After nine weeks of red weekly candles in a row, Bitcoin (BTC) recorded a green weekly candle on June 5. At the beginning of this week, buyers were able to maintain momentum with a strong weekly opening, allowing the BTC price to rise to $ 31,800.

Traders are now eagerly awaiting the Consumer Price Index (CPI) data for May, which will be released on June 10. Depending on how they turn out, this could increase volatility until investors react significantly to them. The next actions of the US Central Bank are also a factor that will affect the volatility and reaction of traders.

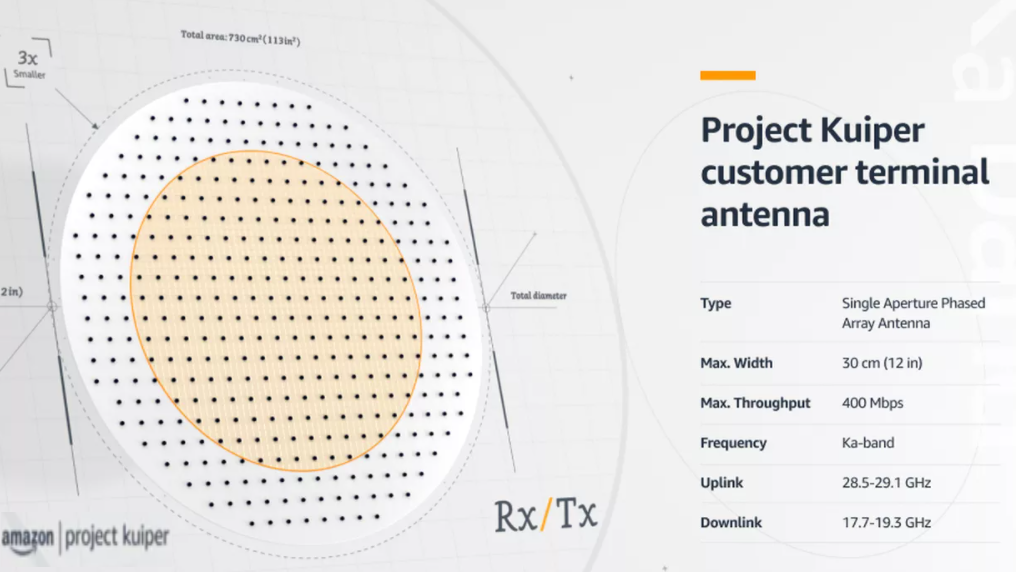

Cryptocurrency market daily performance. Source: Coin360

Cryptocurrency market daily performance. Source: Coin360

Analysts still disagree on how Bitcoin will develop in the near future. Some believe that the bottom has been reached, others expect a further decline. Analyst Bob Loukas believes that the course development in the summer will be uninteresting, and he expects the new cycle to begin at the end of the year.

Can the bulls hold higher levels or will the bears pull the price down? Let’s look at the charts on this.

BTC/USDT

After two days in a small range, the range widened on June 6, and Bitcoin climbed above the 20-day EMA at $ 30,510. The bulls are currently trying to make the price rise to the resistance at $ 32,659.

BTC/USDT Daily chart. Source: TradingView

BTC/USDT Daily chart. Source: TradingView

The price development in recent days has led to an ascending triangular pattern. With a breakout and close above $32,659, the pattern completes. In this case, BTC/USDT could rise again. The pattern target for breaking out of the triangle is $ 38,618.

The 20-day EMA is flattened, and the RSI is almost in the middle. This indicates that the selling pressure is easing.

This optimistic scenario is void if the price turns down and falls below the trend line of the triangle. The pair could then fall to the strong support at $28,630, where the bulls will try to stop the decline. A slump and closure under this support could give the bears an advantage.

ETH/USDT

Ether (ETH) rebounded from $1,737 on June 3, suggesting that the bulls are defending the important support at $1,700. Buyers are trying to make the price rise above the resistance at the 20-day EMA $ 1,930 on June 6.

ETH/USDT Daily chart. Source: TradingView

ETH/USDT Daily chart. Source: TradingView

If successful, ETH/USDT could gain momentum and rise to $2,016. Above this level, the pair could climb up to the resistance at $ 2,159. The bears are likely to aggressively defend this level. If the price turns down from this resistance, the pair could remain in a range between $ 2,159 and $1,700 for a few more days.

The long wick on the June 6 candle suggests that the bears will continue to defend the 20-day EMA. This suggests that the sentiment is still negative and traders are selling at rallies. The bears will now try to make the pair sink below the $ 1,700 mark and continue the downtrend.

XRP/USDT

Ripple (XRP) lies in a descending triangle. This is a bearish pattern. The bulls are trying to make the price rise above the downtrend line, but the bears are making strong resistance, as evidenced by the long wick on the daily candle.

XRP/USDT Daily chart. Source: TradingView

XRP/USDT Daily chart. Source: TradingView

If the bulls make it over the downtrend line, the bearish pattern would lapse. This could lead to a short squeeze that could push XRP/USDT to $0.46 and later to the psychologically important $0.50 mark.

However, if the price turns down from the downtrend line, the pair could fall to the support at $ 0.38. If the bears let the price fall to below $ 0.38, the descending triangle pattern will complete. The pair could then fall to the important support at $0.33. A slump and closure below this support could continue the downtrend.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and every trade involves risks. Do your research well before making a decision.

The market data comes from the crypto exchange HitBTC.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.