This week on the US stock market will be saturated because more than a third of S&P 500 will report their quarterly results. On Thursday, the results fail Apple, Google, Facebook and Amazon, as well as announced the preliminary GDP estimate for the third quarter.

In the last week of October, investors expect a lot of news, since more than one third of the components of the S&P 500 index, or 186 companies must report financial results for the third quarter.

The information field even more intensely, given the race in the United States, the situation with the pandemic and waiting the decision of Congress on the stimulus bill to help the economy “Cares 2”, allocating more than a trillion dollars.

Economists and analysts give their forecasts for revenues and profits, noting that the results of the reports of the largest companies in the S&P 500 will affect the movement of the market as a whole, predicting high volatility this week.

Brian Pryce, head of investment management at Commonwealth Financial Network in an interview with MarketWatch said that most companies (about 84%), which already reported its quarterly profit exceeded Wall Street expectations, although the figures were significantly lower than in the previous quarter. 81% of companies exceeded analytic expectations on quarterly earnings.

“The report on profits and losses is important, but the market seems focused on the elections, and any news related to the negotiations on the incentives,” said Price. “It seems unlikely that we will get a big stimulus package before the election, and I am somewhat surprised that the volatility is not higher in light of this uncertainty.”

Quarterly reports this week, including such significant components as Apple (AAPL), Google (GOOG, GOOGL), Facebook (FB) and Amazon (AMZN) will demonstrate what is the impact of the crisis, analysts and investors also will closely evaluate the forecast statements of companies.

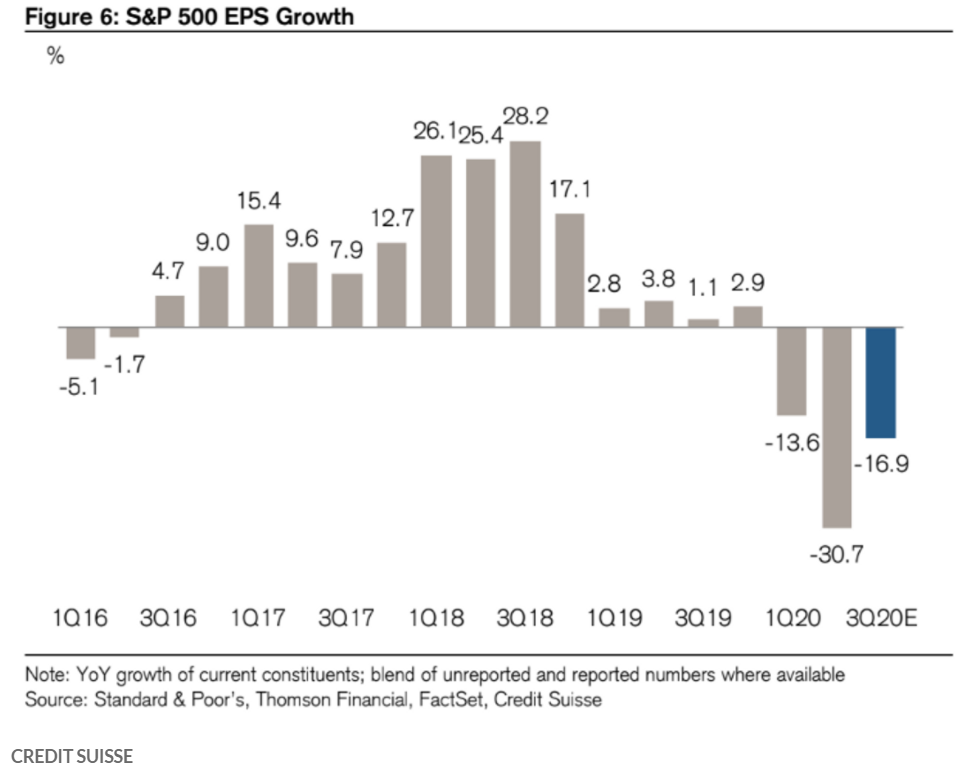

Statistics reports of companies from the S&P 500 that have already reported results, shows a decrease in net profit by 16.5% in the third quarter, compared with the same value last year.

