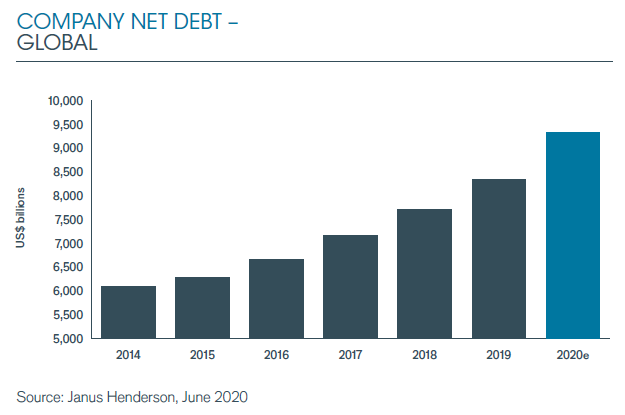

Pandemic coronavirus has forced companies worldwide to resort to new borrowing to keep their business. According to the study Janus Henderson, total global corporate debt will rise by 12% to $9.3 trillion. in the year 2020. The largest size of firms ‘ debt is approaching the level of debt of some countries.

Pandemic COVID-19 was the reason that the global business has reached a new high of debt. The level of total global corporate debt, according to the research company Janus Henderson, will grow by 12% to $9.3 trillion. in the year 2020. The study covered 900 world leading companies with the analysis of growth of debt from January to may.

The graph below shows the growth of global corporate debt in billions of dollars, based on the data till may 2020.

The level of debt grew until 2020 and pandemics, but the global crisis because of the coronavirus raised it to a new record amount.

When last year showed a sharp increase in global corporate debt of 8%, the trend has been associated with mergers and acquisitions, as well as numerous major firms that resorted to borrowings to Finance share repurchases and dividend payments.

But the leap this year is for a completely different reason – the desire of companies to resort to borrowing for the sake of their business because the pandemic has caused a sharp fall in revenues and profits of many sectors.

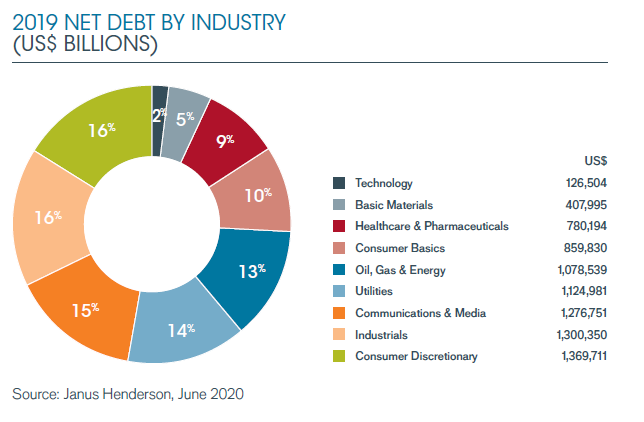

Among the most affected was the consumer sector, industry (including the airline and automotive industry), media (including film), utilities, oil and gas and energy sector, healthcare and pharmaceuticals.

“COVID changed everything,” said Seth Meyer, a portfolio Manager at Janus Henderson, the firm that built the analysis for a new index of corporate debt. “Now we are talking about the preservation of capital and the establishment of a strengthened balance sheet.”

The companies included in the new index debt Janus Henderson, already have almost 40% more than in 2014, and the growth of debt outstripped the increase in profit.

At the beginning of the pandemic (February-March 2020) the credit markets were available for companies with the best ratings. However, after the steps of the Central banks, a large number of companies with lower credit ratings got loans for state programs.

The US Federal reserve, the European Central Bank and the Bank of Japan lowered interest rates to near zero, announcing large-scale programmes to support the economy.

American companies – the largest debtor in the world, their corporate debt accounts for nearly half of the world at $3.9 trillion. Germany is in second place with a total debt of corporate sector to $762 billion In the country there are three companies with the highest debts in the world, including Volkswagen, the level of debt of which $192 billion reaches the level of debt of countries such as South Africa or Hungary.

With the exception of steel about a quarter of the companies in the new index Janus Henderson, who generally have no debt. There’s also Switzerland, where instead of growth of loans has been a wave of large mergers and acquisitions.

There are also companies who have resorted to the accumulation of large cash reserves, so did the largest banks (accumulated reserves for potential coatings defaults on loans) and certain other financial and technology companies, for example, the parent company Google Google (GOOG, GOOGL) has funds the sum of $104 billion.

According to the forecasts of economists, a substantial recovery of the world economy is expected only next year. At the same time, the depth of the recession this year means that economic activity will continue to shrink, depending on the terms dictated by the pandemic.

According to Paul O’connor, the portfolio Manager of the Janus Henderson: “economic activity in most countries will stagnate or even decline over the three-year period, covering the period from 2020 to 2022. It is expected that even by the end of 2022, the unemployment rate in most major economies will be significantly higher than at the beginning of this year.”

Experts believe that to be a “long war” with COVID-19, until it becomes widely available vaccine and herd immunity is formed, which will rapidly open and to restore the pace of growth of the economies of countries around the world.