Quarterly report Twitter on Friday showed earnings per share above Wall Street forecasts, as revenues increased by 14%. However, shares fell by 21.1% at the close of trading, and analysts were divided in opinions as to the cause.

Shares of Twitter (TWTR) rose more than 60% from the year before to fall on Friday for the whole 21.1 per cent after the publication of the financial report for the 3rd quarter ended September 20.

Whether low growth in the number of new Twitter users?

Twitter reported earnings per share of $0.04 vs. $0.02 for according to analysts, the total quarterly income of the company earned from digital advertising increased by 14% (compared with the same period a year ago) and also exceeded analytic expectations. See the quarterly history of revenue and profit Twitter for the last 2 years can link.

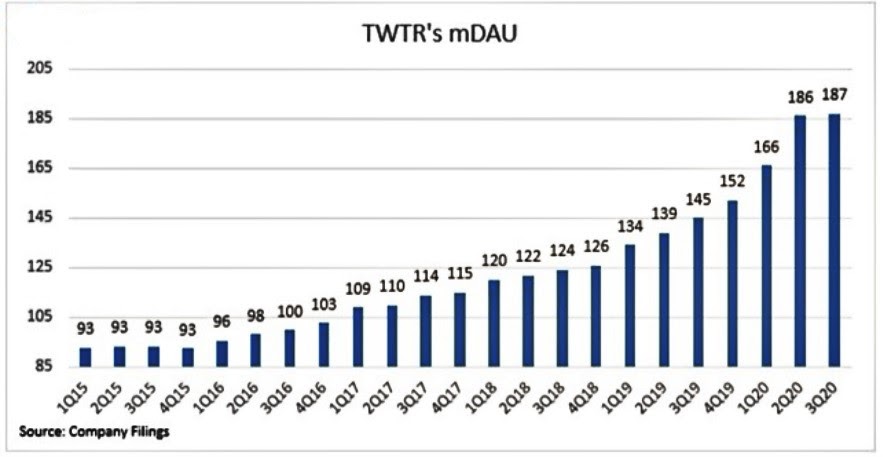

However, the key metric among the companies digital platforms from Twitter in Q3 was, on the contrary, too far from the expectations of Wall Street. The number of average daily active users, generating income (mDAU) for the third quarter grew by 1 million: up to 187 against 195,2 million that analysts had expected.

It was the slowest pace of growth consistent with mDAU the end of 2017, but if you compare it with last year’s value is 29% higher. The graph below shows broader growth.

MDAU growth in the US was 20% to 36 million, and international mDAU 32% to 152 million.

The analysts were divided

Some analysts pointed to deterioration mDAU, compared to Twitter with a similar Snap (SNAP), Pinterest (PINS) and Facebook (FB), which clearly played to the benefit of the company’s shares.

Analyst Luke Lango from InvestorPlace called the price of Twitter shares at $41,36 (after the fall on Friday 21%) too high, expecting that in the near future it can get any lower, not even stopping at around $35.

However, many others were not so pessimistic, pointing to statistics which shows that the Twitter audience grew annually by 14% – this suggests that the company retains or loses the basis for monetization, which is good. Twitter has indeed doubled the number of its users over the past 5 years.

The decrease in additions after a sharp spike after the start of the pandemic is fine, even the giant social. networking Facebook in its history, showed declines.

Deutsche Bank raised its growth forecast shares of Twitter from $56 to $64, which implies a potential growth by 54% compared with today’s lower price, appreciating the obvious recovery of the advertising market and broad geographic growth. The Bank’s experts predict that in the future will be a variety of catalysts for revenue growth: in 2021 will be more events, and advertising brands revival will happen and will be constantly updated promotional products.

Pivotal Research has also raised target price on shares of Twitter from $was 59.75 to $64, and Mizuho analyst – up to $48, while suggesting that fears of investors concerning growth mDAU inflated because they do not point to internal operational problems.

Mark Mahoney from RBK provides the Twitter stock rating of “neutral”, but also raised its target price to $43.

Thus, many market experts saw the drop in the share price of Twitter reaction to unfulfilled expectations of investors. Now they recommend to use the decline as an opportunity for long-term purchases.

Twitter did not give forecasts, citing uncertainty associated with the consequences of elections and other factors, however, indicated that in the last quarter of the year, expenditures will grow by 20%, including $250 million of capital expenditures. Such a statement of leadership, focusing attention on the negative stuff, not naming any numerical advantages to counterbalance them, could also become one of the main reasons for the decline of Twitter shares.