High sales of Tesla talking about good opportunities to make a profit for the fourth quarter in a row, which is a key requirement to be added to the S&P 500. When you add Tesla to the S&P 500, mutual funds have to buy shares of the automaker, if this does not happen, Tesla stock will drop.

Stock market investors look forward to the final financial results of Tesla (TSLA) 2nd quarter, to be published July 22. Many are predicting Tesla’s recognition through the inclusion of the company’s shares in the S&P 500 index comprising 500 largest U.S. stocks. However, while the press-Secretary of joint-venture S&P Dow Jones declined to comment on specific changes in the index.

“Bulls” Tesla indicate the results of the last three quarters, sales above expectations and Tesla plans to launch new productions. This has increased the shares of Tesla on 483,6% over the past 12 months, the capitalization reached nearly $240 billion.

If Tesla will report a profit of 22 July, the company has a chance to be included in the S&P 500, which could further push the stock up. At the same time, many point to the overvaluation of Tesla stock, the average price target on wall Street, $860 more than half below the closing price Thursday of $1394,28.

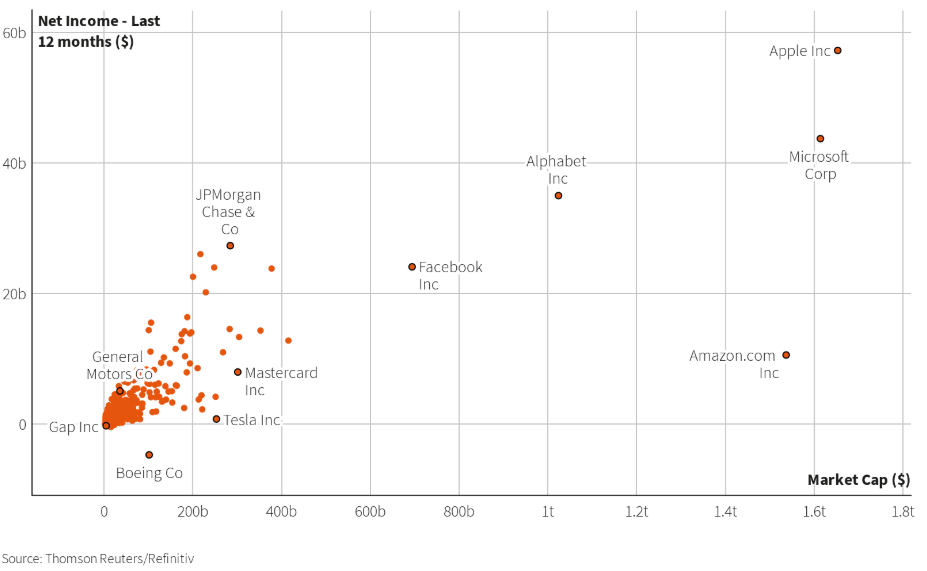

If Tesla will be added to the S&P 500, it will be one of the most valuable companies in the index, next to Mastercard (MA) and JP Morgan Chase & Co (JPM), but with a small level of profit. The following is a schedule of Reuters, which points marked the S&P 500 companies in the coordinates of the profits (net income) for the last 12 months and the market capitalization (Market Cap.).

The addition of Tesla stock in the S&P 500 will have a big impact on investment funds that track the index.

Howard Silverblatt, a senior analyst at S&P Dow Jones, commenting on the situation, gave the example of Yahoo, whose shares in 1999 increased by 64% in five trading days between the announcement that the company will be added to the index on November 30, and its inclusion after the close of trading on 7 December.

“The lesson of Yahoo, was the fact that, if the stock is preparing to get into the index, you should already own it, otherwise, you will have to pay a hell of a lot more than a week earlier,” said Silverblatt.

Similar could happen with Tesla stock, their growth in just the last eight sessions, there were already 43%. Investment funds that track the S&P 500 will need to quickly buy shares of Tesla, to avoid tracking errors, the performance of the index.

Ivan KAIC, head of research indexes and exchange-traded funds in the ETF Virtu Financial, believes that the Manager of index funds would need about 25 million shares of Tesla, which is currently worth $34 billion.

Other analysts confirmed that managers of index funds simply does not remain other choice, except how to include this chart in the portfolio even if they believe that the stock is overvalued. This fact is also one reason for the high valuation of Tesla stock today.

At the same time, risk investors“bulls” Tesla high. According to S3 Partners, short sellers are betting $19 billion on a drop in shares of Tesla, which is the largest short level in the history of the American company.

The bears point to the increasing competition from Porsche, General Motors and other competitors. They are also skeptical of the corporate governance Tesla when the eccentric gene. Director Ilona Mask. If adding the Tesla to the S&P 500 is not going to happen, stocks can fall significantly.

Source:

Reuters