Jim Himes, a Member of the Connecticut House of Representatives, has published a proposal to open a dialogue on the possible introduction of a central bank digital currency (CBDC) in the United States.

On Wednesday, a white paper was published in which Himes called on Congress to consider the introduction of a digital dollar to be issued by the Federal Reserve. This is to prevent the government from being the last in terms of innovations in financial technology. According to the US legislator, a CBDC “should not be seen as a replacement for existing payment systems and currencies, but as an additional alternative for consumers and businesses”.

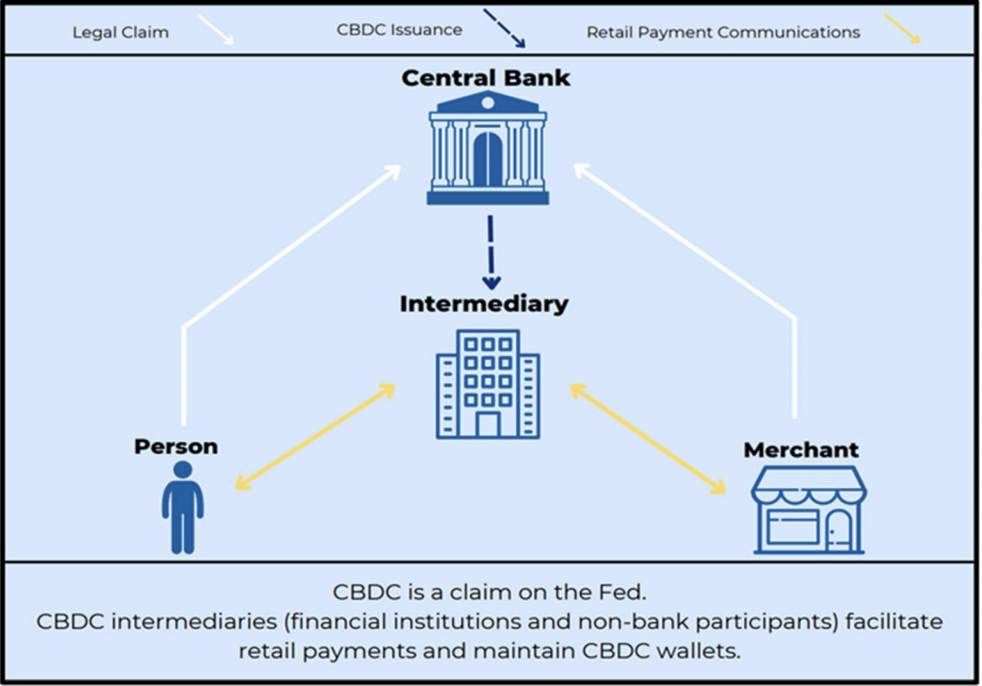

The white paper states that a CBDC could raise concerns about transparency, security and data protection compared to fiat currencies. Himes added that a regulatory framework for CBDCs adopted by Congress should include strict identity verification measures for users. Intermediaries should verify the identity of the wallet holders” and the US Central Bank and the “participating commercial institutions” should set guidelines.

“The longer the United States government waits to embrace this innovation, the further we fall behind other governments and the private sector,” Himes said. “It is time for Congress to examine and advance a legal framework that will make a US CBDC possible.”

Source: CBDC white paper, Rep. Jim Himes.

Source: CBDC white paper, Rep. Jim Himes.

Various agencies and ministries of the US government have studied the possible effects of a digital dollar. In May, the US Central Bank published a report in which it concluded that “the implementation of monetary policy by a CBDC for retail clients depends very much on the initial conditions of the Federal Reserve’s balance sheet”.

Himes has repeatedly called on Congress to take action on cryptocurrencies, especially with regard to the technology used to examine the possibilities of circumventing sanctions by Russia. He also introduced a section in a bill that was criticized by many for giving the finance minister unlimited power over certain crypto transactions. Representative Tom Emmer of Minnesota also introduced a bill in January to prevent the US central bank from acting as a retail bank in the possible issuance of a digital dollar. This indicates that the legislators have not yet come to an agreement with regard to a US CBDC.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.