Amazon is able to take away significant market share of digital advertising with Google and Facebook, given its dominance in the online market. According to the forecast Cowen, in 2026 the advertising business Amazon will bring an income of more than $85 billion.

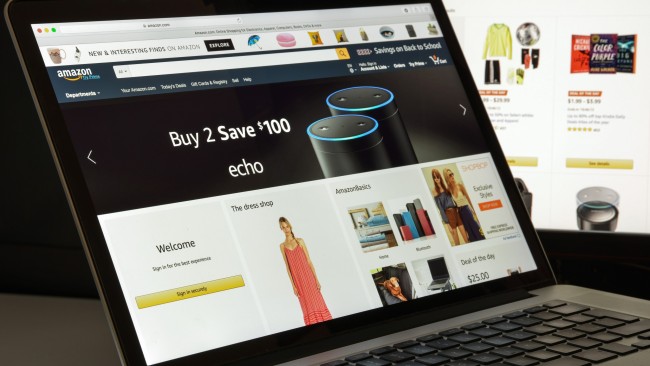

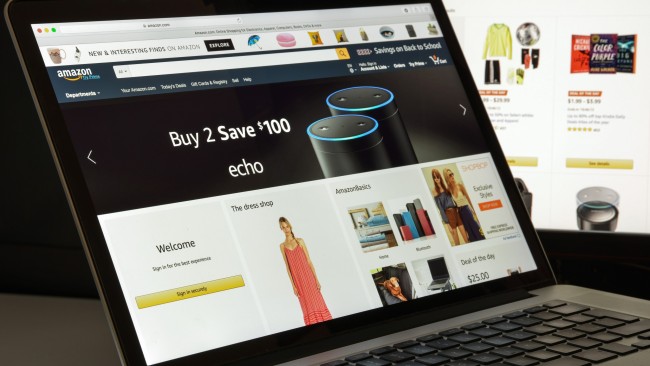

Amazon (AMZN) has become one of the main companies in the life of Americans in 2020, because of the pandemic COVID-19 millions of consumers stayed home, shopped on her site and watched a Prime Video.

Amazon shares rose by 74.7 percent over the past 12 months.

In addition to sales, increased sales of digital advertising Amazon for the first nine months 2020 income item Other, which mostly consists of advertising, increased by 45%.

According to eMarketer, last year online sales in the U.S. increased by approximately 32.4 per cent. Even given the fact that the growth of electronic sales in 2021 can be a bit slow after resume physical stores, they will still be high because of their advantages and formed consumer habits.

Amazon has a number of key advantages to offer both its customers and advertisers. Data show that the model is an annual subscription to Amazon Prime, which includes free fast shipping of online orders, gives an incentive to more frequent purchases.

Considering the operation of the site as a trading platform that in 2019 there were already 2.5 million sellers, buyers get huge range of products and competitive prices.

Based on these advantages, nearly half of Americans website Amazon.com is the first stop for searching products online.

As for the advertisers – they seek to offer their goods exactly where its likely to acquire. According to a new study Cowen, in the next couple of years, advertisers expect to spend more % of their advertising budgets to advertising Amazon. As a result, the advertising business, Amazon will continue to take market share from competitors such as Facebook (FB) and Google (GOOG, GOOGL) Google.

Greater independence compared to Facebook and Google

Advertising Amazon is less dependent on external influences than Facebook and Google. So, with the update FOR iOS on devices from Apple (AAPL) Facebook may lose the ability to target and measure advertising effectiveness, since users are free to choose – whether to allow you to track your data for each of the installed applications.

According to the third quarter of 2019, 94% of advertising revenues Facebook has had on mobile devices, then the company ceased to disclose this data.

Google, in turn, annually pays Apple and other manufacturers for that its search engine was installed in the devices by default. This causes disputes and antitrust investigation, which may cause some negative changes to Google. In addition, Apple is reportedly developing its own search engine, which may become the new search engine by default.

The advantage of Amazon is that digital advertising is placed on its own trading platform and owned by the video streaming service Prime Video. In addition, Amazon has the ability to track advertising from impression to conversion.

Given the continuing growth of e-sales Amazon, the company’s revenues from digital advertising are also expected to demonstrate an increase.

According to analysts Cowen, promotional business Amazon can bring more than $85 billion in 2026, compared with $80 billion that Facebook received over the last four quarters.

In other words, Amazon can increase revenue of their business to the level of Facebook over the next six years. This will have a significant impact on overall margin of the company, bringing huge profits to the investors.

Source:

The Motley Fool