Google parent company Alphabet has published more than high profits and income for the 4th quarter of 2020 than analysts had expected. The income from advertising on Google search and YouTube has shown strong growth. The company published its first operating performance of Google Cloud as a separate segment.

Shares of Alphabet (GOOGL, GOOG), increased by 29.4% over the last year, increased by 7% in after-hours trading on Tuesday when the company published its financial report for the fourth quarter.

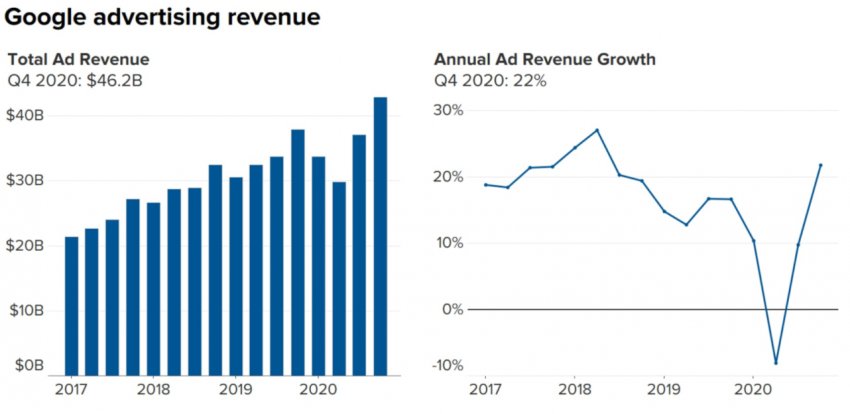

The key signals for investors was the strong growth in advertising revenues, which proved that the demand for digital advertising continued to recover quickly in the context of the pandemic of coronavirus.

An important event was the first disclosure of the Google operating loss of his unit cloud computing Google Cloud, which suggests that the business of the company is still in investment mode.

Alphabet reported a 45% growth in earnings per share 4th quarter to $22,30, or $6,31 more than the analyst estimate of $15,99. The amount of profit totaled $15.2 billion, compared to $10.7 billion, the company informed.

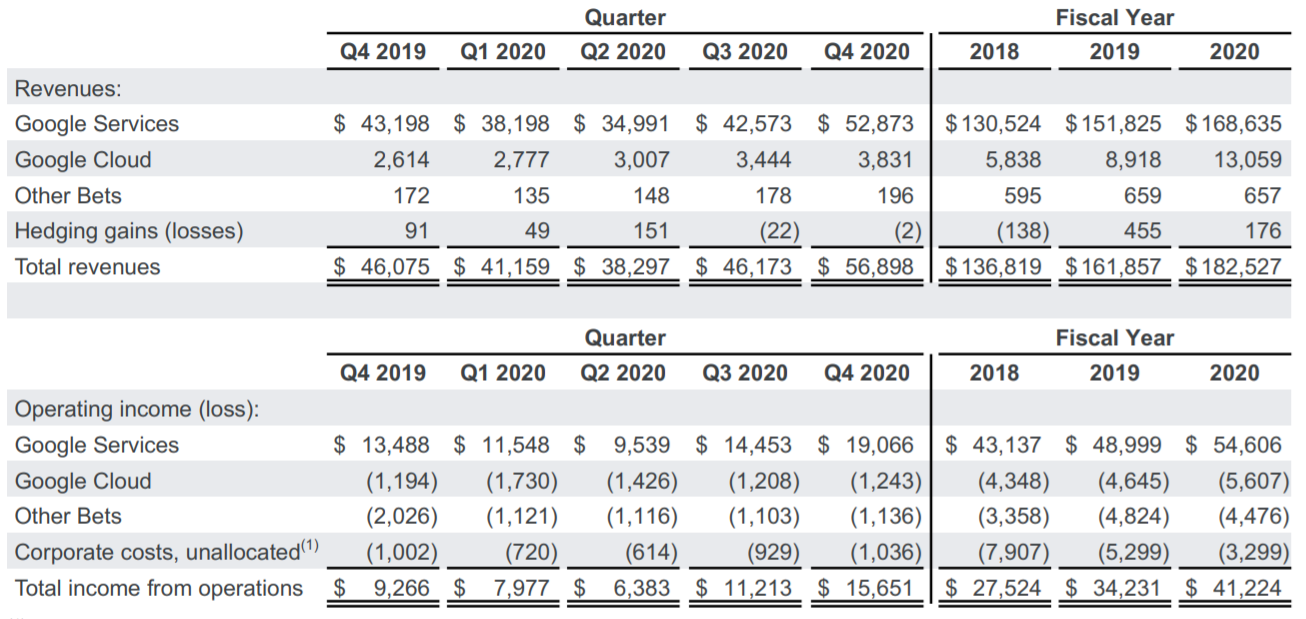

Total quarterly revenue grew by 23% (in comparison with the last year’s value) to $56.9 per billion, which was also above average analytical estimate of $53,15 billion Statistics quarterly revenues and profits Alphabet for the last 2 years is available here.

Income units

Ads By Google

Advertising business to Google, including YouTube, secured 81% record quarterly sales and Alphabet was $46,20 billion, which is 22% greater than $37,93 billion in the same quarter last year.

It is a signal of significant improvements compared to the second quarter, when because of the impact on the business during the start of the pandemic Alphabet was first published by the negative growth in total revenues. Growth also increased compared with the previous third quarter, which means that the recovery of the market of digital advertising is gaining momentum.

The income from advertising on YouTube showed a sharp increase of 46% to $6.89 billion, compared to last year, as the service has become one of the most popular in the world during the pandemic.

“Now we cover more people aged 18-49 years than all the linear television network together,” said Philipp Schindler, chief commercial officer of Google, adding that “more than 100 million people from their broadcast YouTube TV”.

At the same time, Google has to allocate a significant amount of traffic (TAC) – $up 10.47 billion, above the $9,32 billion expected by analysts.

Revenues Google Cloud

Alphabet first identified Google Cloud in a separate reportable segment, resulting in the company’s financial statements will reflect the revenue and operating profit (loss) by segment:

1. Google Services (products and services such as ads, Android, Chrome, hardware, Google Maps, Google Play, search advertising and YouTube);

2. Google Cloud (data centers and platforms for data analysis and other services for corporate customers).

3. “Other articles” (“Other Bets”), which is a division Verily working in the biomedical Sciences, and the division for the production of unmanned vehicles Waymo, and will also include the income of the company Fitbit, the acquisition of which was completed.

Google Cloud revenues grew by 47% compared to the same quarter of 2019 to $3.83 billion, slightly below analysts ‘ forecast of $3.81 billion

The company has published data showing that Google Cloud still suffers losses due to investments in the expansion of its data centers: the company lost $5.61 billion for the full year 2020 and $1.24 billion for the fourth quarter.

The division of the “Other articles” (“Other Bets”) in the fourth quarter suffered losses in the amount of $1,136 billion, and for the entire 2020 $4,476 billion.

The table below shows the report Alphabet with the quarterly and annual data on income (Revenue) units and profit or loss – Operating income (loss) figures in parentheses are losses.