Lemonade Insurance Company, five new York-based company, debuted on the NYSE under the Ticker LMND on Wednesday, with the IPO price of $29 per share, the amount of attracted funds amounted to $319 million At the close of trading on Thursday, shares Lemonade soared 139% to $69,4.

Debut mobile insurance startup Lemonade Inc. (LMND) this Wednesday on the NYSE was extremely successful, as investors welcomed the company, whose branch is designed to provide peace of mind to clients in this stressful period of the global pandemic.

About company Lemonade Insurance

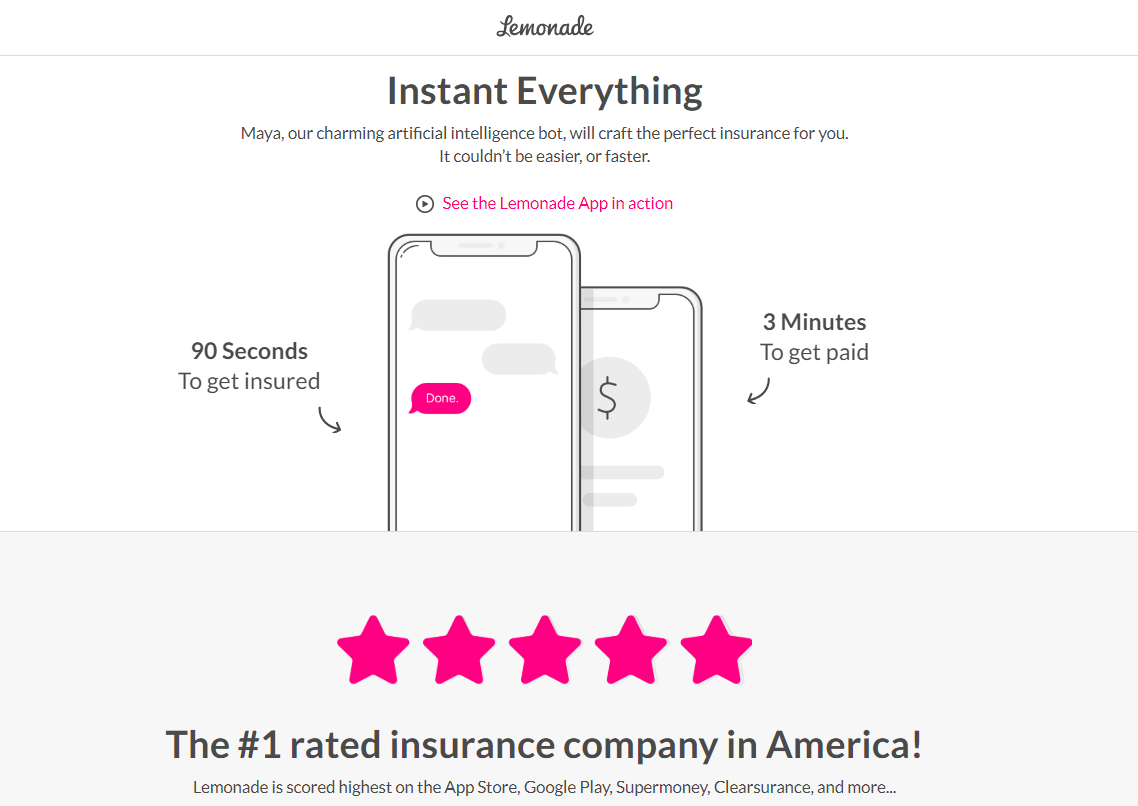

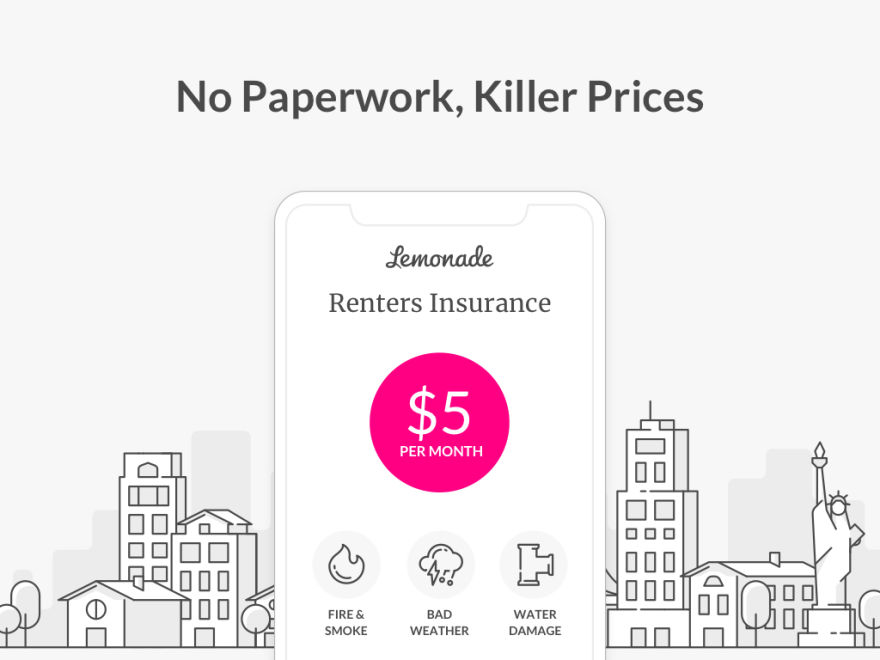

Lemonade calls himself an “insurance company No. 1 in America” and most technologically advanced in the industry. App available in the App Store, Google Play offers a simple and inexpensive service property insurance from accidents in many States in the USA, the Netherlands and Germany. For Dutch consumers Lemonade, among other things, offers insurance cover theft of a Bicycle.

The company has launched insurance homeowners and renters in new York at the end of 2016 and since then has become one of the fastest growing insurance companies.

Lemonade is a platform built on technologies of artificial intelligence (AI), using chat bot in May, allows you to get insurance online in 90 seconds and to cover it for 3 minutes.

Lemonade says that many of her customers refused the services of their old insurance companies in favor of the service.

“It couldn’t be easier or faster,” Lemonade assures customers of their services.

In its quest to expand the offer other insurance products (car insurance, life insurance, etc.) and will approach a larger number of customers, including international, Lemonade, investors were attracted to and sought an IPO.

CEO of Lemonade Daniel Schreiber (Daniel Schreiber) and chief operating officer, Shay Delicacies (Shai Wininger) stated that the company’s mission is to “use technology and social impact to become the most favorite insurance company in the world.”

The co-founders of the company and certain of its employees for product development, support services and support of online sales are in Israel. As of March 31, the company employed 123 full-time employee.

IPO Lemonade Insurance

1 Jul Lemonade Insurance Company, five new York-based company, debuted on the NYSE under the Ticker LMND with the IPO price of $29 per share. The price of $29 per share Lemonade was the third increase price range of IPO from the previous $26–$28 and $23–$26 per share.

