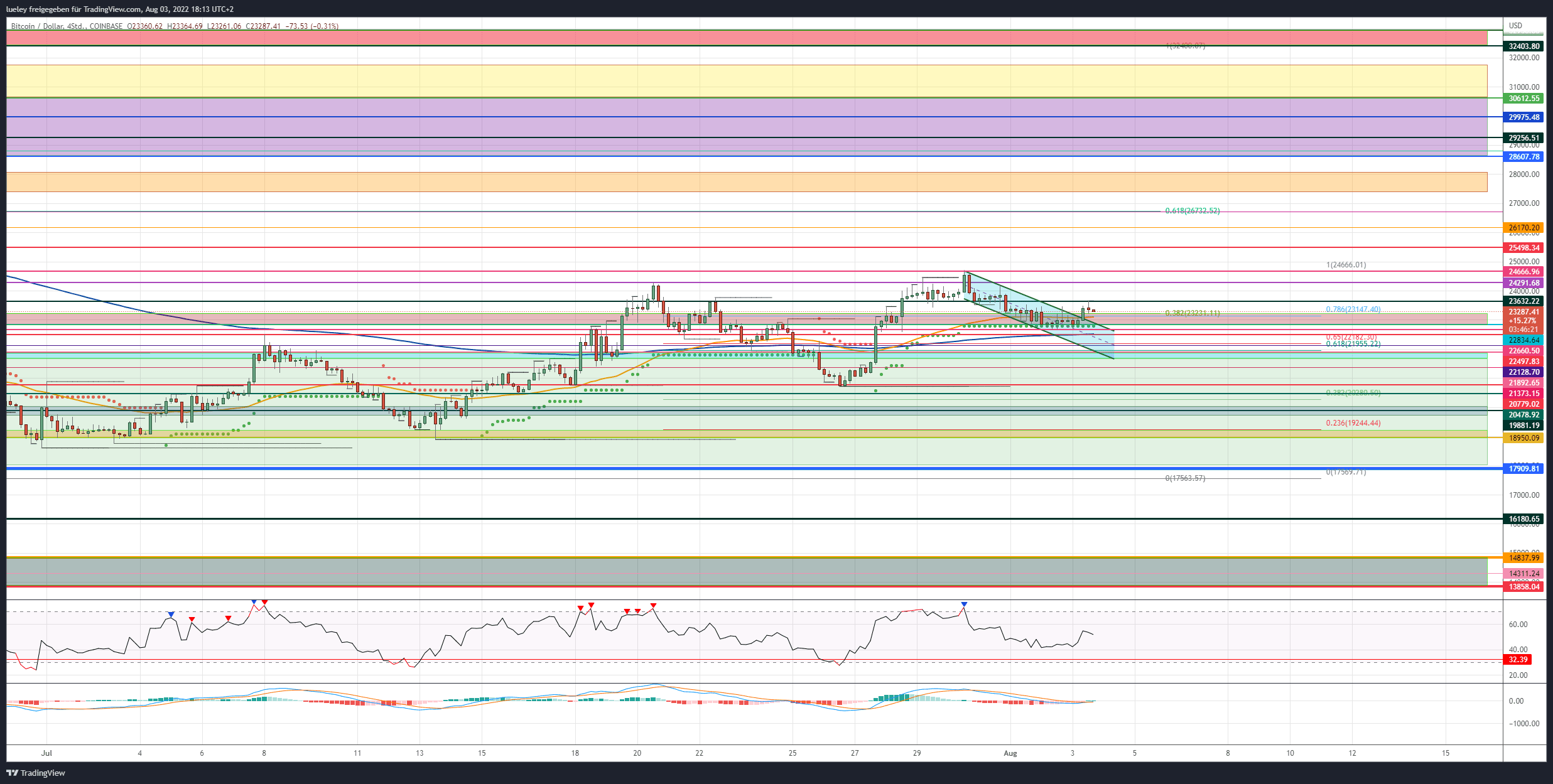

Bitcoin (BTC): only an increasing trading volume can move the crypto reserve currency towards $ 28,000

BTC Rate: $23,287 (Previous week: $21,300)

Resistances/Goals: $23,632, $24,291, $24,666, $25,498, $26,170, $26,734, $27,696/$28,104, $28,607, $29,256, $29,975, $30,612, $31,750, $32,443/$32,938

Support: $23,147, $22,834, $22,497, $22,128, $21,936/$21,721, $21,373, $20,779, $19,881/$20,036, $19,212/$18,950, $18,604, $17,909/$17,567, $16,180, $14,838, $14,311, $13,858

4-Hour chart Price analysis based on the value pair BTC/USD on Coinbase

4-Hour chart Price analysis based on the value pair BTC/USD on Coinbase

Recap Bitcoin

- A new week, a new attempt to escape. This is how one could describe the current price movements of the crypto reserve currency Bitcoin.

- Good business prospects from Amazon and Apple for the coming quarters have recently led to a recovery of the Nasdaq technology index and the crypto sector.

- Bitcoin took advantage of the positive signs on the classic stock market at the end of the previous week to initiate another attempt to rise.

- Although the Bitcoin price rose to a new historical high at $ 24,666 last weekend, the low trading volume again prevented a sustainable upward movement to $ 28,000.

- As a result, Bitcoin slipped back below the resistance at $ 24,291 at the end of the day and corrected its peak in the direction of the supertrend in the 4-hour chart at $ 22,834.

- Although the weekly low was slightly lower at $ 22,660, the bulls were subsequently able to lift the BTC price back over the supertrend again and again by the close of candles. The fact that Bitcoin is also trading further above the EMA200 (blue) in the 4-hour chart, currently at $ 22,497, is to be interpreted bullish in the short term.

