Frankfurt, Düsseldorf For many IT service providers, these are golden times: Providers who introduce cloud services, support the development of a data strategy or strengthen IT security have full order books. Despite economic uncertainty, companies are investing in digitization.

Financial investors want to participate in this boom. Private equity companies have been buying IT service providers of various types and sizes for several years in order to forge larger companies out of them. They hope to accelerate sales and profit growth of the acquired IT service providers.

Figures from the consulting firm Alantra for the German-speaking region prove this trend: since 2015, financial investors have taken over around 50 platforms for IT services, including Cloudflight, Valantic and Skaylink. These companies, in turn, made more than 220 company acquisitions.

A wave of consolidation is underway in the industry, which has been fragmented to date, with a few corporations such as Capgemini, Atos or T-Systems and a large number of small and medium-sized companies. For customers, this often means better and more comprehensive services – but sometimes also higher prices.

Currently, the market is about Intive, which promises acceleration in digital transformation. Owner Mid Europa Partners has chosen Goldman Sachs as its sales consultant. Bidders could value the company, which has an operating result (Ebitda) of 30 to 35 million euros, at 400 to 500 million euros.

Private equity investors pursue two strategies

According to financial circles, the digital agency FFW of the investor Findos is for sale. The company with an ebitda of twelve million euros could be valued at 150 to 160 million euros in a deal. Jambit, owned by the founders, could reach a valuation of 70 to 80 million euros with its ebitda of around seven million euros if the company changes hands soon. The companies declined to comment.

All three sales processes are still ongoing and, despite the different sizes, have one thing in common: the probability is high that the buyer will be a private equity investor. Companies that deal with digitization are in high demand in search of attractive returns.

>> Read here: Deutsche Telekom stops selling T-Systems

Two complementary strategies are being pursued. Either the company is being used as the core for a new IT service provider, or it is a so-called add-on acquisition that adds specialists to an existing company and opens up new customer groups.

This procedure corresponds to the industry logic. “An IT service provider today needs a certain minimum size in order to be able to prevail in tenders,” says Mario Zillmann, partner of the consulting firm Lünendonk. With more and more orders, a combination of several competencies is required. For example, consulting and technology topics are increasingly being requested equally in tenders.

An example: When a company introduces the new generation of SAP software, support in adapting business processes is usually required in addition to technical know-how. “There are many small and medium-sized companies that cannot meet such requirements on their own,” says Zillmann.

