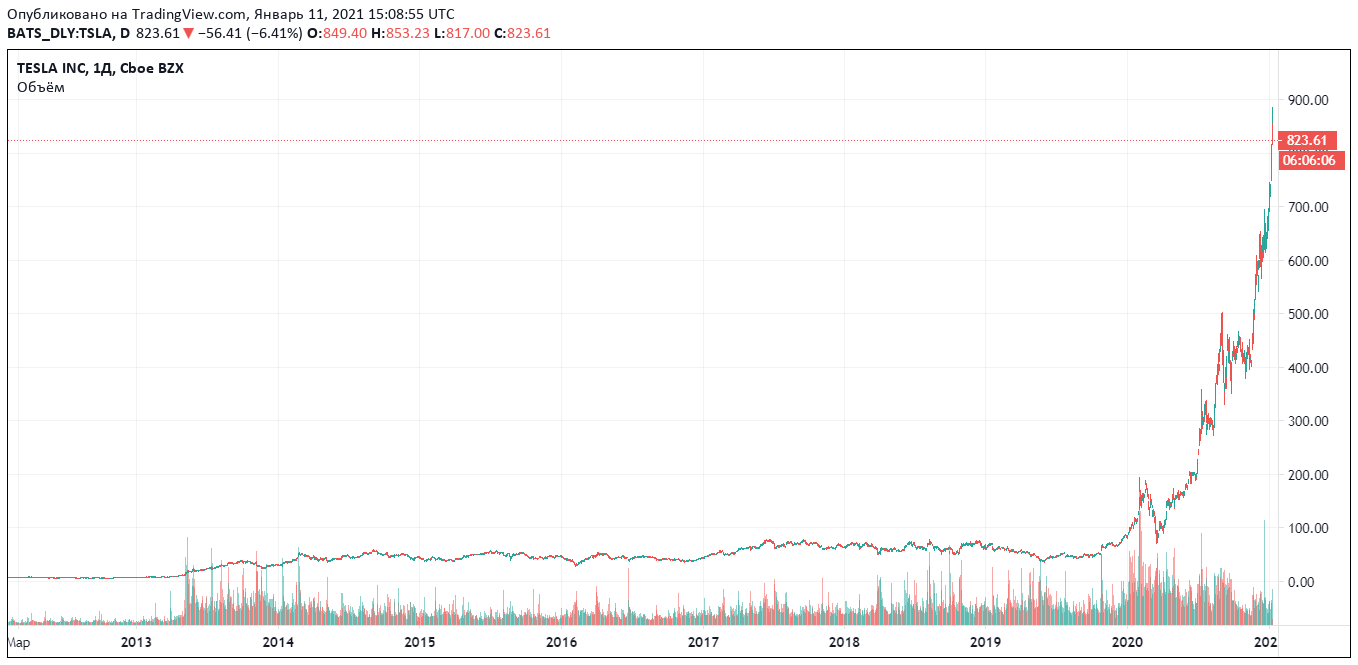

Tesla shares, which debuted on 29 June 2010, has shown incredible growth over the last ten years. 2020 for Tesla, the company’s enormous success and ambitious plans. Analysts have raised their estimates of Tesla stock and noted the involvement of the company about $12 billion from the sale of additional shares in 2020.

Today, the company Tesla (TSLA) has the largest capitalization in $billion 834,18 among automotive companies in the world and is the fifth value company in the S&P 500 index, ahead of Facebook (FB).

The growth of Tesla stock in 814% over the past 12 months has forced the skeptics Wall Street to double or triple your target price and ratings, though the average valuation of the market is far below the share price at $880 at the close of trading on Friday.

In the ten years since IPO Tesla Jun 29, 2010, shares of the electric car increased by an impressive 18 318%.

Investment of $10 000 in 2010 would have increased today to $1.8 million, says the average yield more than 63%.

For comparison, the same $10 million invested in an investment portfolio equivalent to the S&P 500 index at the same time, would have grown by only 267% to $36 732, is only 13% per year.

What will happen to Tesla in 2021?

In 2020 Tesla has proven that it can be profitable, though, before she managed to reach the supply in nearly half a million electric vehicles a year, the company has lost profit every year since its inception in 2003.

Many analysts warn investors about the risks for Tesla in 2021. First for Tesla stock there is a risk of decline of the desire of investors to fix profit from the incredible growth over the past year, and many analysts have long been talking about this growth as a “bubble”.

Secondly, the production growth rate, Tesla probably will slow down in 2021, as the Tesla factory in Fremont and Shanghai are approaching the highs of its production capacity.

Third, the capital cost of Tesla this year will grow strongly as the company is building two plants – one in Germany, for the second selected location in the state of Texas. In this case, the gene. Director of Tesla Elon Musk has warned that the factories will take more time to reach large-scale production than it took the plant in Shanghai.

Analyst Joseph spak of RBC Capital Markets raised its rating of Tesla stock from “sell” to “hold” and doubling their target price to $700, said as the company Tesla has been very cheap to raise capital by selling shares in 2020, instead of relying on their own monetary opportunities. Tesla gained about $12 billion from the sale of additional shares in 2020.

However, investors cannot be sure that in 2021 Tesla will be able to continue to Fund their investments using this growth stock. In addition, the decline of the shares will trigger a reverse situation – for its ambitious goals, Tesla will have to seek expensive loans.

At that time, as one continues to believe in the continued growth of Tesla stock, others are encouraged to look at the real market share of the company in the global automotive market in less than 1% and the increasing number of competitors around the world. Investors ‘ expectations for Tesla are very high and will struggle to match them this year.