable at any time.

- A first indication of a new price weakness would be to be seen in a sustained decline below the $ 0.50.

- If the seller manages to sell off Cardano under this strong support at the close of the day, the correction will immediately expand to $ 0.45.

- If the last intermediate low is dynamically undercut, a retest of the annual low at $ 0.40 is increasingly likely.

New annual lows must be planned

- The unchanged weak trading volume could mean that the bears could push the ADA price below this range during the next sell-off attempt.

- If the $ 0.40 is broken in the event of renewed weakness in the overall market, the lower edge of the green support zone at $ 0.33 will immediately come into view of investors.

- Here we can expect the first resistance of the bulls.

- If, on the other hand, this support level is also broken sustainably, the correction will expand directly towards $ 0.26.

- If the ADA exchange rate does not turn over to the north in a sustainable manner here as well, a relapse into the range between USD 0.17 and USD 0.19 is not excluded in the medium term.

- As long as the area around the annual low is not abandoned at the close of the day, investors can venture an entry into Cardano. However, a stop loss below the previous annual low should be set mandatory.