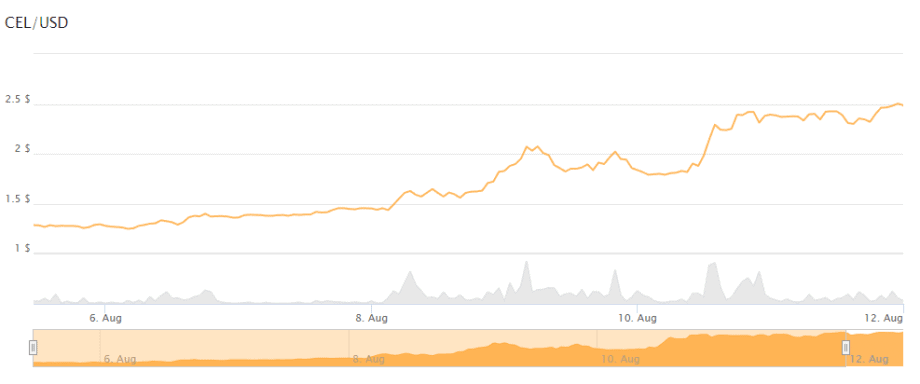

Unbelievable, but true: although Celsius will file for bankruptcy on July 14, 2022, the price of the CEL token will rise again, contrary to all logic. Since the announcement of the insolvency, it has been more than 500 percent. At the low point in June, CEL was still at $ 0.18. Today it is about $ 2.50.

Celsius has thus returned to the price level of the end of April and has interrupted its downward trend for the time being.

The reason for the price increase could be a call from Celsius supporters on Twitter under the hashtag #CelShortSqueeze. The process is reminiscent of the Wallstreetbets saga, in which a Reddit forum (r/wallstreetbets) bought up GameStop shares in a coordinated manner. Professional traders who had bet against these stocks with a lot of capital got into trouble as a result – BTC-ECHO reported.

It plays into the cards of the group that Celsius paused withdrawals from its platform for customers. Because as a result, there are currently fewer CEL tokens in circulation. Accordingly, it is easier to move the price of the cryptocurrency with purchases or sales with the lower liquidity. Once the ball is rolling, larger price jumps are possible.

Read also

A sustainable recovery in prospect?

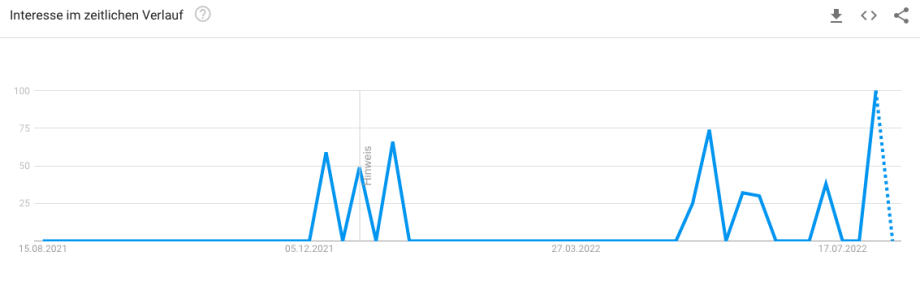

What seemed insane a few months ago is currently reaching unimagined heights. In the Internet, the trend has been gaining increasing interest in recent weeks. Probably also because the price development seems so absurd.

CEL was also able to benefit from the general recovery in the market. Pausing any withdrawals on the platform on June12 was a catalyst for Bitcoin’s recent slump from about $28,000 to about $17,700, marking the bottom of the bear market so far.

Celsius stated in the insolvency declaration that they wanted to ”leave the proceedings strengthened“, thus ”positioning themselves for success in the crypto industry”. Perhaps, however, this has given investors false hopes for a quick recovery and thus given the food for thought for the questionable buying mood.

Does Celsius have to sell?

It is also not clear to what extent Celsius will sell its own assets, including the CEL token, in order to plug a $ 1.2 billion hole in its balance sheet.

According to a report by CoinMarketCap, which refers to the documents in the insolvency proceedings, it is clear that the company is already pushing for a release to sell its Bitcoin assets. It would therefore be conceivable that the sale of CEL tokens could be considered next.

You want to buy cryptocurrencies?

eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet user-friendly platform. We have taken a close look at eToro.

Go to the eToro Review