Google released a fully updated app Google Pay for Android and iOS with a host of features that allow you to compete with Venmo, owned by PayPal, Square Cash app and Apple Pay.

Shares of parent company Google Google (GOOG, GOOGL) rose dramatically after the submission of a new application Google Pay.

This move by Google marks the increasing competition among the leading companies – “digital wallets” in the world. Similar to Google Pay products exist in PayPal (PYPL) is the app Venmo, Square Cash at Square, Apple Pay from Apple (AAPL) and others.

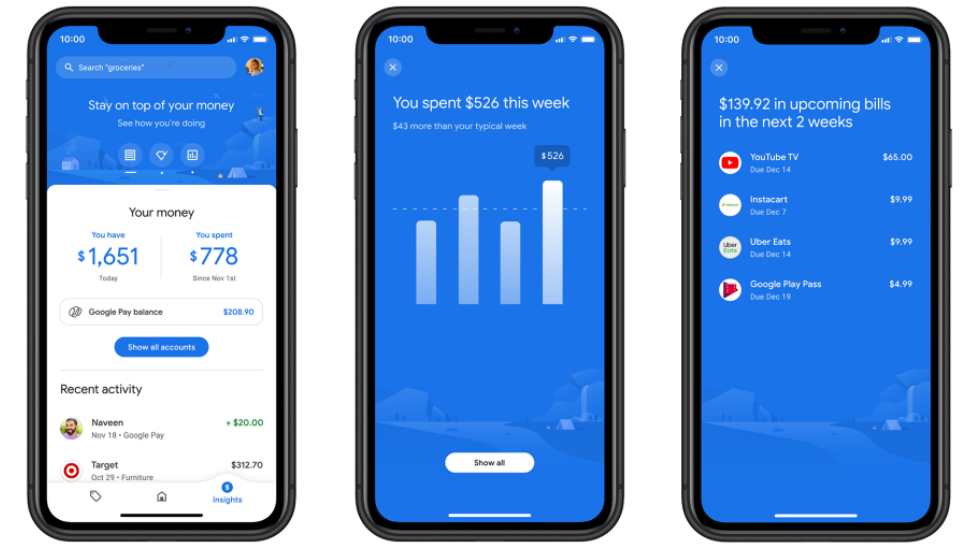

In the new Google Pay added functions Analytics data and search of transactions, payments, photos, Bank records and credit cards. In this case, as previously, app Google Pay allows for contactless payments in stores and remittances.

Users of the new app Google Pay is also now able to make deals with groups of people and receive offers cashback from the merchants, including Burger King and Target (TGT). Google will get a fee for the distribution of these promotional offers, which will open a small new line of income for the advertising giant.

At the same time, the company determined that it will not use user data for advertisers and the advertising services of Google.

A new app in the US, operates in more than 100,000 restaurants, the 30,000 gas stations and Parking meters 400 cities, according to Google.

Google has also partnered with 11 banks to launch a new type of Bank account in 2021. Called Plex, these mobile Bank accounts will have monthly fees, fees for overdraft (short term credit) or a minimum balance. The account will belong to banks, but the Google Pay will be the main channel for managing these accounts in a single interface for customers. Partners for launch are Citi and Stanford Federal Credit Union.

Head of product Google Pay Josh Woodward in an interview with Yahoo Finance said that Google Pay exists in more than 30 countries, and will soon be expanded to 40, 150 million people are already using it each month.

According to Woodward, Google Pay “helps to do three things”:

1. To pay friends and companies, while the interface will display the user’s photo or a company logo.

2. Save money with promotional offers and rewards programs.

3. Gives an idea about your finances for better control and management.

Software Google Pay uses algorithms for learning and automatic reminders to users about upcoming bills or encouraging them to save more.

Industry analyst of Bankrate Ted Rossman also noted that the function “smart” search of transactions in Google Pay can be a key competitive advantage of this app: “One of the reasons for the success of Gmail is its excellent search capabilities. The addition of the Google experience in the search for Finance users should get a response from consumers who want to better understand their money.”

Head of product Google Pay Josh Woodward reiterated that the company has no plans to become a Bank and Pay Google intends to “work within the ecosystem and within the existing regulatory framework”.

Analysts Ark consider digital wallets as a market with sales potential of $800 billion.