The major stock indexes of USA has greatly restored growth on Thursday, after a heavy fall on Wednesday. The growth was driven by news on the simplification of regulatory requirements for big banks that will potentially allow you to accumulate more liquidity. At the same time risks to market high growth in the incidence of COVID-19.

On Thursday the largest US stocks finished a choppy trading session with significant growth: Dow Jones Industrial Average increased 1.2%, the S&P 500 1.1%, the Nasdaq Composite index also rose 1.1%.

News of the day was the announcement by the Federal reserve and other regulators on simplification of requirements limiting the ability of banks to invest in hedge funds and some other areas. These changes may help to attract more liquidity and strengthen small banking income amid near-zero interest rates the fed.

“When we think about the recession of such magnitude, like us, some banks will write off loans,” said Art Hogan, chief market strategist at National Securities. “The fact that they will have more working capital, makes markets breathe a sigh of relief”.

On Thursday, the fed issued a so-called “stress tests”, the results of the financial analysis by economists of the fed resilience of large banks to a hypothetical downturn or reduction scenarios that may arise as a result of the crisis associated with the pandemic. The results of these tests showed that all the major banks remain highly capitalised, this gives a chance for a quick recovery.

Bank of America shares (BAC), JPMorgan Chase (JPM) and Citigroup (C) rose more than 3% (to 3.8% to 3.5% and 3.7%, respectively).

Morgan Stanley (MS), Goldman Sachs (GS) and Wells Fargo (WFC) showed even more significant growth of 3.9%, 4.6% and 4.8% respectively.

The persistent reasons for concern

At the same time, the “level of fear” in the stock market remains high, as investors see growth in the number of incidence COVID-19, which leads to the fact that some States suspend its plans for further weakening of quarantine measures.

On Wednesday, the US recorded a new peak incidence was confirmed by more than 45,000 new cases of coronavirus, which exceeds the previous record of April 26, more than 9 000 cases.

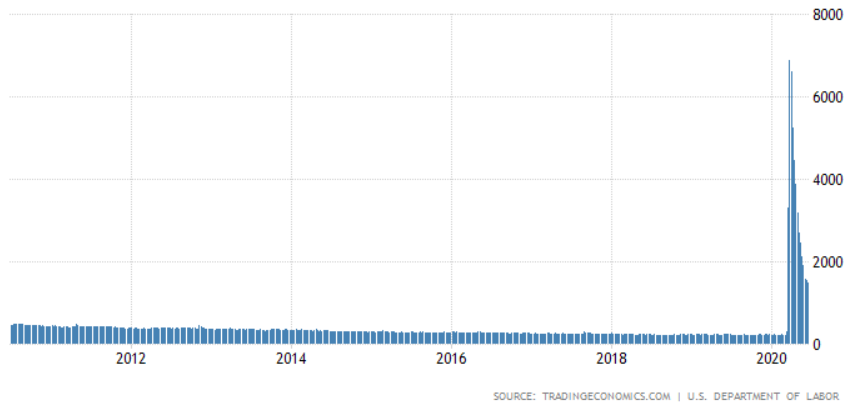

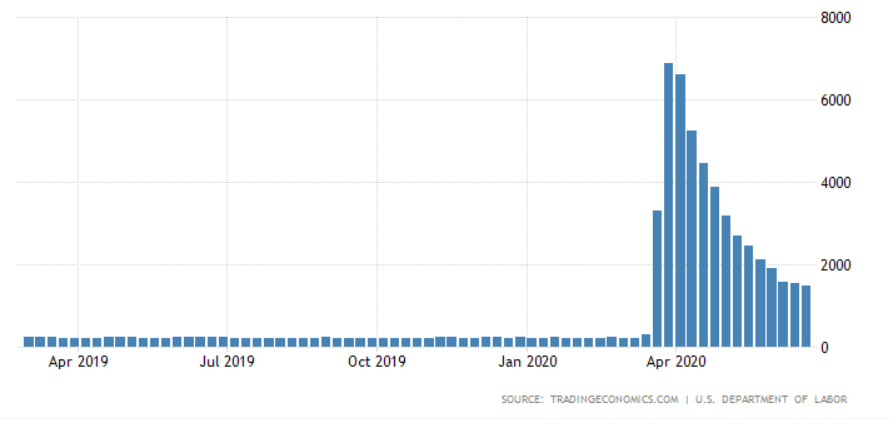

Thursday’s report on weekly initial applications for unemployment benefits the U.S. Department of labor did not add optimism. For the week ended June 20, Dole filed of 1.48 million Americans, above the economists ‘ forecast of 1.35 million. This marks the second consecutive week when data on unemployment in the United States was worse than expected. However, the total number of unemployed people continuing to receive benefits fell by more than 700 000 last week.

“No matter how you look at it, more than a million unemployed – this is very bad,” said Mike Loewengart, managing Director of investment strategy at E-Trade. “It will take some time to eliminate structural damage COVID in the world.”

“While this is certainly inconvenient, everyday investor needs to get used to the constant market volatility at this stage,” he said Leonhart.