Bitcoin (BTC) is trying to recapture the important $ 20,000 mark on June 19 today, after massive losses of a total of $ 7,000 had to be coped with so far in the current week.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

Downturn to $17,000?

As the data from Cointelegraph Markets Pro and TradingView show, BTC / USD was able to recover from the temporary low of 17,592 US dollars before it ended at 20,000 US dollars.

The traditional low trading volume on the weekend days contributes to the fact that investors are facing a dreary weekly close, because the market-leading cryptocurrency has slipped to its lowest level since November 2020 in the last seven days.

While the losses can be slowly made up for, the market is experiencing a real déjà vu, because the $ 20,000 mark – which was the current record high for three years – acted as a massive resistance for the Bitcoin price from December 2017 to December 2020.

To make matters worse, Bitcoin has now fallen back below a previous record high for the first time in its history.

There’s a first first everything. This is the first time Bitcoin has traded below prior cycle highs. I think it’s fair to say things are different now.

– Charles Edwards (@caprioleio) June 18, 2022

This circumstance causes a noticeable increase in panic among some investors, but long-established market participants point out that the price development, by and large, still follows the historical patterns.

“To put the whole thing into perspective: a Bitcoin crash of 74%, as we are currently seeing, is nothing unusual,” as WELT economics editor Holger Zschäpitz notes, among other things. To which he appends:

“In the past, there have already been four crashes in which the market-leading cryptocurrency has fallen by more than 80% from a local high to a local low.“

With regard to the further short-term price development, the trader Credible Crypto assumes that it will initially go down to $ 17,000. On the other hand, a relieving upturn seems rather unlikely.

Looks like no squeeze first. Well then, let’s rip the bandaid off and get this over with! https://t.co/xliurgtPrO

– CrediBULL Crypto (@CredibleCrypto) June 18, 2022

Meanwhile, his colleague Rekt Capital reminds that the 200-week moving Average (200-MA) is probably the most important lower limit for the Bitcoin price. This “lower limit of the lower limits” is still intact and could provide a new boost.

No matter how much of an extreme time this seems to be for #BTC

Historically $BTC tends to wick between -14% to -28% below the 200-week MA

BTC has wicked -21% below the 200 MA so far, still within the historical range & not out of the ordinary in that respect#Crypto #Bitcoin pic.twitter.com/cJm5A9yYYO

– Rekt Capital (@rektcapital) June 19, 2022

New negative records on the assembly line?

Nevertheless, the blow to the neck for the Bitcoin investors should not be taken lightly, because with a fat minus of $ 7,000, BTC is facing one of the worst weekly deals ever.

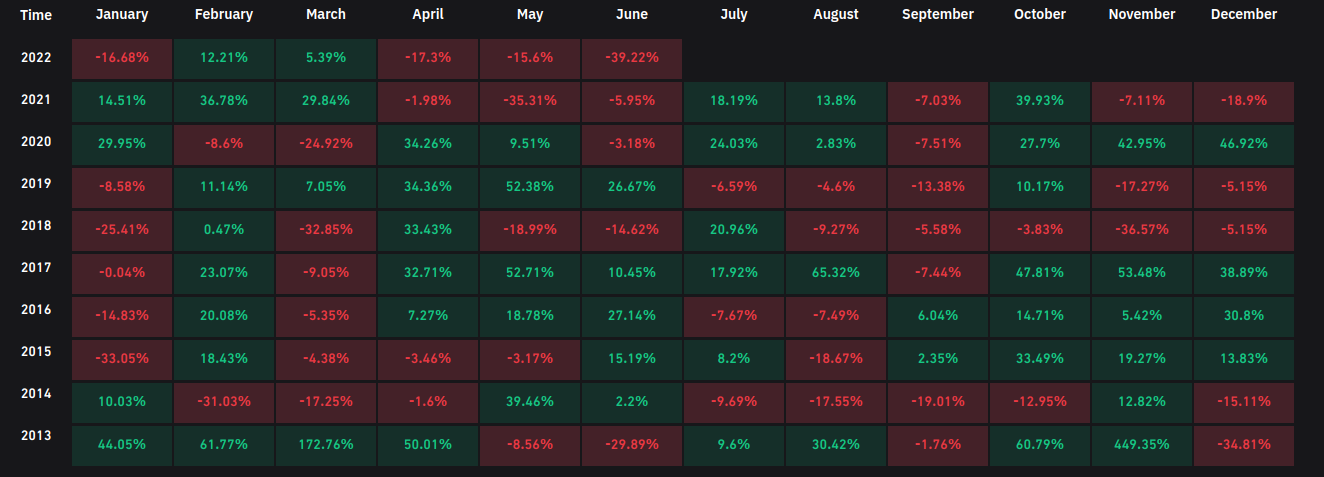

Bitcoin monthly statements. Source: Coinglass

Bitcoin monthly statements. Source: Coinglass

And it could get even thicker, because the crypto market researchers from Coinglass point out that June 2022 is on the best way to get even the worst monthly close of all.

The last three consecutive days have been the largest USD denominated Realized Loss in #Bitcoin history.

Over $7,325B in $BTC losses have been locked in by investors spending coins that were accumulated at higher prices.

A thread exploring this in more detail

1/9 pic.twitter.com/O7DjSK2rEQ– glassnode (@glassnode) June 19, 2022

The extent of the panic or selling pressure among investors at the moment can be seen from the fact that in the three days to today, June 19, more BTC were sold as loss transactions than ever before.

Meanwhile, there is also the fear that even the Bitcoin miners can no longer operate profitably because of the low exchange rate. Should such a capitulation of the miners occur, this would mean another heavy blow for BTC, because at the latest then the fundamentals begin to erode. However, at least in this respect, there is an all-clear that the profitability of miners has not yet been undermined too much.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.