Mixed numbers of US technology companies

- Even the departure of Michael Saylor as CEO of MicroStrategy did not have a negative impact on the BTC price, despite the company’s poor quarterly figures yesterday evening.

- Rather, the strong quarterly figures of the payment service provider PayPal are likely to have a positive effect on the development of Bitcoin.

- Further price impulses could have next Friday, August 5, the publication of the major labor market report in the United States. The so-called non-farm payrolls (NFP) usually cause an increase in volatility on the global financial markets.

- The Fear and Greed Index has increased again since the previous week’s analysis and is trading six points higher at 34. Investor anxiety is thus continuing to decline. Investors are once again showing more courage when investing in the crypto space.

A look at the indicators

- The recent sell-off has caused the RSI as well as the MACD indicator in the 4-hour chart to return to neutral territory. The MACD is currently trying to generate a fresh buy signal again. With a value of 55, the RSI could also generate a fresh long signal on a 4-hour basis in a timely manner.

- Looking at the daily chart, the situation is a little more complicated. On the one hand, both indicators have stable buy signals. On the other hand, the RSI indicator has now produced a bearish divergence. This may indicate further price consolidation and substantiates the lack of trading volume in the last trading days.

- As long as Bitcoin is trading above the 21,373 USD at the close of the day, a new breakout attempt by the bulls is to be planned at any time.

Bullish Scenario (BTC):

- The bulls again failed to start a sustained price breakout towards $ 26,170 last weekend with low trading volume.

- Once again, after a false breakout on the upside, the BTC price fell back to the supertrend in the 4-hour chart in the area of $ 22,800.

- On Wednesday afternoon today, Bitcoin is trading above the EMA50 (orange) again at $ 22,300. Thus, the break out of the short-term downward movement seems to have succeeded for the time being.

- However, in the short term, the bulls will have to try to move the BTC price back above the $ 23,632 mark in order to subsequently initiate another attempt to rise towards $ 24,291.

- If the bulls succeed in stabilizing the price above this important resist in the coming days and Bitcoin then also cashes the previous week’s high at $ 24,666, the resistance mark at $ 25,498 will first come into view of the investors.

Focus on the 61 Fibonacci retracement as a target

- However, this price mark is likely to stop only in the short term. Rather, a march up to the 26.170 USD is conceivable. For this, however, the trading volume must also increase significantly.

- If Bitcoin then also overruns the $ 26,170, there will be a preliminary decision on the 61 Fibonacci retracement at $ 26,734.

- If there are no sustainable profit-taking by the buyer side and Bitcoin stabilizes above the last historical high at $ 24,666, the bulls will target the orange zone between $ 27,696 and $ 28,104.

- Also a spike up to the 28.607 USD can be planned. If the bears then remain abstinent, Bitcoin is likely to start the range between $ 29,256 and $ 29,975.

Will the breakout succeed above the $30,000?

- Although some bulls will want to secure profits at the psychologically important $ 30,000 mark, the probability of a price increase to the maximum bullish target range between $ 31,750 and $ 32,443 is noticeably increasing.

- As already mentioned in the last analyses, a price increase up to USD 32,443 should be regarded unchanged as a corrective recovery movement in a higher-level downward movement.

- The zone between $ 32,433 and $ 32,938 is of key importance here. Since the moving average of the last 200 days (EMA200) also moves in this range, a break in the current bearish market structure is only given when it stabilizes above $ 32,938.

Bearish Scenario (BTC):

- The bears prevented another breakout attempt over the $24,291 last weekend. At the close of the day, the seller side pushed the BTC price back below the 24,000 USD with low volume.

- Although Bitcoin slipped to a new weekly low at $ 22,660 on Tuesday, the sell-off momentum was not enough to break the supertrend and the EMA200.

- In order to activate further downside potential, the bears will have to sell off the BTC price again below $ 22,446 in the coming days.

- Already in the range between 22.182 USD and 21.955 USD, it is to be planned again with resistance from the bulls.

- If the BTC price falls sustainably below this support level, and the upper edge of the old sideways range at $ 21,892 also does not give a foothold, a price decline up to $ 21,373 is likely.

A preliminary decision is approaching

- Here, a preliminary decision is to be expected for the coming trading days.

- If this support is dynamically undercut, the area around the previous week’s low of $ 20,779 will once again come into the focus of investors.

- If the seller side succeeds in breaking through this strong support in the long term, the chart picture will deteriorate in the short term.

- As a result, Bitcoin would quickly fall back to at least $20,478.

New annual lows are increasingly likely

- A direct sell-off up to the 38 Fiboancci retracement at $ 20,280 must also be planned. If the bulls remain abstinent here, the area around the psychologically important mark of $ 20,000 will come back into focus.

- If this support can also be broken, the sell-off will immediately expand to the yellow support zone between $ 19,150 and $ 18,950.

- The probability of a bearish trend following movement then increases massively.

- If the area around 18,950 USD does not stop either, the bears will want to sell off the BTC price via the intermediate stop at 18,604 USD in the direction of 17,909 USD. Here is the last chance for the bulls to stabilize the BTC price and turn the tide in their favor again.

The $14,000 target area on the bottom

- If the bears hold against it with further sell-offs, and the annual low at $ 17,567 is also broken, a price slide up to $ 16,180 is expected.

- In addition, if the classic financial market also tends south again in the next trading weeks, a start of the support range between 14,837 USD and 13,858 USD is not excluded.

Disclaimer: The price estimates presented on this page do not constitute buy or sell recommendations. They are just an analyst’s assessment.

The chart images were created using TradingView.

USD/EUR rate at the time of writing: 0.98 Euro.