Shares of Disney rose after the publication of the report for the 4th fin. quarter, as the company’s revenues surpassed expectations of Wall Street, and the audience is a streaming service Disney + increased by 15.5 million paid subscribers to 73 million

Shares of Disney (DIS), which fell by 6.3% since the beginning of the year grew by 3.3% in after-hours trading on Thursday when investors reacted to the publication 4 of the financial quarter ended 30 September.

Disney reported a loss per share of $0.20, down $0,51 better than the analyst estimate of -$0.71 loss per share.

Total quarterly revenue decreased by 23% compared to last year’s value, but increased significantly compared to the previous quarter to $14.71 billion, also better than the average analytic forecast of $14.2 billion Statistics quarterly revenue and profit Disney for the past 2 years, click here.

In the three months ended September 30, coronavirus pandemic continues to have an impact on the business of Disney.

Income units Disney

The closing of Disneyland in California and limited traffic in the public parks (in Florida, Shanghai, Japan and Hong Kong) has led to the fact that the largest division of the company ”Parks, entertainment and merchandise”, which includes specialty stores Disney, has brought $2,58 billion in revenue, which is 61% lower than a year earlier.

According to a statement from Disney, the company was forced to close Disneyland Paris at the end of October and the opening is expected only in 2021.

Disney estimates the negative impact Covid-19 to operating profit division of the parks, about $2.4 billion in the fourth quarter.

The business studios also suffered income fell 52% to $1.60 billion, since pandemic studios ceased or greatly slowed, as many cinemas are still closed due to quarantine. Besides, the same quarter of last year was successful for the Department of the studios, so how come such a successful premiere, as “the lion King” and “toy Story 4”.

The revenue of “Media network”, which includes the Disney Channel, National Geographic, ESPN and others, rose 11% (compared to the previous year) to $7.21 billion

The income of the unit “Direct-to-Consumer and International”, which includes streaming services Disney +, ESPN +, 60-percent stake streaming service Hulu and Hotstar increased by 41% (compared to last year) to $4,85 billion.

Service Disney +, which debuted a year ago on 12 November 2019, proved the success of the company and love of the audience to the original content, Disney and MARVEL studios, PIXAR Animation, and others, belong to the company.

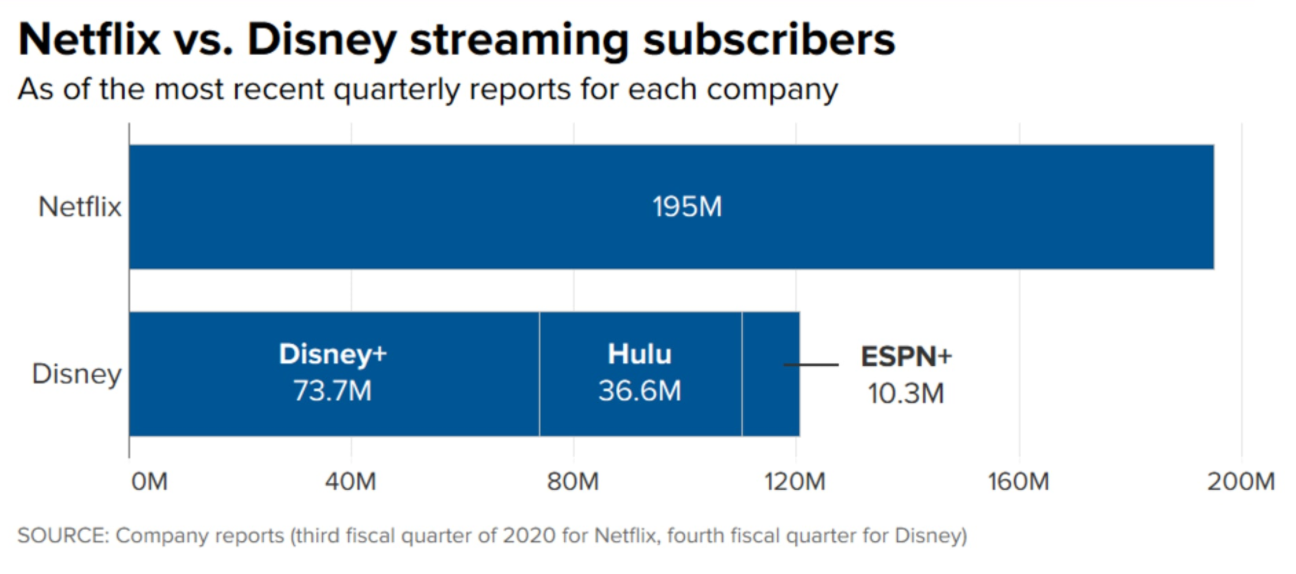

Since its launch, Disney + has reached 73 million paid subscribers, surpassing their own expectations to reach 60 to 90 million subscriptions by 2024. Growth over the three months amounted to 15.5 million subscriptions, as in the previous third fiscal quarter, the company reported 60.5 million paid subscribers Disney +.

The number of subscribers to streaming service Hulu was 36.6 million, and sports content ESPN+ 10.3 million Below the comparison for the rapid success of streaming services Disney with the market leader of streaming video company Netflix (NFLX), which in its latest report, said about 195 million subscribers.

Disney has announced that it will waive the semi-annual dividend in January, but will continue to pay dividends in the long run. The decision to suspend dividends was taken after activist investor Dan Loeb (Dan Loeb) said that the company ceases to pay dividends, to Fund the content of Disney +.