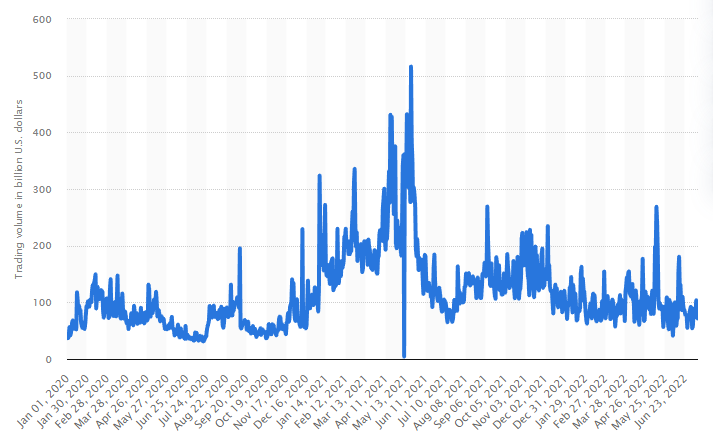

While Germany is heading for a weekend with temperatures of up to 40 degrees Celsius, Bitcoin (BTC) is also falling into the summer hole. According to data from Statista, the daily trading volume dropped significantly from the peak phase in the crypto summer of 2021.

While traders were still trading BTC worth around $521 billion in May 2021, the daily volume on today’s July 12 is only $71 billion. Too little to give the already troubled Bitcoin exchange rate a push north.

Bitcoin trading volume since January 2020. Source: Statista.

Bitcoin trading volume since January 2020. Source: Statista.

Consequently, the largest cryptocurrency by market capitalization is listed at $ 19,814 by the time of writing. Thus, BTC again falls below the psychologically important mark of 20,000 USD.

Hodlers hold on to Bitcoin

But the trading volume is not the only factor that makes market observers bearish these days. As the analysis portal Glassnode writes, not enough “weak” hands could have been flushed out of the market to establish a reliable floor. According to the on-chain analysts, “the bottom formation […] often accompanied by the fact that the long-term hodlers shoulder an increasing part of the unrealized loss. In other words: for a bear market to reach a final bottom, the share of coins held at a loss should […] moving on to those who have the least price sensitivity and the greatest conviction [also Hodler, Anm. d. Red.].”

But that is not the case at the moment. 16.2 Percent of the coins are still owned by shortterm holders; compared to the 3 to 4 percent from past bear markets, this share is still too high. “Bitcoin investors are not over the hill yet,” the analysts summarize.

Is the miner surrender imminent?

Even with mining, one had clearly arrived in bearish territory. A capitulation of the mining companies could not be ruled out in view of the falling prices. After all, miners always have to liquidate a certain part of their BTC in order to cover ongoing costs. If the price is low, more coins flow to the market, which can ultimately increase the supply overhang. Or, to put it in the drastic words of Glassnode:

The miners are under considerable capitulation pressure.

Even the experts at F5 Crypto do not necessarily see the end of the flagpole yet. Prof. Hermann Elendner, Director of Research at F5 Crypto, summarizes the current market situation to BTC-ECHO – and advises on long-term Hodln:

The only definitive “bottom” is 0 – as with all assets. Whether Bitcoin, gold, dollars or Twitter stocks, no one can predict tomorrow’s return. But you can know what the Nobel Prize was for in 2013: low prices mean high expected returns in the longer term. Those who are currently buying and holding 2 to 4 years will probably be very satisfied.

Falling prices are always an opportunity to buy again. For this we recommend Binance, eToro or Kraken.

You want to buy cryptocurrencies?

Binance is one of the largest crypto exchanges active worldwide and offers its users a variety of coins – often the ones that the competition misses.