Will the Solana price now fall back to its last low at around 26 USD or even fall even lower?

The Solana course was rejected three times at the Golden Ratio resistance at around 46 USD

Solana Price Chart by Tradingview

Solana Price Chart by Tradingview

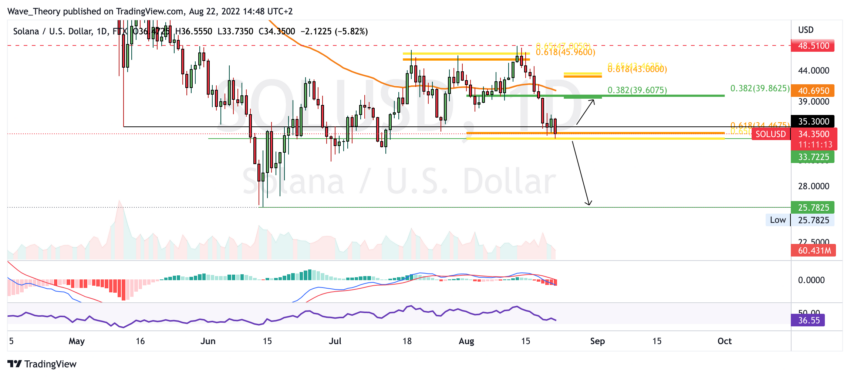

The Solana price failed three times to break the Golden Ratio resistance at around 46 USD. Following the third failed attempt, the Solana price corrected very strongly, breaking both the 50-day EMA and the 0.382 Fib support at around $ 40 to return directly to the Golden Ratio support at around $34.

Once there, the Solana price could now bounce to target the 0.382 Fib resistance at around $40. On the other hand, if the Solana price breaks the Golden Ratio support at around USD 34 bearishly, it could return to the annual low at around USD 26.

Neither the MACD nor the RSI give bullish signals. Instead, the MACD’s histogram is ticking bearishly lower on the daily chart and the MACD lines are crossed bearishly as the RSI approaches oversold regions.

The Solana course could move sideways for the next few days

Solana Price Chart by Tradingview

Solana Price Chart by Tradingview

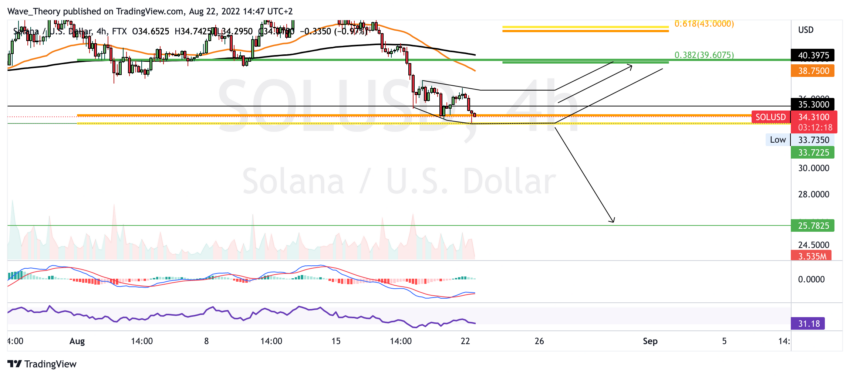

The Solana price could move sideways between $ 34 and $ 37 over the next few days and then break out either bullish or bearish. Should Solana break the 0.382 Fib resistance at around $40, wait at around 43 USD the decisive resistance. Because without a break in the golden ratio at around $ 43, the correction will remain intact and Solana may move even lower.

But even in the 4H chart, the MACD is bearish, because the histogram is ticking bearishly lower and the MACD lines have crossed bearishly. The RSI, on the other hand, could build a bullish divergence if the SOL price forms slightly lower lows now. The MACD lines, on the other hand, have established a death cross, which confirms the trend bearish in the short term.

Weekly MACD is still Bullish

Solana Price Chart by Tradingview

Solana Price Chart by Tradingview

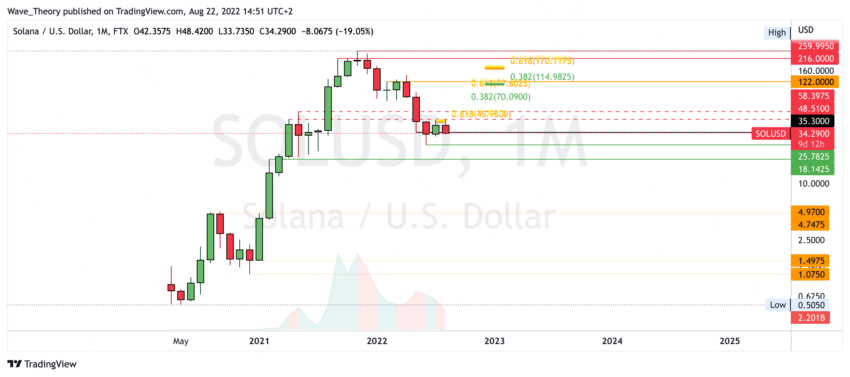

Im weekly chart shows the MACD is still bullish, because the histogram is ticking bullish higher and the MACD lines are still crossed bullish. If Solana bounces off the Golden Ratio support at around $ 34, Solana could make another attempt to break the Golden Ratio resistance at around $ 46. There are still chances of a bullish trend reversal.

However, if Solana breaks the Golden Ratio support at around $ 34, support will only wait between $ 18 and $26 again.

If the SOL course does not recover soon, it could quickly go deeper

Solana Price Chart by Tradingview

Solana Price Chart by Tradingview

With the bearish rejection at the Golden Ratio resistance at around $ 46, the trend is initially bearish confirmed. So if Solana does not stay above the Golden Ratio support at around 34 USD or bounces off it bullish, it could soon go one floor lower.

The Solana price has now broken out bearishly against BTC

Solana Price Chart by Tradingview

Solana Price Chart by Tradingview

The Solana price had been moving against BTC for weeks between 0.382 Fib resistance and 0.382 Fib support. After the SOL price broke out almost bullish, the bearish breakout followed, which means that the SOL price could now correct to the Golden Ratio support at around 0.00145 BTC.

In addition, the MACD is clearly bearish on the daily chart, because the histogram ticks bearishly lower and the MACD lines are crossed bearishly. The RSI is neutral, but is approaching oversold regions.

In addition, the 50-day EMA is now acting as a significant resistance at around 0.00175 BTC.

Here is the last Solana course forecast.