Munich For months, investors have been afraid that the war in Ukraine and fears of a recession are having an impact on the success of the chip industry worldwide. If the figures presented by the manufacturer TSMC on Friday are an expression of this lull – then the worries are rather unfounded. In June, sales increased by 17 percent compared to the previous year, the world’s largest contract manufacturer of the chip industry announced at the end of the week.

The increase was therefore significantly lower than in the previous months. In the second quarter, however, total revenues increased by more than 40 percent to the equivalent of just under $ 18 billion. Customers are showering the Taiwanese semiconductor manufacturer with orders.

TSMC is essential for the industry and it is just as important that TSMC is doing well. “They have developed a systemically relevant position,” says Peter Fintl, chip expert at the consulting company Capgemini.

Only TSMC has mastered the most complex and advanced manufacturing processes in the world. At the same time, the company also offers older, more mature technologies, such as those demanded by the European automotive industry. The flip side of success: almost the entire semiconductor industry is dependent on the market leader. “If something happens in Taiwan, then the tremors of the supply chain will be felt worldwide,” warns consultant Fintl.

For the Taiwanese, manufacturers can choose who has a reputation in the chip industry: from AMD to Broadcom and Nvidia to Qualcomm. Even rival Intel, which itself is pushing into the business of contract manufacturers, is on the list of buyers.

“Systemically relevant”, but the own name does not appear

The three major European semiconductor companies Infineon, NXP and STMicroelectronics are also buying into Hsinchu. By far the largest customer with around a quarter of sales is Apple.

With 63,000 employees, the Group manufactures around 12,000 different products, using more than 300 technologies. In principle, TSMC does not sell chips under its own name, so as not to compete with customers.

