Tokyo So far, Masayoshi Son has also been optimistic about Softbank’s high losses. Even though the numbers were red, the founder of the Japanese investment group continued to invest rapidly with his Softbank Vision Funds 1 and 2. This Monday, when he presented the latest quarterly results, there was no sign of that.

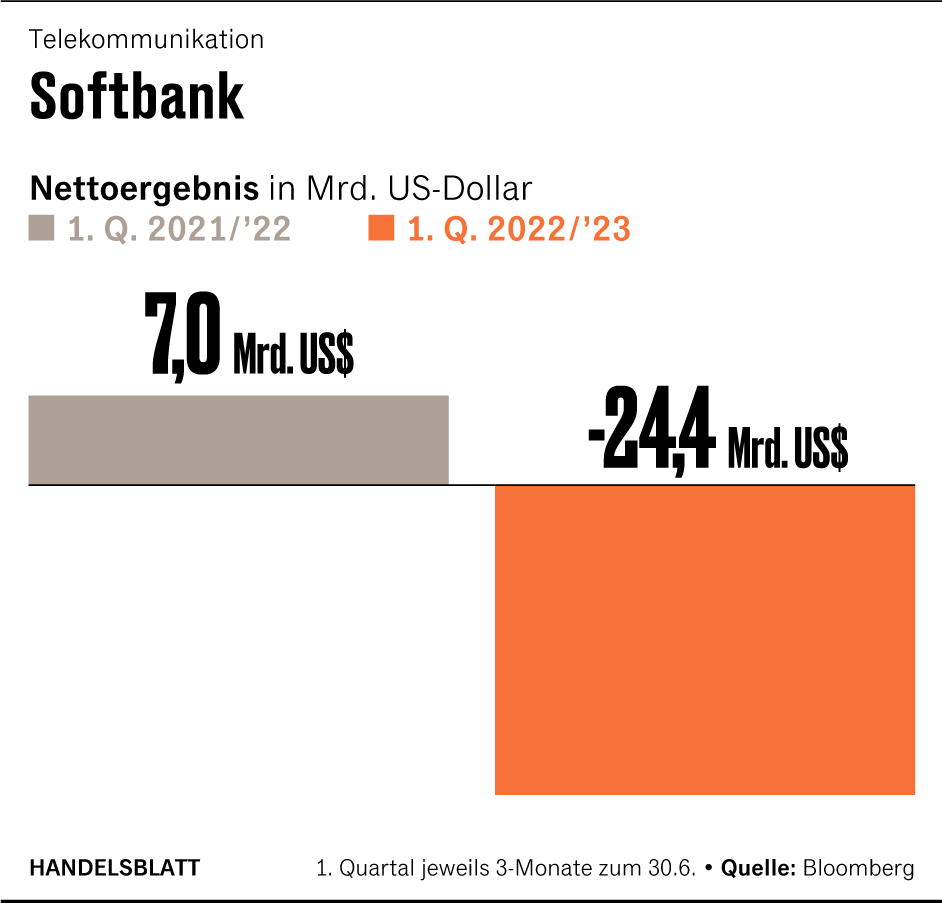

Driven by the fall in tech stocks worldwide and the fall in the yen, Son reported a net loss of 3.2 trillion yen, the equivalent of about 23 billion euros. “This is the biggest quarterly loss in our history, and we take it very seriously,” he said with a stony face.

Shortly after, Son announced a major savings program at the heart of the world’s largest technology investor. “We need to drastically reduce the number of employees in the Vision Fund and also reduce costs at the company level,” Son said. Instead of going on the offensive as usual, Japan’s investor legend is now fully switching to defensive.

Softbank is thus another major investor that is being hit hard by the fall in stock prices in general and technology companies in particular. Berkshire Hathaway, the holding company of US investor legend Warren Buffett, even recorded a loss of $ 44 billion for the past quarter.

But at Softbank, the crisis is more dramatic, as the company has focused on riskier investments in mega-start-ups, which the group then wants to bring to the stock market at a profit. In the past two quarters, Softbank’s two vision funds have lost nearly six trillion yen (44 billion euros). As a result, almost all the accumulated profits disappeared into thin air.

The current value of the 473 companies that Softbank now manages in the two funds has fallen to just 112 billion yen. Only at the end of 2019, the value was lower, namely just minus. At that time, crises such as those of the community office provider Wework and the mobility service Uber tore the balance sheet in the basement.

But Softbank was saved by the boom in tech stocks, which was triggered by the flood of money during the corona crisis and the worldwide triumph of the home office. A year ago, the value of Son’s fund was $54 billion – before the even steeper fall came.

Son sees no end to the crisis yet

But this time there seems to be more at stake for Son. The founder is now questioning his business model: the rapid investment in a swarm of companies with which Son wants to advance the development of artificial intelligence (AI) and robotics.

With the Vision Fund 1 alone, Son had invested almost 100 billion dollars from Softbank and above all financially strong partners in 88 so-called unicorns, i.e. start-ups with a billion-dollar valuation, since 2017. Among them are the car service provider Didi, the online retailer Coupang or the German used car platform Auto1.

With the second fund, he changed his strategy and invested smaller sums in smaller companies. But even then he overestimated himself, Son admitted on Monday. “I thought we could get a good return,” Son said. Softbank has therefore invested more “than we should have invested”. In fact, the value of the second Vision fund is now negative, while the first still has a positive impact on the balance sheet thanks to successful IPOs.

In contrast to the past, Son is also skeptical that the situation will improve quickly again. Some investors thought that they should buy again now. “But I’m frowning this time,” Son explained. “Three months or three years” – he does not know how long the downturn in tech stocks will last in the face of the Ukrainian war, the Taiwan crisis, rising interest rates and prices, and the pandemic. “Usually stocks are sold a lot at times like this,” Son said.

Harsh criticism of the start-up industry

The Softbank founder is taking a particularly hard line with the start-up industry shortly before his 65th birthday. “The bosses of the unicorns still believe in their high ratings,” he said. As long as companies that are not listed on the stock exchange are valued many times higher than those listed on the stock exchange, he wants to wait and see, Son promised. “The winter for privately held companies could last longer.“

To stay the winter, Softbank is slashing spending even more than Son announced six months ago. The criteria for investments will be further tightened, new investments will be massively reduced. In the last quarter, Son invested only $ 600 million in start-ups, one-thirtieth of the total from a year ago. Fresh money should be concentrated on start-ups in the existing portfolio, Son said. In this way, he wants to safeguard the financial health of the group.

The net asset value, which means the value of the investments minus net debt, has remained the same at 18.5 trillion yen despite the losses, as Softbank has reduced debt. But Son does not console this. Not once did he talk about the AI revolution, which he considers his mission, as usual. Instead, at the conclusion of the 90-minute press conference, he said: “I apologise for the very depressing results announcement, but I wanted to be transparent.“