The company sold 11 million shares, and up to 1.7 million available to underwriters to cover cost overruns. The underwriters include Goldman Sachs (GS), Morgan Stanley (MS), Allen & Co., Barclays, JMP Securities, Oppenheimer & Co., William Blair and LionTree.

The amount of attracted funds of Lemonade during the IPO amounted to $319 million

On Thursday, the stock price jumped by an incredible 139% to $69,4, while intraday high was $70,80 per share. At the close of trading on Thursday, the Lemonade company received a market valuation of $3.81 billion

Prior to the IPO the company has raised $480 million in several rounds of financing, and in April 2019, the company announced a funding round of $300 million, led by SoftBank.

It is expected that after the closing of the IPO, SoftBank will become the owner of 21.8% stake in the company, Sequoia Capital, and Aleph LP – by 8.3% and General Catalyst Group – 5,9%. Founders Daniel Schreiber and Shay Delicacies will own 28.3% and 29% respectively.

Thus, in Lemonade, said that significant stakeholders are not able to vote more than 9.9% of the shares in the company without first obtaining the approval of the Department of financial services of the state of new York.

A fair price for another tech startup?

Despite the fact that the product is Lemonade looks extremely topical currently, digital transformation, market analysts have warned inexperienced investors against inflated estimates of this action.

Senior partner consulting company cg42 Hugh Tallents said Thursday that the action Lemonade – it’s not a long-term game “for today’s surge is likely to be followed by an equally significant fall.”

“Lemonade is just another unprofitable FINTECH company that is supported by AI,” said Callens.

Start-up, while loss. Although revenues grow from $22.5 million in 2018 to $67.3 million in 2019, along with higher losses, from $52.9 million in 2018 to$108.5 million in 2019.

In this case, Lemonade chose a socially-oriented policy, directing more funds for charity. In 2019 Lemonade donated $600 000 26 non-profit organizations.

Competitors

In his statement, Lemonade declared that competes with traditional insurers, such as Allstate (ALL), Farmers Insurance, Liberty Mutual, State Farm Insurance and Travelers.

However, the company has a number of competitors with similar services online insurance: Assurant, Gabi Personal Insurance Agency, and Sure Inc.