The shares of PayPal hit a new high on Wednesday on news of the license Regulations from the Department of financial services of new York state for the purchase, storage and sale of cryptocurrency (Ethereum, Bitcoin and Litecoin Cash) through the digital wallets PayPal.

The shares of PayPal (PYPL), an increase of 97% year to date, reached a new high in 52 weeks on Wednesday, and it increased to 5.7% during trading and closed with a growth of 5.5% at a price of $213,07.

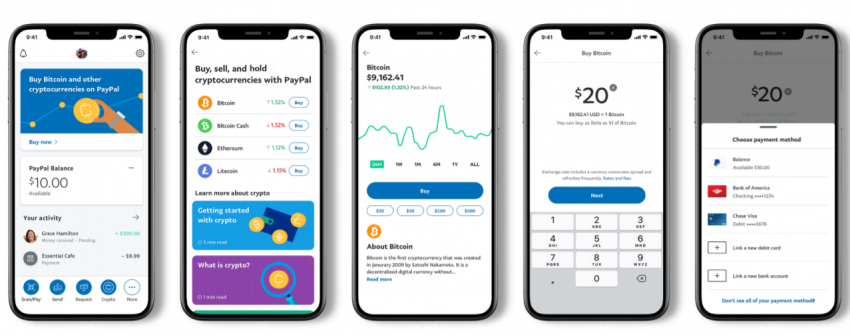

Amid rising interest in bitcoin from both consumers and commercial organizations and vendors, enhanced during a pandemic, PayPal announced the launch of services using cryptocurrency in a digital wallet. Efforts are in cooperation with governments, regulators and Central banks of the countries.

According to the company, the service will be available to PayPal account holders in the U.S. “in the coming weeks” and while it applies to the cryptocurrencies such as Ethereum, Bitcoin and Litecoin Cash.

According to a press release PayPal: “when buying or selling cryptocurrency until 31 December 2020, maintenance fee is not charged, for possession of crypto-currencies in your PayPal account does not permit the Board”.

PayPal announced that its customers will have the opportunity to make transactions digital Commerce using cryptocurrencies have 26 million sellers.

PayPal has completed the 2nd quarter of 2020, 346 million active accounts, which is 21% more than last year’s value. Was added 21.3 million active accounts, the highest figure for the quarter, with performance on platforms PayPal, Venmo, Honey and Xoom.

According to the study Ewebmarketing, most customers PayPal from U.S. accounting period by 43.86%, the following countries-leaders by the number of accounts in PayPal are: Germany (17,61%) and the UK (of 14.39%).

The company said it will expand the function of the use of cryptocurrency and Venmo in international markets in the first half of 2021.

“The transition to digital forms of currency is inevitable, which brings with it awya advantages from the point of view of financial availability, efficiency, speed and resiliency of the payment system; and the ability of governments to quickly allocate funds to citizens”, – reads the statement of the Director General PayPal Dan Schulman.

“We strive to work with Central banks and regulators around the world to offer our support and to make a significant contribution to the formation of the role that digital currencies will play in the future of global Finance and trade.”

PayPal received a license from the Regulations of the Department of financial services of the state of new York and said that the service is available in partnership with Paxos Trust Company, a regulated provider of products and services to the cryptocurrency.

PayPal also noted that created ”the educational content that will help customers to understand the ecosystem of cryptocurrency, risks and opportunities associated with investing in the cryptocurrency, as well as information about blockchain technology”.

PayPal has long set a goal to be among the first companies in the world at the moment when Central banks will allow the use of cryptocurrency. To do this, PayPal was created by “internal research group focused on blockchain”, which for the past five years, PayPal has made significant progress in developing ways to create “next generation infrastructure in digital financial services”.

In 2019, the investment arm of PayPal Ventures, invested in the company TRM Labs, which helps financial institutions to prevent fraud with cryptocurrency and financial crimes, as well as in Cambridge Blockchain, a company engaged in the development of software for identity management and compliance on the basis of the block chain.

Central banks around the world have long been studying the idea of issuing its own digital currency. Seven world’s leading Central banks, including the Federal reserve and the European Central Bank, has recently developed the basics of how this system can work. Meanwhile, the people’s Bank of China is moving ahead with tests of its own proposed digital currency.