The payment card provider Visa now allows payments in Bitcoin and crypto by card. Users can pay, buy or receive cryptocurrencies in Latin America.

Visa and Mastercard. These are the names of the two largest payment card providers in the world. Visa recently released a statement that users can now pay with Bitcoin and crypto by card. Partnerships with various start-ups in Latin America make this possible.

Specifically, users should now be able to pay with crypto, buy crypto with Visa cards and receive crypto cashbacks through the start-ups. Visa justifies this step with the adaptation of crypto worldwide and Visa’s contribution to it.

Romina Seltzer, Vice President Innovation and Products at Visa Latin America, comments as follows:

“Cryptocurrencies continue to gain momentum in the region with increasing innovations, more acceptance and more crypto-enabled use cases. We will continue to pursue the strategy of enabling crypto payments for our customers.”

The company wants to support all legitimate forms of money movement, regardless of whether they originate in the Visa network. According to Visa, buying Bitcoin or crypto should become the easiest and safest means via the card.

Especially for the cashback function, the company wants to use Latin American start-ups. For example, partnerships with Lemon Cash or Satoshi Tango in Argentina and with Crypto.com , Alterbank and Zro Bank in Brazil support this project.

In particular, the partnership with Crypto.com should contribute to the hoped-for success in Latin America. Filomena Ruffa, Manager of Crypto.com in Latin America, he said:

“Through our products and the expansion of our card program with a cashback function of up to 5%, we are providing consumers in the region with an additional way to pay with crypto.”

“In South America, we see that cryptocurrencies are the solution to a concrete problem. They improve people’s lives. Lemon Cash wants to drive the revolution and offers 2% cashback in Bitcoin for all purchases via Visa,” says Borja Martel Seward, co-founder of Lemon Cash.

In addition to Argentina and Brazil, Mexico, Colombia and Peru are also among the targeted markets. In the context of Bitcoin and cryptocurrencies, Visa also offers infrastructure, advice and tools to better navigate the world of digital assets.

Bitcoin and Crypto not only popular with Visa

Just a few days ago, Mastercard announced that it had entered into a partnership with MercadoLibre. Known as Mercado Pago, the e-commerce giant can already rely on a functioning crypto payment system.

Through a special technology Mastercards, MercadoLibre wants to be able to take a closer look at crypto transactions. It is a preventive measure in the field of money laundering and terrorist financing.

Paula Arregui, Mercado Pagos COO commented on this:

“In line with our corporate philosophy of democratizing financial services, we want to lower the entry barrier. We want to offer a simple and secure way to invest in cryptoassets.”

A picture of gemini.com

A picture of gemini.com

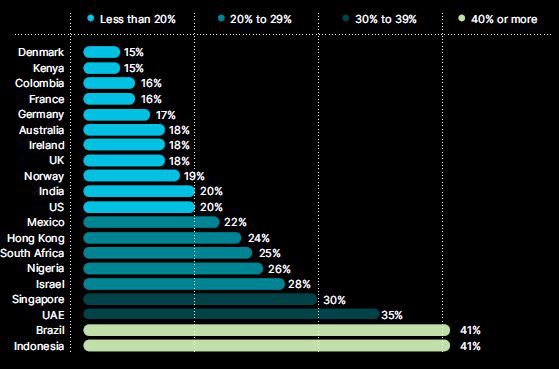

In the Latin American countries Brazil and Argentina, the rate of Bitcoin and crypto adoption is particularly high. Argentina, for example, has been suffering from horrendous inflation for years – inflation was only around 48% in 2021. Based on the graph attached above, it can be seen that Brazil shows the highest rate at 41%.

Brazil in particular also made a statement a few weeks ago when the Senate approved a pilot law. It is intended to achieve greater transparency and consumer protection for users affected by scams. The chamber responsible for this now decides whether the law should come into force.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.