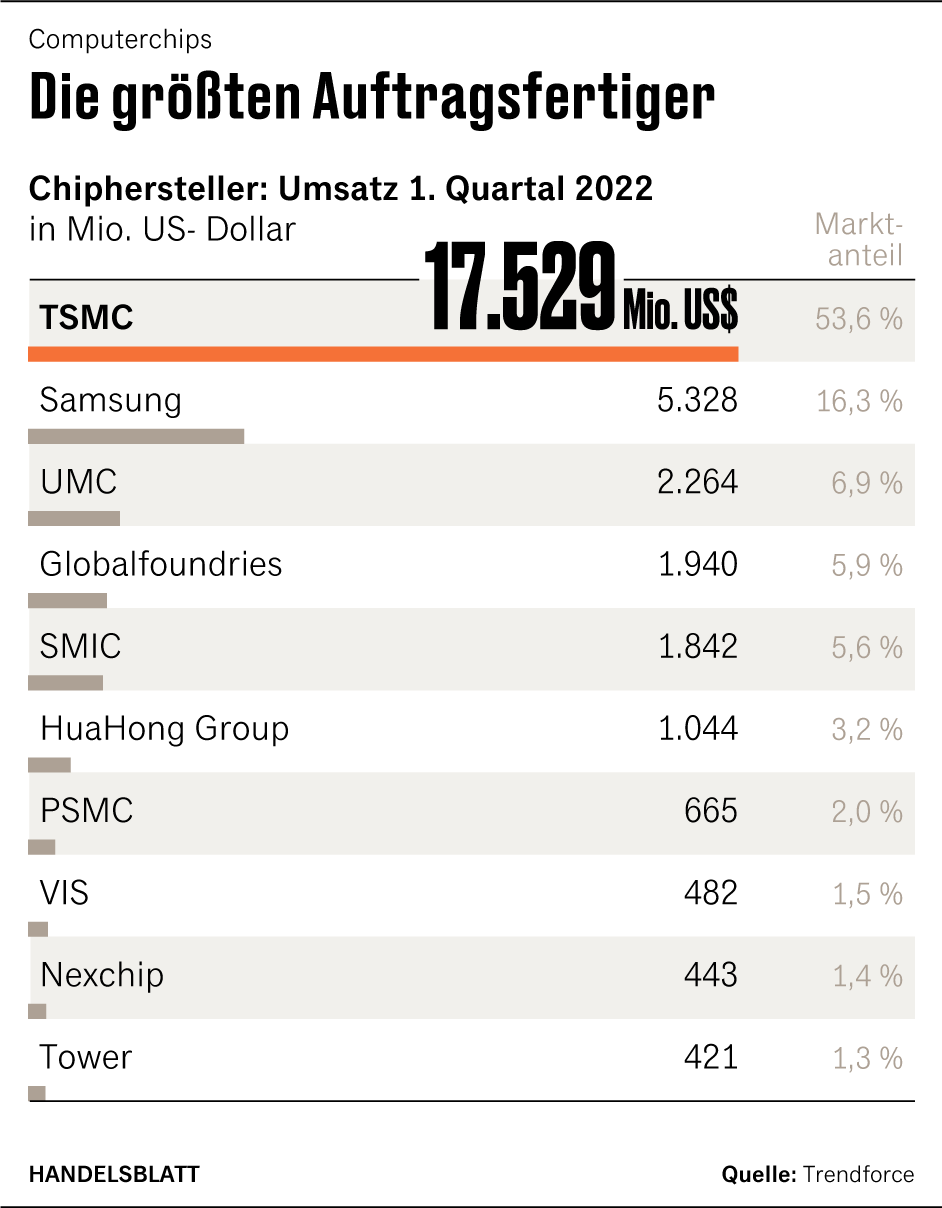

The market position is unique: the Group represents more than half of the revenues of the ten largest contract manufacturers worldwide, explain the market researchers from Trendforce. The number two among the so-called foundries, Samsung from South Korea, has a share of less than 20 percent. If you don’t make your own chips, it’s hard to get past the Taiwanese.

Proximity to China increases an old concern

So far, TSMC has been producing almost exclusively in its home country. This is increasingly worrying consumers. Because the location of the island in the South China Sea carries various risks. TSMC engineers cope with natural disasters such as cyclones that regularly hit Taiwan, and even earthquakes. The Group also survived the drought last summer without major production losses.

However, the proximity to China has exacerbated an old concern in the shadow of the Ukrainian war: an armed conflict with the People’s Republic of China, which does not recognize Taiwan’s autarky, would put an end to freedom and peace and hit the global economy in the marrow.

It often does not take much to seriously disrupt the highly sensitive chip production. When the power went out for only 20 minutes in Dresden last autumn, all the wafers – i.e. the discs on which the chips are produced – had to be checked individually at the Infineon plant.

A matter of national security

In an area of conflict, the disruptions would be far more significant for TSMC. And German car factories would quickly feel this through the supply chains. Because it takes several months to produce a chip, it takes hundreds of individual steps. If the highly complex process is interrupted even at one point, this throws the production back by weeks and months.

iPhones

The new iPhoneSE from Apple: the US group is the largest customer of TSMC.

(Photo: Reuters)

The US should therefore do much more to attract TSMC – and also the South Korean competitor Samsung – to America, former Google CEO Eric Schmidt recently demanded in an opinion piece for the “Wall Street Journal”. This is a matter of national security. What Schmidt also says: even the leading American semiconductor manufacturers lack the know-how of the world’s two largest contract manufacturers.

After all, TSMC is currently building a state-of-the-art plant in the USA. However, TSMC has so far shied away from a location in Europe, although Asians can expect extensive state support. “Factories can be subsidized 100 percent according to European law,” says Thomas Skordas of the EU Commission. However, numerous conditions would have to be met for this, including the degree of innovation of a location.

That could be a sticking point, experts say. This is because the industry located here, such as the automotive industry, usually requires sophisticated technology in the supplier components. High–performance chips for smartphones and computers would rather not be produced – which reduces the degree of innovation, which in turn affects the promotion. “We’re looking at a lot of places,” TSMC board member Kevin Zhang said recently at a meeting with customers in Amsterdam. However, there are no concrete plans for a factory in Europe.

TSMC makes huge investments

“We have to keep an eye on our own resources,” he explained. Too many projects at once could overwhelm your own organization. Apparently, however, TSMC also doubts that a factory in Europe can be operated profitably. Zhang says, “We have to take the whole environment into account, and there is still a lot in Asia.“

There is speculation in industry circles that the acceptance commitments of European customers have so far not been sufficient for the Asians. The EU still does not agree with TSMC, Skordas explained recently at a semiconductor congress in Munich.

However, the customers would be happy to no longer be so dependent on the Taiwan location. “We welcome it when the foundries diversify and build up the business outside of Asia,” says Rutger Wijburg, Chief Production Officer of Infineon. “It is particularly important to expand production capacities in structure sizes of 28 to 12 nanometers in Europe.“

The Group would have enough money: “TSMC is defending its position with huge investments,” says consultant Fintl. In 2022, the Group plans to invest 40 to 44 billion dollars in new plants and plants. This is three times as much as the largest German chip manufacturer, Infineon, generates in terms of sales.