Investments in cloud and IT security

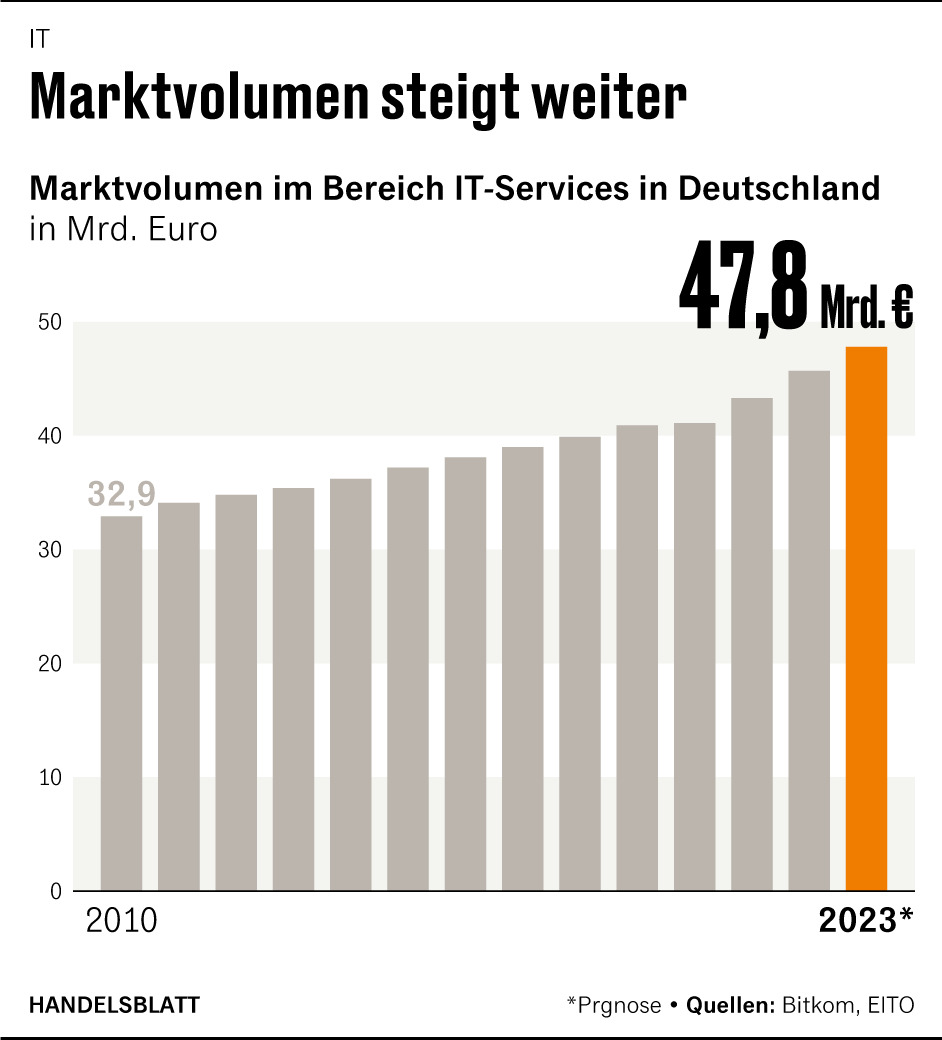

The market is attractive. Companies need to modernize their IT infrastructure in order to be able to use the possibilities of artificial intelligence and Internet-enabled products (Internet of Things). Modern technology is also needed for digital customer contact, whether via website or app. At the same time, investments in IT security are vital for survival.

IT budgets are therefore increasing in many organizations. “The shift of the IT infrastructure to the cloud and the topics of the digital workplace, cybersecurity and data analytics are key drivers for digitization, especially in SMEs,” says Mathias Heymann, technology expert at the consulting firm Alantra.

>> Read here: IT service providers hope for a cloud boom

The strong fragmentation of the IT services landscape in Germany with increasing customer requirements at the same time is driving forward the consolidation and targeted development of larger platforms. Financial investors supported the process, which is reflected in increasing deal volumes and high valuations.

However, the forces of small providers are often no longer sufficient. “The customer’s requirements with regard to IT service providers are becoming more complex. This is also reflected in increased project budgets, which can often no longer be serviced by small providers,“ says Christoph Bregulla from the investment banking boutique MCF. “With capital and experience, private equity is ready to create larger units in a market that is still fragmented.“

“Not just capital, but expertise”

Transactions in recent months show that financial investors are pursuing exactly this strategy. The Munich-based service provider Skaylink, which specializes in the introduction and operation of cloud services – formed with the help of the financial investor Waterland – bought the small Danish rival cVation in November.

“All investors are looking at software and digitization service providers because, despite tighter budgets on the customer side, they are still growing, even in the crisis,” says Carsten Rahlfs, Managing Partner at Waterland. For example, many companies are in the process of introducing the SAP S/4 Hana program. “This provides an implementation provider with a special economy for years to come.“

The Swiss Partners Group, on the other hand, acquired the Munich-based digitization service provider Cloudflight in November for a valuation of around 400 million euros and announced initiatives such as expanding the technical capabilities of the teams, expanding into new markets and professionalizing internal structures.

Dutch private equity firm Rivean Capital joined Init’s Berlin-based competitor in January with a valuation of almost EUR 300 million. “Rivean prefers investments not in ‘finished companies’, but in those that can be professionalized,” says Matthias Wilcken, partner at the investment firm.

“In order to further develop IT service providers, not only capital is needed, but expertise and a specific knowledge of the local market. Because customers often do not need the standard product for their IT topics, but tailor-made solutions.“

Resale to McKinsey and Co.?

When private equity has finished with its buy & build strategy with IT service providers, reselling to a consulting or service group is the most obvious option, in some cases also an IPO. There have been several such exits in the past two years: McKinsey bought S4G, IBM Neudesic, Accenture Infinity and Allgeier Evora.

>> Read here: McKinsey questions its own strategy

The strategy is not entirely without risk. “The challenge of ‘company building’ is to create a uniform corporate culture and to commit the management team to a goal,” says Lünendonk partner Zillmann. Only then is it possible to provide holistic advice to customers and to be an attractive employer.

The partner is convinced that this will not always succeed. “But we won’t see that until later – the wave has only been running for a few years and there are still no empirical values.“

More: The “won’t work out anyway” mentality: how Germany is losing touch