If this level of deterioration in net profit to remain after most companies will report this week, this will be the second largest profit decline in the second quarter of 2009, when the average decline in profits of 26.9%.

At the sectoral level, nine of the 11 sectors in the S&P 500 index reported a decline in profit compared with last year’s value, primarily in the energy sector (-123,6%).

The research team at Credit Suisse led by Jonathan Blue predicts decline in earnings per share by 16.9%.

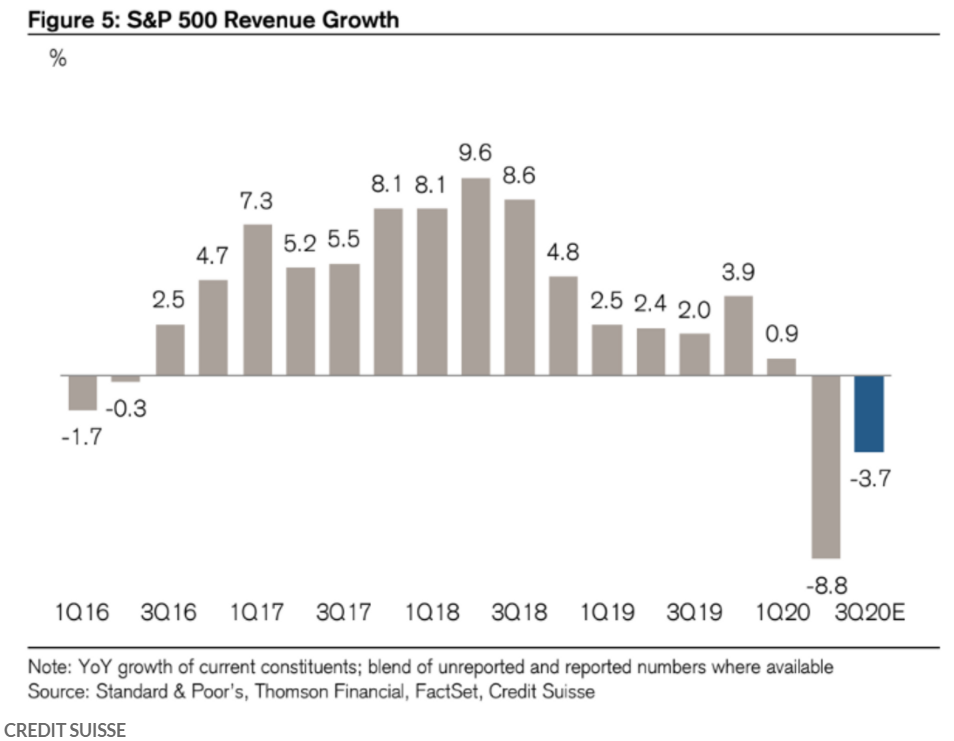

With regard to the average earnings forecast in the third quarter, analysts at Credit Suisse also expects a decline of 3.7%.

However, there are positive forecasts, the market experts of the Leuthold Group expect a strong rise of sectors such as technology and healthcare will help to stimulate market growth, ultimately leading to the achievement of an unprecedented sharp growth and record results earnings per share in 2021.

US GDP in the third quarter of 2020

The initial estimate of the US GDP, a key indicator of economic activity in the country, is expected on Thursday, while the final data for the third quarter should be published in less than a week after election day on 3 November.

Economists are optimistic GDP growth of 31.8%, which is a sharp increase after falling by 32.9% in the second and a fall of 5% in the first quarter of 2020.

At the same time, critics warn that GDP figures do not reflect the fact that millions of people remain without work, and many sectors of the economy, especially in tourism and entertainment remain in a difficult situation due to quarantine restrictions.

Economists at Morgan Stanley, if Congress passes incentive measure in this month, GDP growth in the fourth quarter will be 9.3%, but at the end of the year will decrease by 3.4%.